September 5, 2023

How do you increase your personal capital in the post-COVID era? Do you like investment or deposit? According to the latest research result, Taiwanese netizens started investing in the stock market and insurance after the Government canceled the Level 3 alert for COVID-19.

The latest research finds that people estimate the environmental situation in a negative aspect after they experience the 2 months quarantine. Although the pandemic was under control, only 36% of participants thought the situation would turn better in 12 months, and it showed a 1.6% drop compared to the result in April. Furthermore, 48.9% of people predict that Taiwan would take 12 months to return to normal. Nevertheless, people start to invest hot money into the stock market.

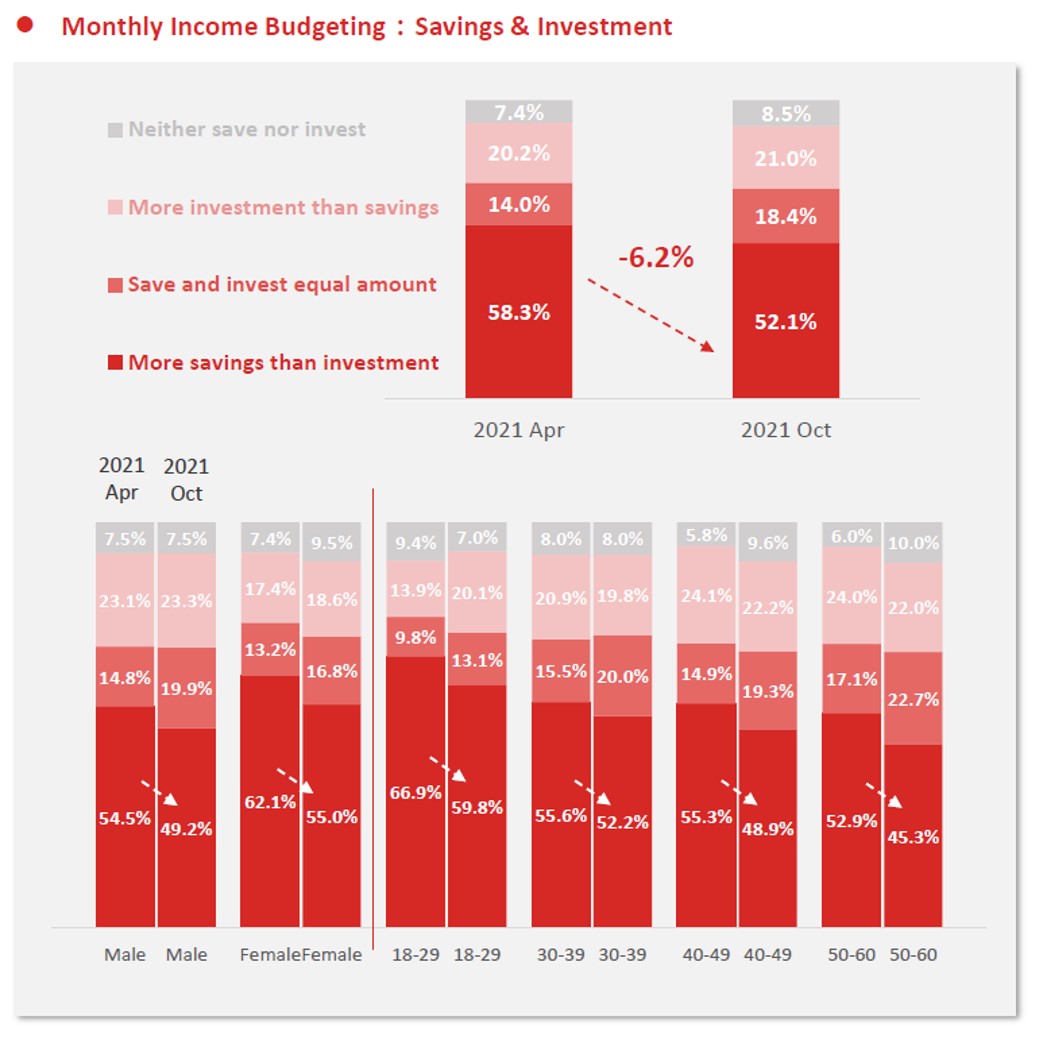

Compared with the situation before the Level 3 alert for COVID-19, there was a 6.2% decrease in people whose deposit was more than investment. The decline of females was 7.1% that was more than male. In terms of the age group, there was 7.6% of decrease in the 50-60 age group that was the largest reduction in all groups.

