September 5, 2023

Which game console is the winner in the pandemic? COVID-19 pandemic boosted the game market. The series survey of game players this year includes an overview of players' preference in January, players’ payment intention in March, and the potential of AR & VR game market growth in May.

COVID-19 pandemic has boosted the game market. The game market reached US$53.9 billion in 2020, and the value in 2021 is predicted to be US$58.6 billion. According to the latest survey result, 16.8% of netizens had more than one game console at home. In addition, the netizens forecast that the situation of the COVID-19 pandemic will turn better. The percentage of people who predicted the macro-environment will turn better was raised from 23.7 last month to 35.6 this month, and people who were willing to be vaccinated increased from 34.3% to 31.4%. How is the game console market in Taiwan when the outbreak lessens?

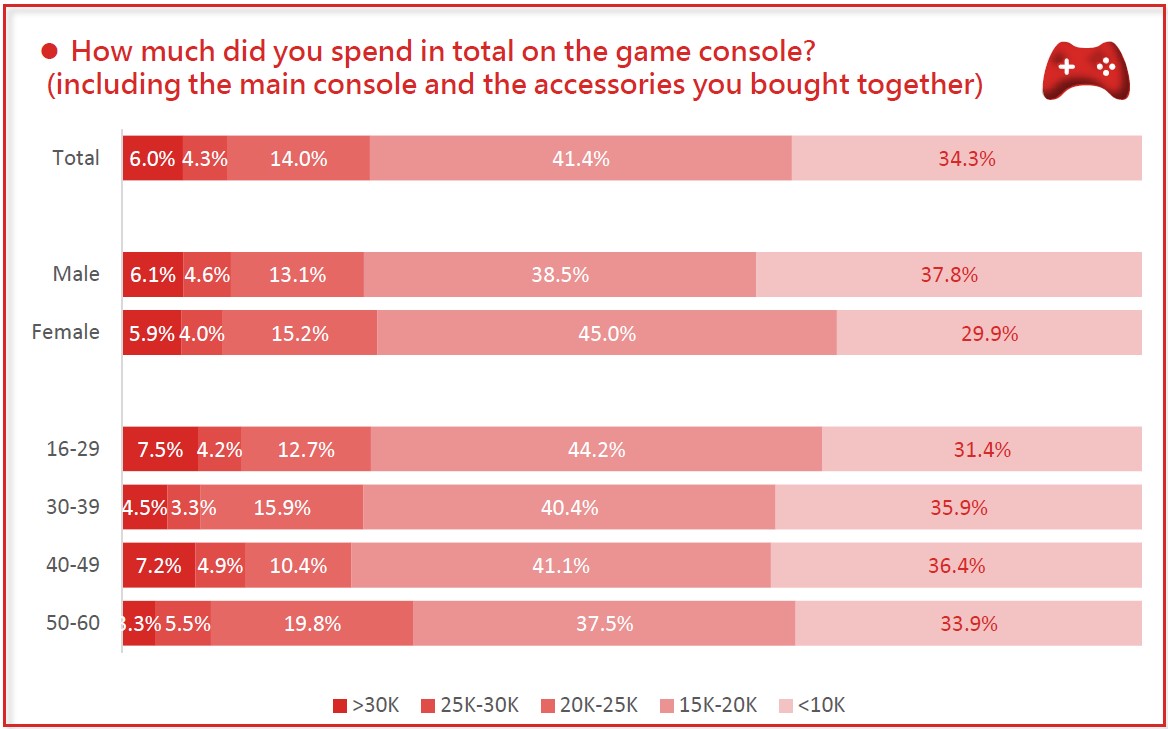

