September 5, 2023

The global beauty industry has been under a great crisis since last year and has broken the resilience which had been consistent for 15 years before the pandemic. COVID-19 has changed the customers' behavior and brought a seminal change in how people are thinking about consumption. Although there is a comprehensive decrease in market demand, opinion leaders and amplifiers predict that they are going to increase the consumption of skincare products in the next three months. How do we seize the business opportunity? What is the new normal in the post-pandemic era for the skincare market?

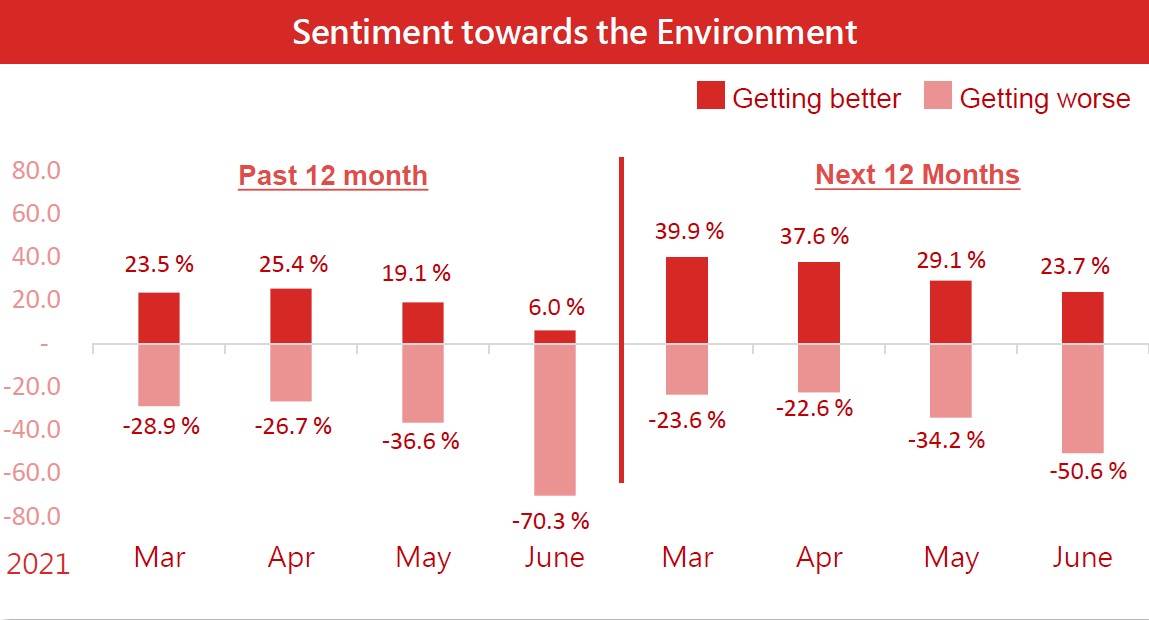

The ongoing coronavirus pandemic has mightily impacted consumer behavior and brought a seminal change in how people are thinking about consumption. The global beauty industry has been impacted by work-from-home and travel restrictions since last year and has broken the resilience which had been consistent for 15 years before the pandemic. Compared with the result last month, netizens are getting pessimistic about the macro-environment under the pandemic. Up to 70.3% of participants thought that the environment would get worse in the past 12 months. In addition, 50.6% of people anticipated that the pandemic would get aggravated in the next 1 year, but most of the participants in the last month predicted that the situation wouldn't change in the next 12 months.