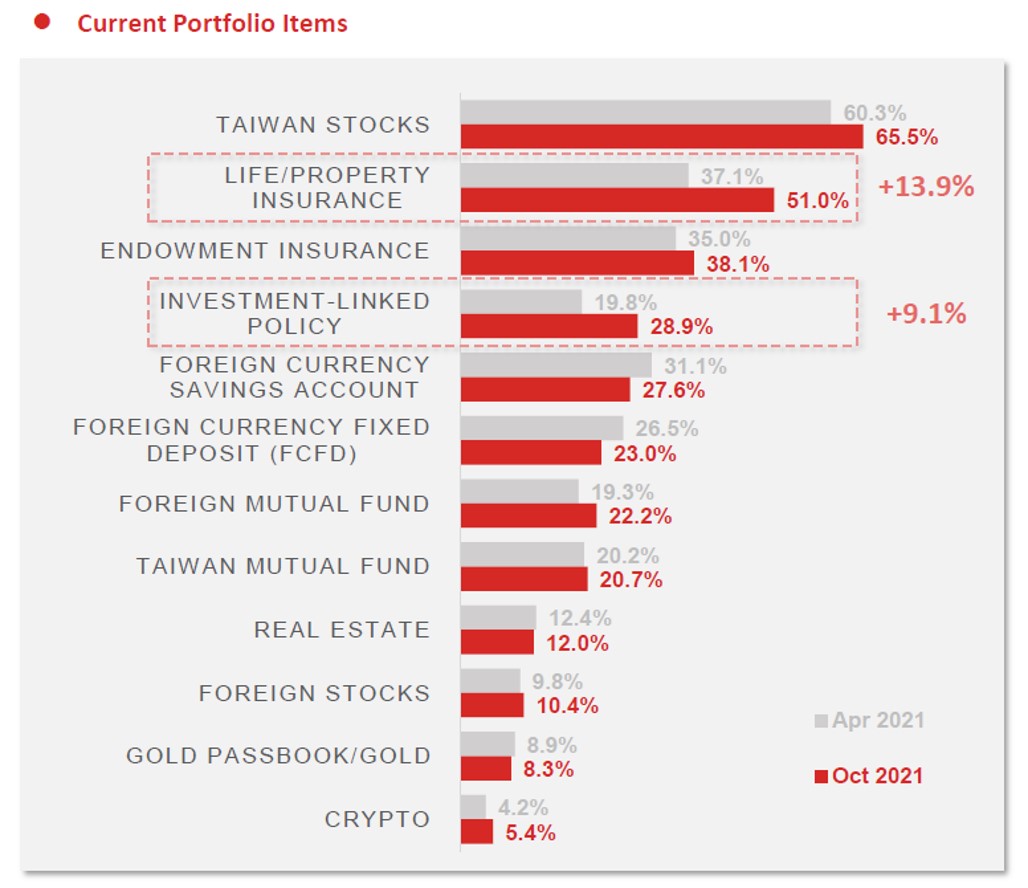

Regarding the investment tools, stocks remain No.1, but the No.2 to No. 4 are all insurances. Life insurance and property insurance were still ranked No. 2 with a 13.9% increase in people compared with April. Endowment insurance was No.3 and the fourth became the investment-link insurance with 9.1% of increase. On the flip side, people who allocate in foreign currency deposit, term deposit of foreign currency, real estate, gold deposit, and gold were less than April. It can be seen that people move toward low-risk investment tools after the 3 Level alert of COVID-19.

|