September 5, 2023

May 2021 is a historical moment that is likely to be marked in Taiwan’s history, which will be remembered for decades or more. Not only is this month’s COVID-19 pandemic taking a turn for the worse, but the number of people diagnosed in screening tests is increasing rapidly compared to usual. Encountering events such as water shortages that lasted for several months, relatively intensive power outages and the decline in the stock market, people everywhere are panicking. But apart from the anxiety and panic buying and hoarding, what are Taiwanese people’s thoughts? What important clues of interpretation did it reveal?

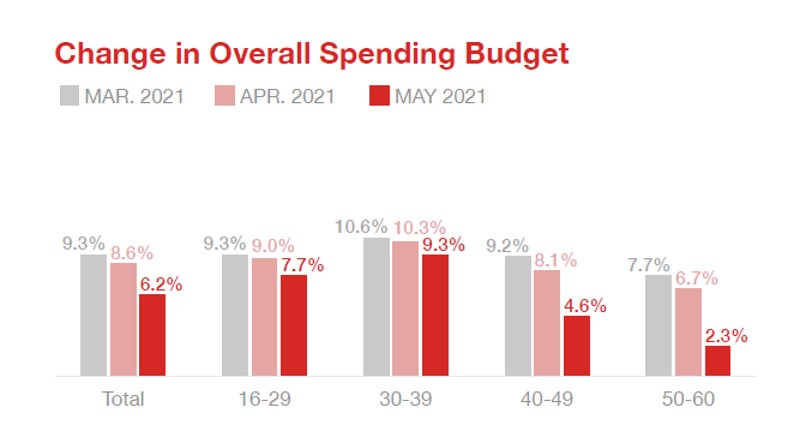

Since the beginning of the epidemic outbreak case at the end of April, there have been signs that Taiwanese people are worried about the epidemic. In addition, May is in a transitional period between the peak consumption and promotion seasons, so the desire to buy is relatively low. This survey shows that Taiwanese people’s overall consumption budget continues to decline, and most of the consumption budget still goes to necessities such as medical and health food, household goods and packaged food, etc.

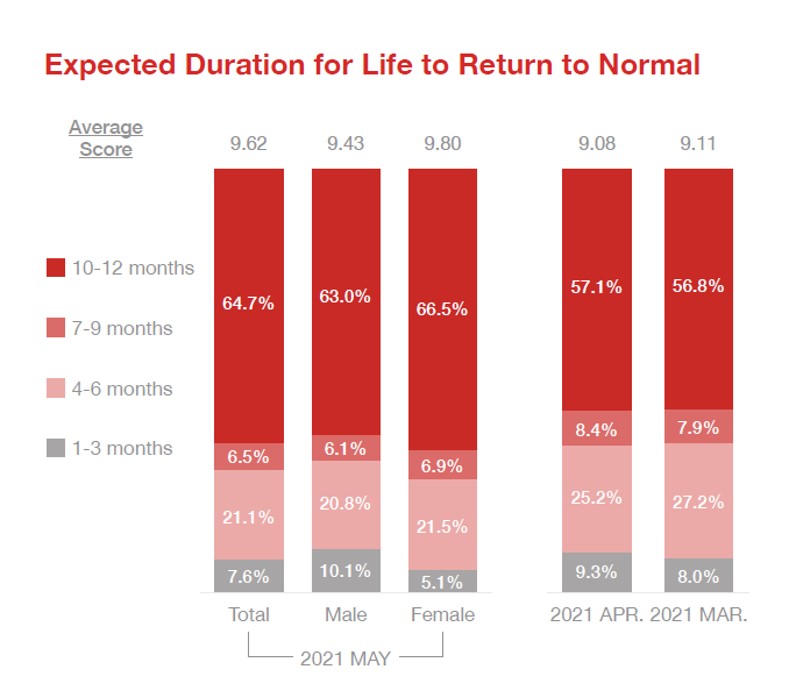

Although some stores have launched holiday promotions such as 517 (I want to eat) and 520 (I love you), the promotion and marketing power is not strong. It may still have to be combined with the current needs of the epidemic to stimulate people's desire to buy and hence bring better sales. Because of the severe epidemic situation, Taiwanese people are facing drastic changes in lifestyle. Compared with the data in March and April in the latest survey, people generally don’t expect to return to normal life until the first quarter of next year and return to their original pace of life. Whether Taiwan will, like other countries, gradually become accustomed to the sharp decline of physical social interaction and come up with the corresponding business models and products is worthy of our continued attention as a "country after the epidemic."

