September 5, 2023

According to the latest survey, female consumers in Taiwan are less interested in purchasing skin care products in December. From the careful observation in data, what are the interesting insights and the details of this unique business opportunity?

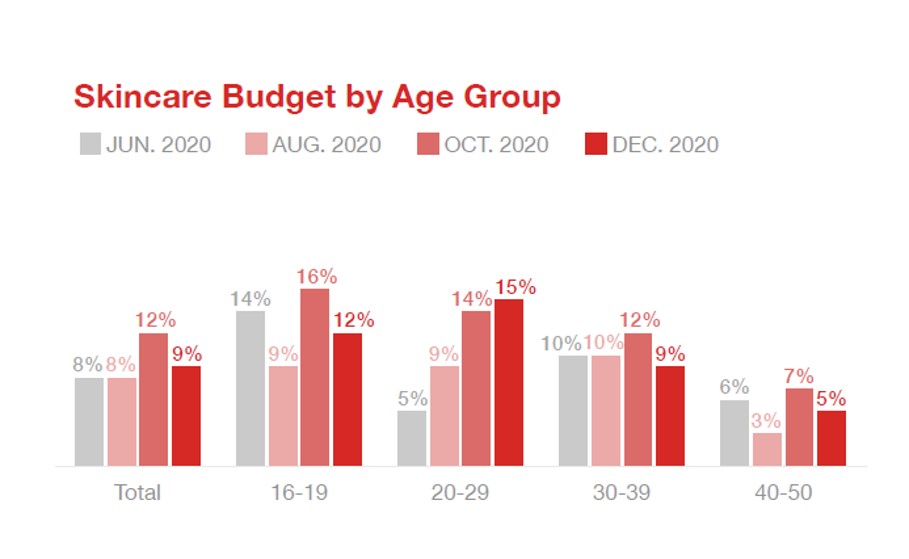

2020 is full of thrilling waves and here comes the final countdown. As the weather is getting colder, the Covid-19 epidemic is heating up, and we are about to enter the unknown 2021. Before looking at future business opportunities, what changes have been made to Taiwanese consumers’ skin care behavior recently? According to the latest survey, compared with October, the overall consumer’s budget for skin care products in December has been roughly reduced, especially for women in the 16-19 year-old range with the largest decline in the budget. And only that in the 20-29 year-old age group has slightly increased.

However, by observing carefully, we notice that October and November have always been the key periods for year-end promotional activities. Consumers will spend their budgets on department store anniversaries or store discounts and auction seasons to buy them all at one time.

This consumption feature is especially obvious in skincare products as they have clear and predictable dates of promotion, higher unit prices, certain amount of consumption but no necessity to people’s livelihood.

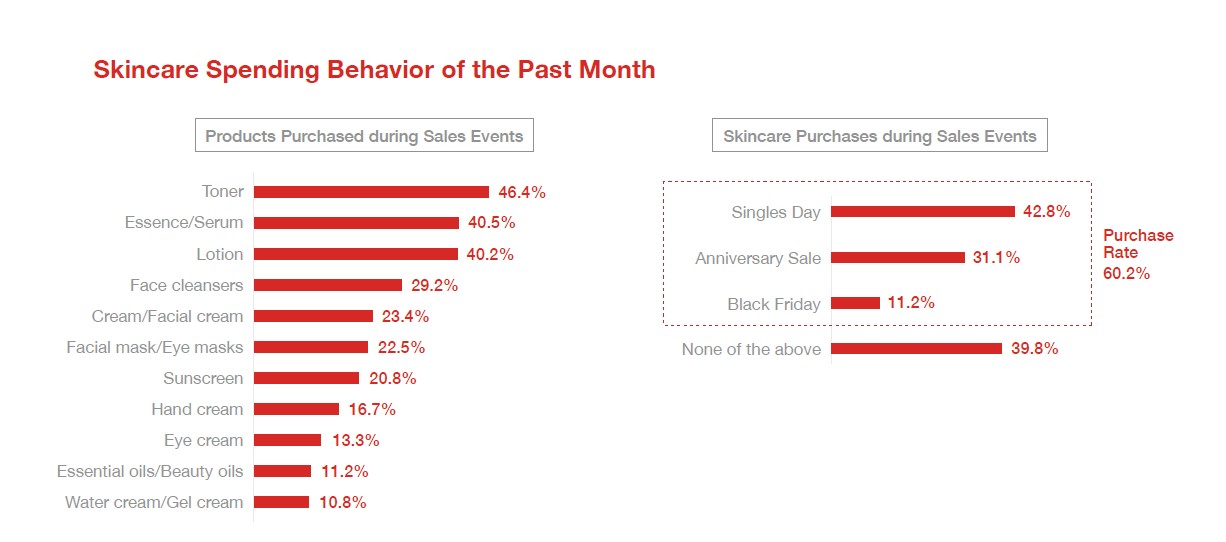

It is worth noting that the survey shows that compared with the traditional discount seasons such as department store anniversaries or Black Friday, the "Double 11 Shopping Festival" has become a mass purchase activity for women in Taiwan. This can also be seen from the double 11 promotion, which has expanded every year and the volume has become more and more obvious. In recent years, "Double 11" is a competition not only in online e-commerce, but also in channels such as beauty stores or department stores. It is also necessary to follow the double 11 trend to launch corresponding marketing. In order to continue the buying boom of "Double 11", many manufacturers have even launched promotions such as "Double 12".

