September 5, 2023

People think that the macroenvironment won't change a lot in the next 12 months. Taiwanese have continually invested in the stock market and are prepared to invest in the foreign stock market. How do investment companies communicate with investors? How can investors predict the economic trend?

Many countries have the coronavirus under control, and AZ vaccines can be acquired by Taiwanese at their own expense now. According to the latest survey result, people who think the general situation in Taiwan will not change were increased, and the percentage was raised from 36.5 to 39.8. Although the number of people who think “the situation is getting better” was decreasing, the percentage of people who think “the situation is getting worse” was also declining from 23.6% to 22.6%. Since COVID-19 crisis, people in the age group of 18 to 29 have increased investment and people aged 50 to 60 decreased their investment, but there is no significant effect in general. In terms of investment products, 65.9% of participants have increased stock investment, and the domestic and international funds are the second and third choices with 16.7% and 16.2% separately. On the other hand, the domestic stocks, endowment insurance, and foreign currency deposit have decreased during pandemic.

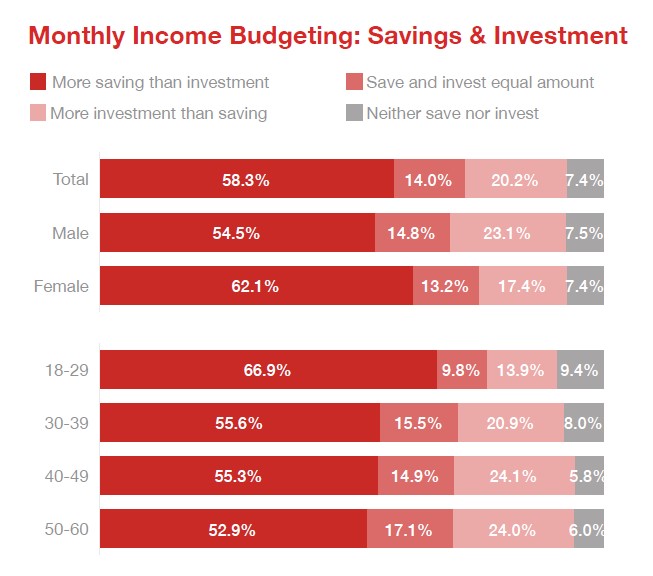

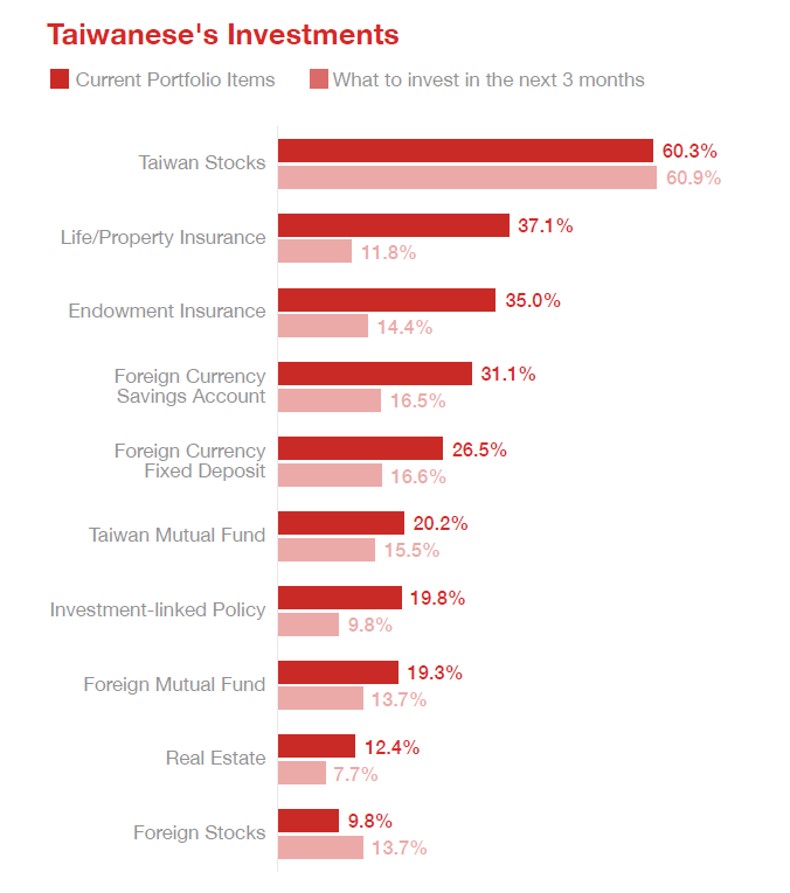

The ways that people allocate their money in deposit and investment are different. Females tend to save money and males like to invest. People whose investment is more than the deposit is in the 40 to 49 and 50 to 60 age group. Contrarily, the youths aged 18 to 29 tend to save money or live from paycheck to paycheck. Basically, the most popular investment product currently is domestic stock followed by life insurance and property insurance. Furthermore, the domestic stock is the most popular investment product in the next three months as well, and foreign currencies certificate of deposit and foreign currencies deposit are ranked number two and three respectively. It should be noted that foreign stock is at the button in the ranking of current investment products, but it is ranked number six of the popular investment products in the next three months.