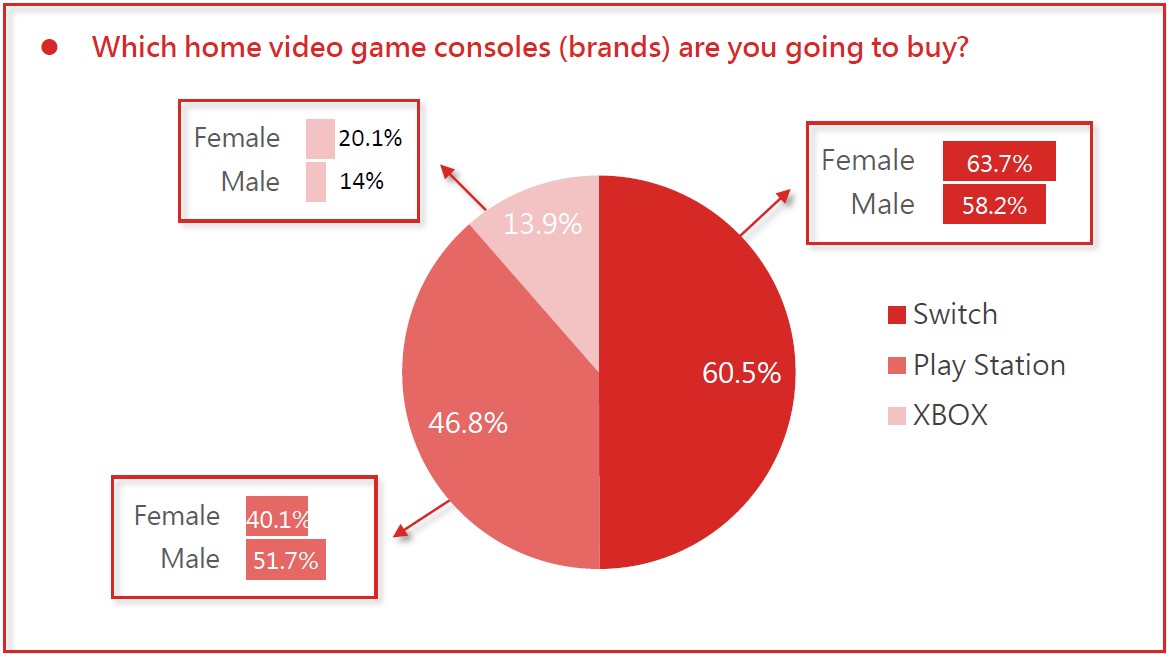

According to the response of participants, Nintendo Switch owned the biggest market share with 64.1% followed by Sony PlayStation with 37.4% and Microsoft Xbox with 19%. Most netizens are willing to pay NT$15,000 to NT$19,999 for game consoles and its derivatives. Furthermore, some people in the age group of 16 to 29 and 40 to 49 paid over $30 thousand for the game consoles with 7.5% and 7.2% separately.

There were 25.4% of netizens who planned to buy a game console in the next 6 months, and the brand preference ranking was led by Switch and followed by PlayStation and Xbox. Moreover, most of the consumers who prefer Switch are females, but male consumers tend to buy PlayStation in the next 6 months. Regarding the acceptable price, 40.6% of players budgeted NT$15,000 to NT$19,999 on the game consoles. People who will pay over $30 thousand were in the age group of 16 to 29 and 30 to 39 with 7.8% and 6.9% respectively.