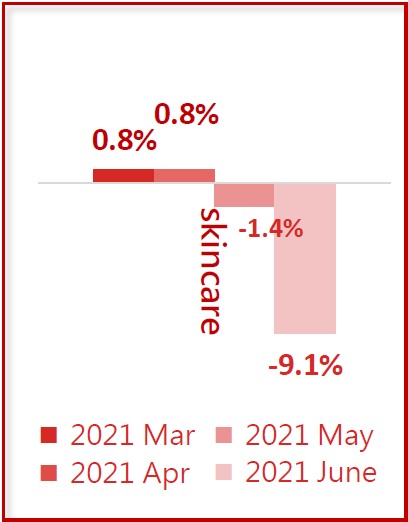

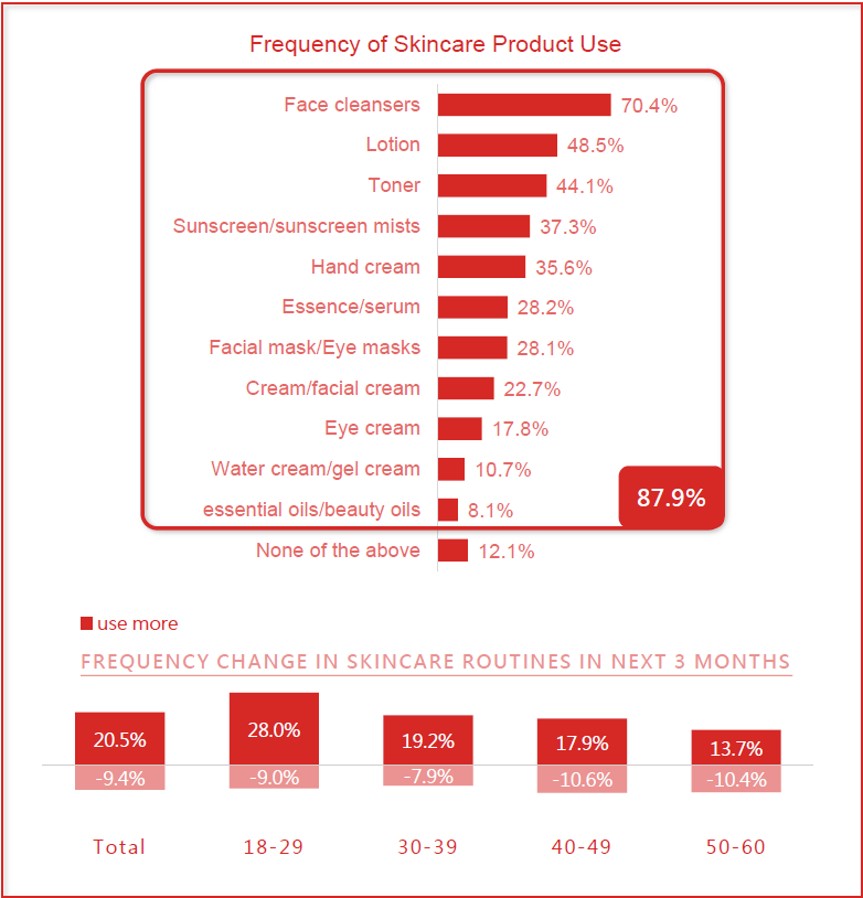

| The purchase budget for skincare products for the next three months was reduced from 1% to 9%. However, the percentage of people who used skincare products in the same period reached 87.9. Consumers now longed for facial cleanser followed by lotion and toning lotion, and essential oil and beauty oil are ranked the least demanded. Despite it being summer now, many saw little need to apply sunscreen or spray sunscreen because of the travel restriction. Regarding the change of skincare adoption, 20.5% of netizens increased in the usage of skincare products, and the age group of 18-29 has a large drop in demand. There were 9.4% of participants who reduced demand for skincare products, and the age group of 30-39 presented the least drop. Conclusively, people between 30-39 years old are less affected by the change of macro- environment. |  |