However, some differences exist between age groups. Domestic stocks were the most popular investment product among the 50 to 60 age group, and 35% of the 18 to 29 age group were not going to invest in the next three months.

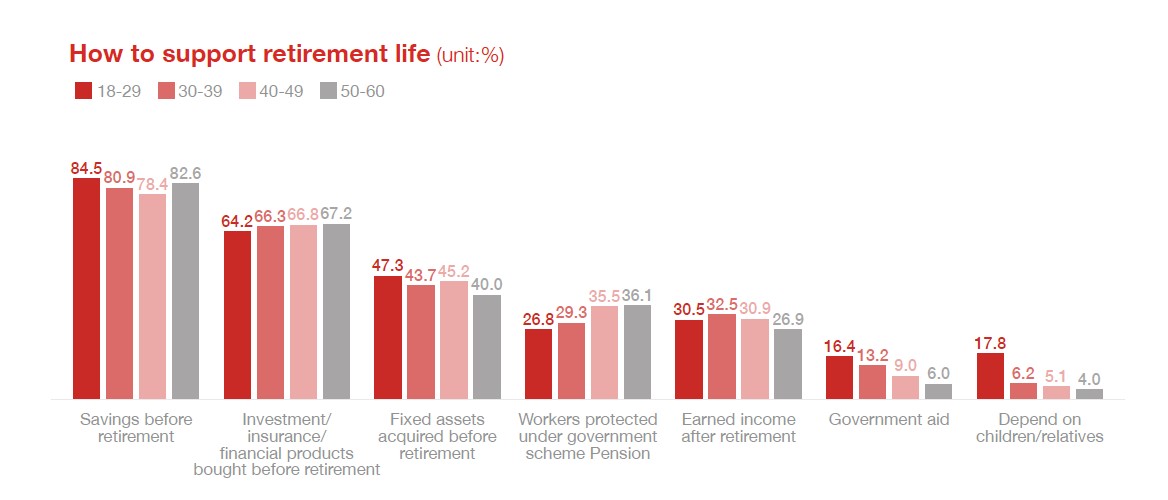

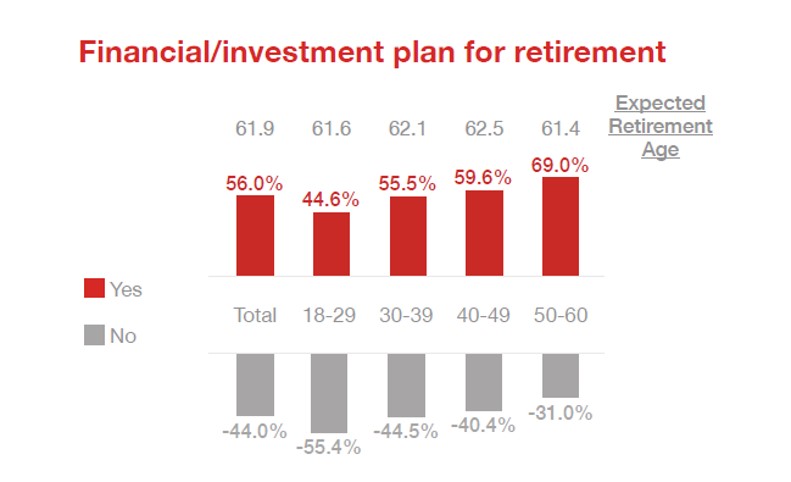

The participants planned to retire at 51.6 years old, and 56% of people made financial plans for retirement. All Taiwanese agree that their deposit is the core of financial management for retirement life, and investment/insurance/financial products and fixed assets were considered the second and third important factors separately. Most participators though that they should make NT$10 million to NT$15 million deposit for retirement with 20.7%, 17.6% of participators deposited over NT$20million for retirement, and 14.1% made NT$700 to under NT$10 million.

The investment information comprehensively affects investors on choosing investment products, buying climax, and selling climax. The relevant website is the main communication channel to investors, and social platform/forum, word on mouth, TV program, and expert are the second to fife choices in descending order. Simultaneously, the loss on investment that can be accepted by investors was 25.4% on average, and the percentage of male with 26.5% was slightly higher than 24.2% of females.

Morgan Housel, the author of The Psychology of Money, contributes three aspectives that learn from the economic crises in the past 20 years.

First of all, risk is what you don’t see. The biggest economic risk is what no-one is talking about, and no one prepares for it when it arrives.

Second, people are easy to be pessimistic about the situation, but getting rich requires swinging for the fences, taking a risk, and being optimistic. Actually, crisis drives new business models and lifestyles to help humans survive and come over the difficulty. For example, it was hard to imagine that large-scale remote-work could exist for one year before pandemic, but relevant new technologies and new management methods were generated during the pandemic. Third, history is meaningless for investment prediction. It is a common mistake to ask the question: "What will happen next?", but most investing fortunes come from asking: "How long can I stay invested for?". It is important to give yourself a room for error, and to realise there’s a distinct difference between getting rich and staying rich, Housel said.

|