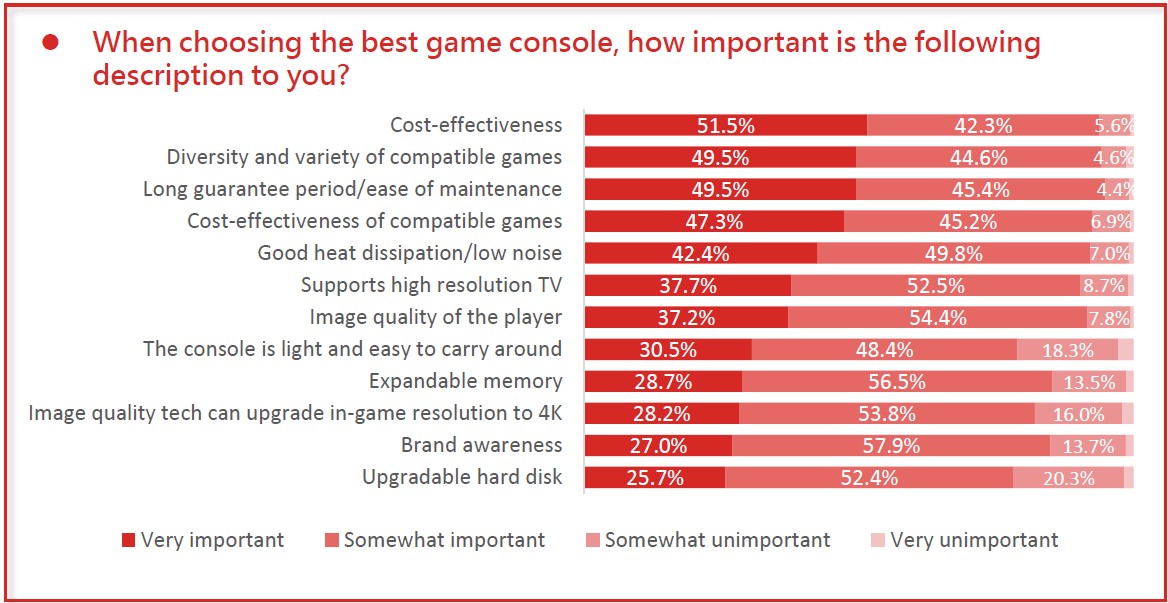

Most players consider price, diversity of game, warranty period, the price of games, and heat elimination, and low noise when they pick game consoles. When consumers wanted to buy consoles, 40.3% of participants wouldn't choose the games until they bought the consoles, 38% of players waited for the occasion of discount, and 22.6% of consumers bought virtual CDs and also digital games. Furthermore, up to 50% of consumers’ decision-making was affected by friends and families’ recommendations, 35.8% and 34.4% of players were impacted by online forums and virtual game stores respectively. It is obvious that offline communication channels are essential to impact purchase decisions of game consoles.

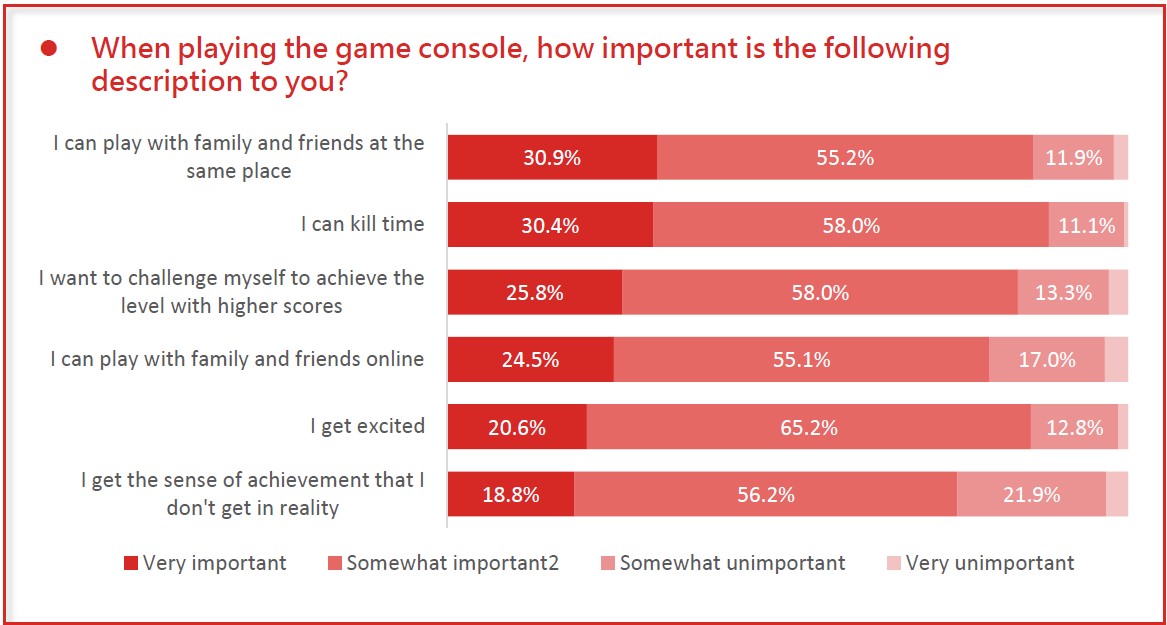

There are some important insights for consoles to expand market share. On the one hand, the top 5 game types were adventure, sport, car race, alpinia, and kids with 57.7%, 48.2%, 46.3%, 37.5%, and 36.8% separately. Therefore, family participation and parent-child interaction are as important as individual enjoyment for video-game players. On the other hand, the top 3 requirements of players are led by family participants and followed by killing time and pursuing better game scores.

In recent years, Nintendo Switch has owned a bigger market share because of the competitive pricing strategy and flexibility to fulfill consumers’ needs. Switch targets all ages from kids to elders and launches Nintendo Switch Lite and RingFit to facilitate family participation. Considering the situation of television usage, Switch can switch from television to its portable console when other family members want to watch television. Since the recommendation of family significantly impacts purchase decisions of consumers, friendly design to family and highly participant of family can effectively possess mind-share of players in the quarantine period.

|