September 5, 2023

The characteristic of modern humans is to play games (Homo Ludens), which is true. The Covid-19 epidemic has brought new opportunities to the video game industry. How do Taiwanese gamers consume at this moment? How can we understand these trends? Let us further analyze the "game world" and find a niche!

Affected by the Covid-19 epidemic, many industries have been hit hard due to limited movement of people. In contrast, the information and communications industry has clearly benefited from the quarantine period of at least two weeks when entering and leaving the country, and maintaining physical distance has become the norm. As people cannot move around at will, the time spent at home gets longer. Not only is entertainment becoming more important, but also it’s crucial to capture the people’s scarce and precious attention, attract more people to join video games, and gradually gain profits from gamers. It’s also important to focus on making long-term consumption habits. For the game industry, the beginning of 2021 is definitely a critical period for expanding and deepening the customer base.

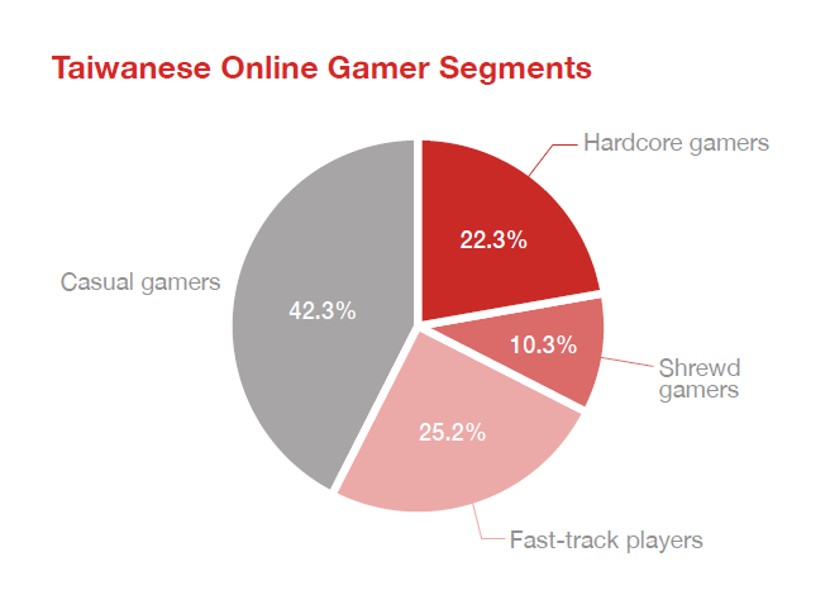

There have been many foreign reports that the epidemic has expanded the consumer group of video games. In order to discover Taiwanese gamers' preferences and gaming behaviors, as well as the corresponding consumption patterns, we must first classify the gamers before proceeding further. The survey established four basic types of gamers groups, including hardcore, shrewd, fast-track and casual with three levels: heavy, medium and light. The current proportions are 33%, 25% and 42%.

Hardcore gamers are the core TA of the entire game industry. Not only in terms of the "length of time", they invest more than 6 hours a week, which is significantly ahead of other groups. Also in terms of quality, they are willing to pay to download games, and also willing to pay while playing.