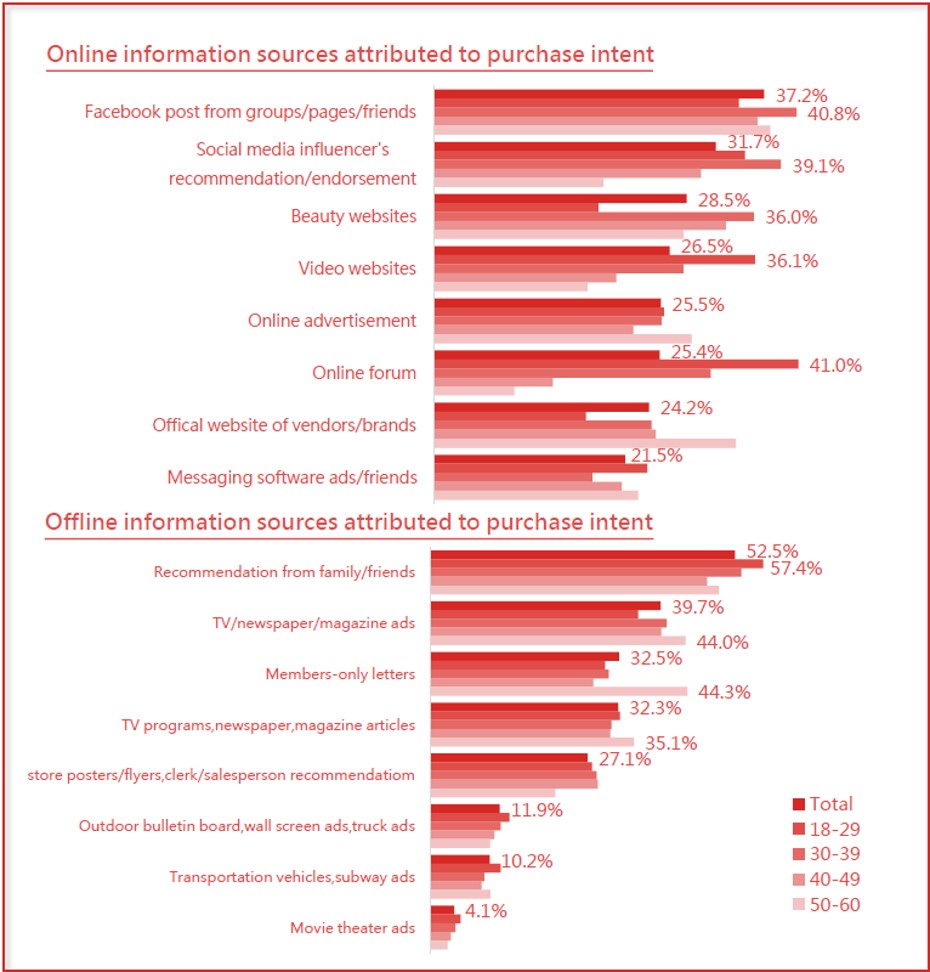

E-commerce has boomed in the last few years, and the pandemic has advanced its business growth. Since the restriction, 63.2% of netizens tended to buy skincare products on online shopping malls, and 30-39-year-old people shared the biggest part of the e-commerce business. In terms of information received, the posts on Facebook strongly impact consumers' purchase decision-making. Yet, the age group of 18-29 were affected significantly by the post on the online forum, such as PTT or Dcard. Besides social media, the 30-39-year-old people focused on the recommendation by bloggers, internet celebrities, and key opinion leaders, the age group of 40-49 liked to refer to the opinions of beauty websites, and the age group of 50-60 trusted brands' official websites. On the other hand, the most influential offline platform was the recommendation by friends and followed by advertisements and sales letters.

These survey participants were constructed by opinion leaders, amplifiers, followers, and laggers of 20.3%, 11.2%, 53.7%, and 14.7% respectively. The amplifiers who like to discuss the trend predict the increase massively in the usage of skincare products and followed by opinion leaders. Skincare consumers like to shop on the online shopping malls, brick-and-mortar stores, brand's official websites, and department stores.

The ongoing coronavirus pandemic has mightily impacted consumer behavior, so it may change the long-term strategy of marketing communications. First of all, consumers value sustainability beyond all things now. Therefore, brands can take the sustainability of skin and environmentally friendly packaging important and upgrade natural, healthy, and safe features of the products to grow business. Secondarily, many consumers now longed for familiar and comforting scents that triggered nostalgic, happy, and relaxed feelings during what continued to be a tough time. Third, brands need more extensive channel strategies. For example, brands can deeply engage consumers through teaching videos or newsletters to facilitate competitive advantage in the digital economy.

|