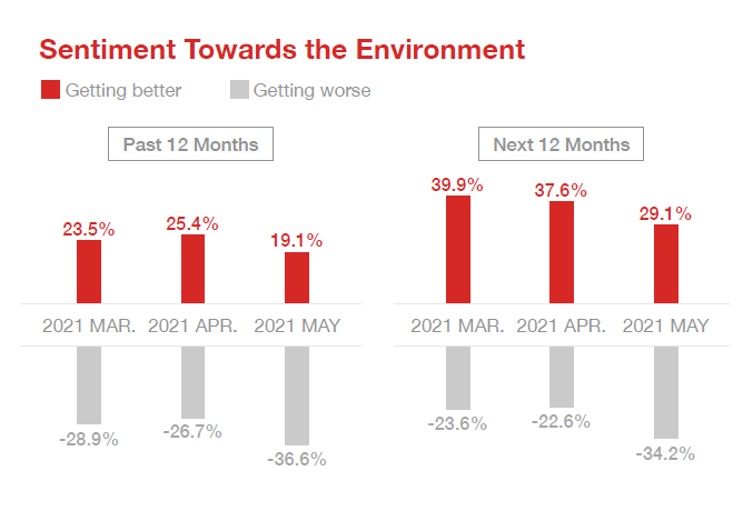

From this survey of willingness to travel in travel bubbles, it can be proved that even if the holiday is in a country where the epidemic is under control, the "epidemic situation" is still an important reason to prevent people from going abroad. Although there have been signs of improvement and loosening a while ago, Taiwanese people’s behavior and feelings towards the environment will immediately reflect in thoughts and behaviors as soon as the news of the epidemic emerges, as shown in previous surveys.

When the cycle of news shocks becomes shorter and faster, in addition to making readers more nervous and panic, how do we make these potential consumers buy? Besides targeting the materials that the public snapped up for the "outbreak tension", what else can be done?

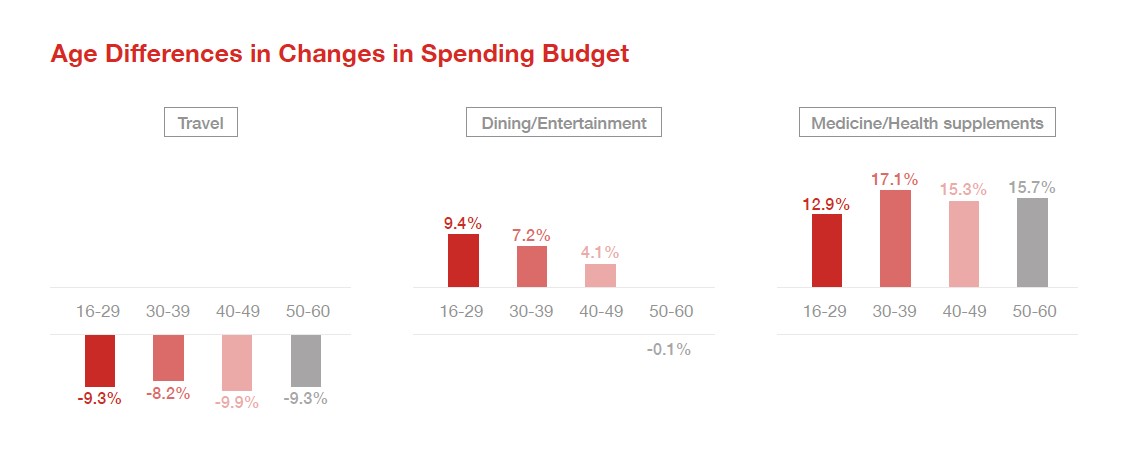

According to the survey conducted in May, young people (16-29 years old) tend to spend more on dining and entertainment while the lightly mature people (30-39 years old) tend to buy health care food. Further discussion: After the epidemic heats up and it is necessary to "stay at home", where will the young people's needs for dining and entertainment be directed to? In what way will the community interaction be satisfied?

This will be an opportunity for the entertainment industry to launch products so that people can further kill time and consume energy in a specific space by “spending money”, which will be the focus of creating a “bored economy", such as a social game that separates the needs of different age groups, exercises at home, how to spend the "extra time", teaching and interaction of cooking, etc. These are expected to become the biggest business opportunities for the target young people.

On the other hand, in addition to starting to afford medical and health food, the lightly mature age group may also have to undertake the health planning of other age groups, and they may also have more room to take on higher investment risks. Therefore, "Safe Economy" can target this age group as an important group and provide services like planning for long-term sports, physical courses, health insurance, and financial planning. Starting from such needs, it gradually expands into various development aspects.

The daily demand for medical products and daily necessities will definitely drive the demand for commodities from the epidemic. Related products that support remote work/learning with technology also become an important driving force for the stay-at-home economy. However, when people panic, feel overwhelmed by the impact of the epidemic and become unbearably bored over time, how can we properly understand these mental or physical interaction needs and "coexist with uncertainty"? I am afraid it will be a huge crisis which everyone must try to keep up with, fill up and create some new products or ideas with, but there is no doubt that it will also be a turning point and business opportunity.

On the other hand, this is an era of focus. How to distinguish the behavior, thoughts and needs between different ethnic groups (for example, distinguish the feelings and behaviors of opinion leader, amplifier, followers, and laggers in order to offer what they like), or in response to the current regional differences in the epidemic, we can design marketing activities with keywords such as "positive epidemic prevention", "mutual assistance" and "regional alternative interactions", which are all targets of precise marketing.

Just as the Taiwanese people’s perception of the environment has turned negative in the survey, if the rapid increase in the epidemic is just the beginning, we will eventually need to coexist with the virus. We originally wanted to say that it was just a temporary behavior that would last a few weeks. Now it’s becoming the new normal. Intimacy/social interaction and changes in life pace and activities are bound to change whether everyone wants it or not and likes it or not. This is probably what everyone will have to learn and accept next. Either the industry or the consumer, are we all ready to take over?

|