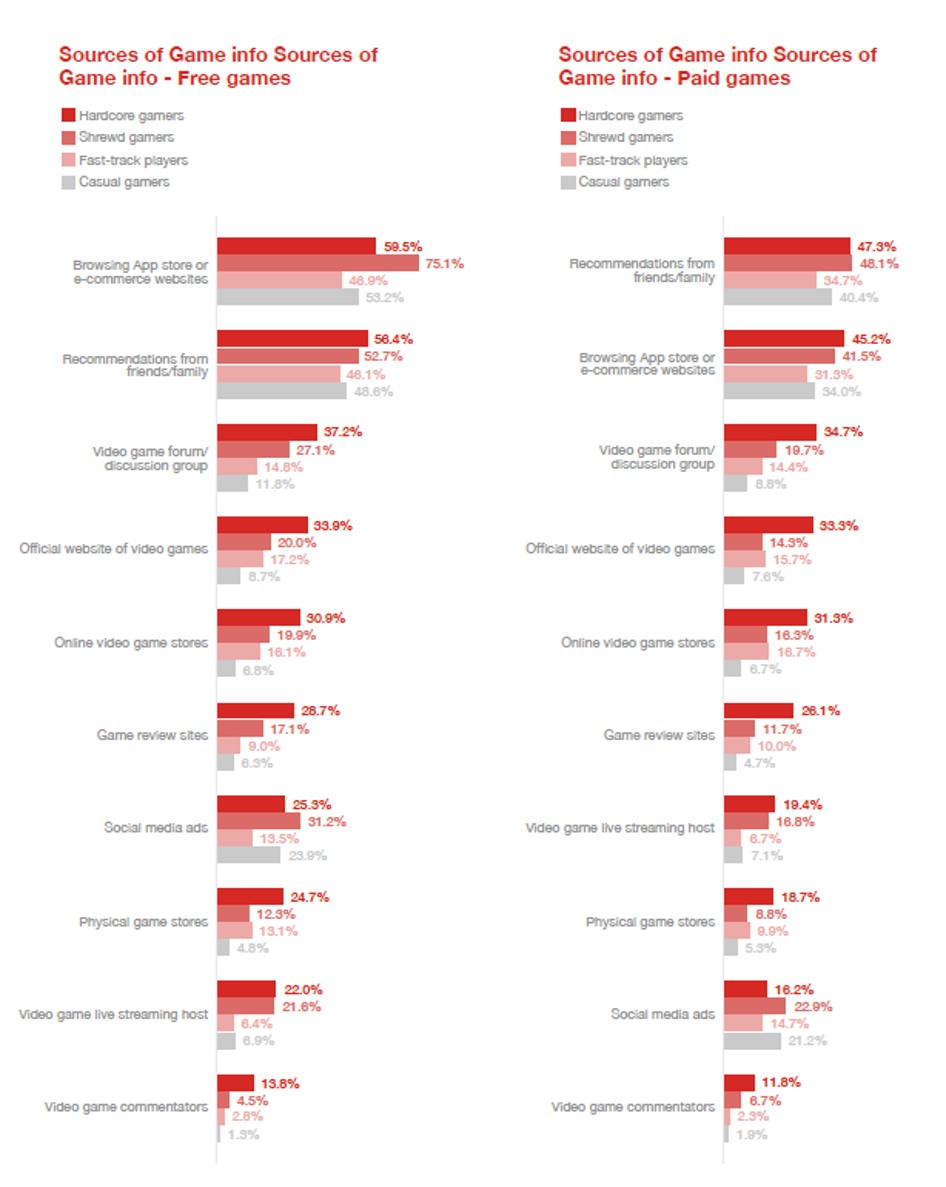

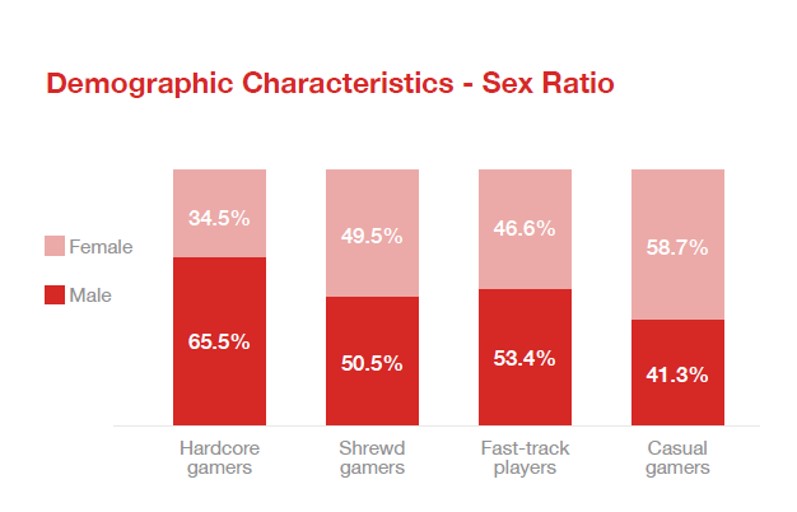

The survey shows that gamers in this group are mainly males aged 30-39, and their annual household income is significantly higher than that of other game gamers, and 20% of Hardcore gamers have an annual household income of more than 1.4 million Taiwan dollars. They often take the initiative to follow multiple channels, including official websites, forums, and discussion about scoring, etc. to obtain the latest game information. In addition to inevitably playing games on mobile phones or mobile devices, they also play on computers and with game consoles a lot, the former exceeding 90% and the latter also exceeding 80%.

This group of gamers do not need advertisement to be attracted to spend time and budget on games every week. Therefore, how to create an astounding game with precise difficulty and challenge will make this group of gamers stay. In addition, if you can reversely create a classic nostalgic game with the atmosphere of a re-enactment, you may be able to win over this group. Since hardcore gamers often actively collect game information, it will be super effective to attract hardcore gamers by strengthening community cohesion, providing feedback and interacting with the community.

Also as heavy gamers, shrewd gamers invest more than 6 hours a week, but the biggest difference from hardcore gamers is that they prefer free games and are less willing to spend money. The age of this group is mainly 16-29 years old, and most of them are students. The way to obtain new game information is mainly from social media, App stores or e-commerce websites.

The biggest feature of this group is that they can put in a lot of time and effort, but they are very cautious of extra charges. How to make them keep watching ads on mobile phones and tablets will be the most important way to monetize at present. In addition, establishing game loyalty and trying to connect game brands with other products or needs is also a viable busi- ness model. It is worth investing in this group of gamers for two reasons. First, their time can be converted into money. Second, they should be encouraged to stick to the game, so that brand image can influence life consumption choices. Furthermore, the investment in the long term is to turn them into hardcore or fast-track gamers in the future.

It is also worth noting that the group is classified as casual gamers. The survey shows that this group is mainly in the 40-50 age group, and nearly 60% are women. This group of gamers play games for no more than 6 hours a week.