"Double 11" seems to have become a key shopping opportunity for Taiwanese consumers. However, whether it has succeeded in expanding consumers' shopping needs, or whether the people are just adjusting the timing of annual purchases and purchasing during this period, it is worthy of long-term follow-up and observation. Taking consumers between the ages of 16 and 19 as an example, it can be inferred that due to limited income, there is a mountain-like change in consumption budget. It is likely that consumers are saving for October and November. After spending on the Double Eleven promotion, their purchases will reduce again.

Take a closer look at the consumer choices during the event period. In terms of product items, all consumers focus on basic skin care that can be used throughout the year, namely toner, essence and lotion. Among them, essence is the first consideration for women over 40. It can be seen that compared to purchasing specific body parts or advanced skin care products, purchasing a large number of basic skin care products at this time is more practical and cost-effective, and it is also a purchasing strategy for many consumers.

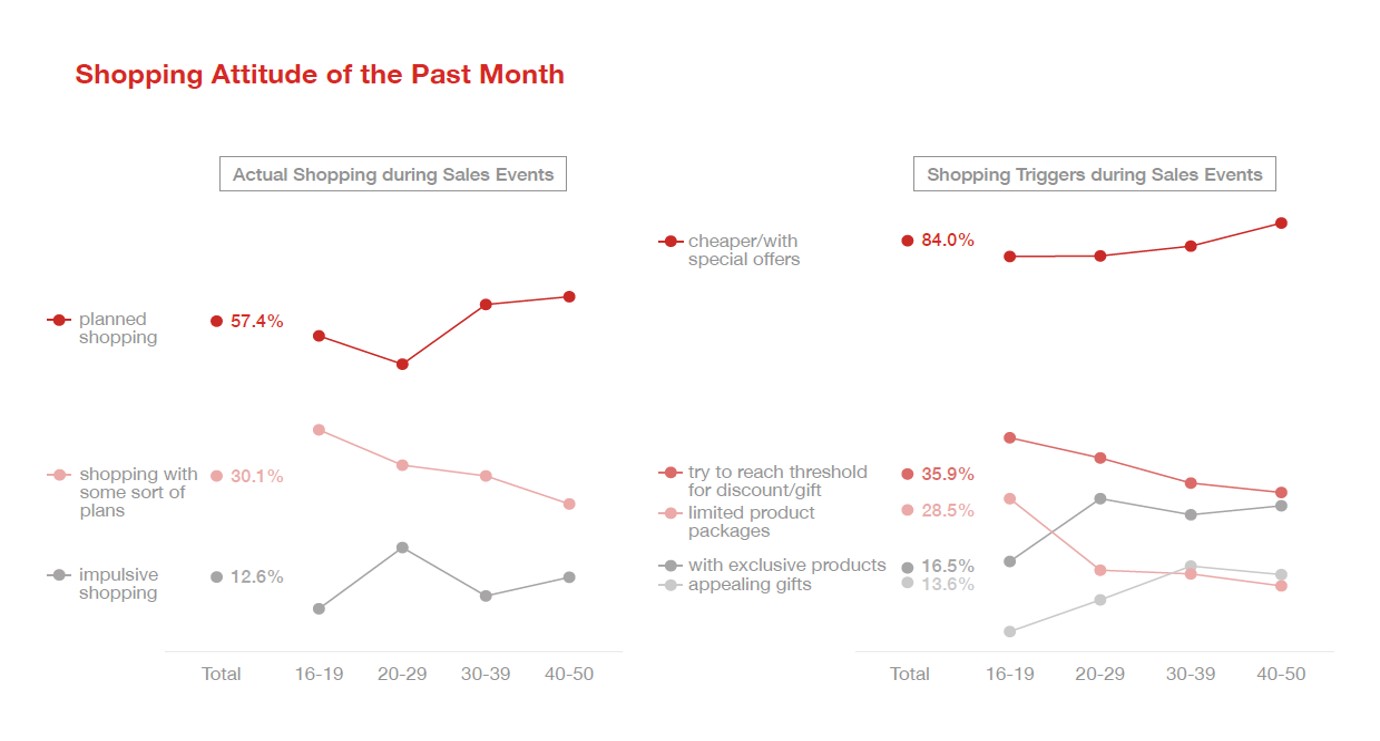

Looking further at the aspect of consumer behavior, most people still plan their shopping, and only about 13% of people on average will shop on impulse. The main age group of impulsive consumption is 20-29 years old. The main incentive for the event period is still the price. As many as 80% of consumers believe that better prices are the most important consideration for taking actions during the event period.

Among them, the 16-19 year-old age group is more attracted to "exclusive products" than "limited product portfolios". Compared to other ethnic groups, they have less interest in "gifts", which is contrary to the consumer preferences of other age groups. From this, we can tell that the youngest customers in the survey group have a particularly higher preference for exclusive products. If calls for unique products of the brand can be created successfully, the 16-19-year-old group will be more likely to be attracted.

At the end of 2020, we can find that Taiwanese consumers have reduced their purchase in skincare products, but overall consumer demand has not changed much. Recently, a lot of stores, including many Japanese drugstores, are expanding in Taiwan, or changing their strategies to expand to the community, or expanding the business scope of existing chain beauty stores, which tells the potential in the skin care products market. In addition, it is a clear trend to strengthen electronic payment and online platforms, while more brick-and-mortar stores are expanding to residential areas and operating with a concept similar to convenience stores.

We can conclude that people are either buying skin care products or on their way to the skin care product store. Although this year's Double 11 shopping festival has ended, the next wave of sales models is also brewing.

|