Most of them prefer free games and are unwilling to spend money in games. They rely heavily on the App Store and advertisements to discover new games. In terms of platform usage, only 40% of people use video game consoles, and most of them use mobile phones/tablets to play games.

For this relatively "light" group of gamers, games are one of the options for killing time, but there is actually a lot of potential in that. First, the entry barrier for this game is low, so they can easily make the habit of playing this game whenever they have nothing else to do. Secondly, if advertising continues, it will be the main profit model. In addition, combining advertising with other products, online or offline activities, etc., may be able to create a trend like a Pokémon. The main benefits will be from non-stop attraction, expansion of new gamers, establishment of catchy brand awareness for the public, or subsequent enhancement of other aspects of the game, such as social interaction, or even interaction during epidemic prevention, etc.

Little by little, gamers might find their ways to relax and add up their consumption.

In general, the industry must target gamers with different characteristics and create unique value for each gamer. This will be the most important strategy for expanding and deepening the consumer group. For example, the games should provide an sophisticated game experience or an eye-catching highlight for medium-level fast-track gamers, attracting this group with little time but high spending power.

In addition, hardcore gamers have both spending power and can actively follow up and explore the latest information. If they can bring out the potential of this group, drive and transform it into a kinetic energy that affects other gamers, it will also be the focus of investment that is worth strengthening today. And we can't help but ask, will the epidemic turn light gamers to medium ones? Do you want to guide the gamer's nature to gradually increase and finally reach hardcore gamer? Or will different categories of consumers remain distinct?

To sum up, during the epidemic, what positive role can games play to provide stress-relieving entertainment? Are we able to design games that build relationships between different people during quarantine? These all show the unlimited possibilities of the game industry, and next how consumer dynamics will wait is worthy of our continuous investigation and tracking.

|