September 5, 2023

According to the latest survey, Taiwanese people’s perceptions of the environment and expectations of when they will return to normal life have not changed much. The public has mainly adopted a standstill in response to various changes in the current situation in April. However, there are still some key changes in the unchanged situation. What factors deserve further attention and discussion, and how to interpret the behavior of Taiwanese consumers to help us make arrangements in advance?

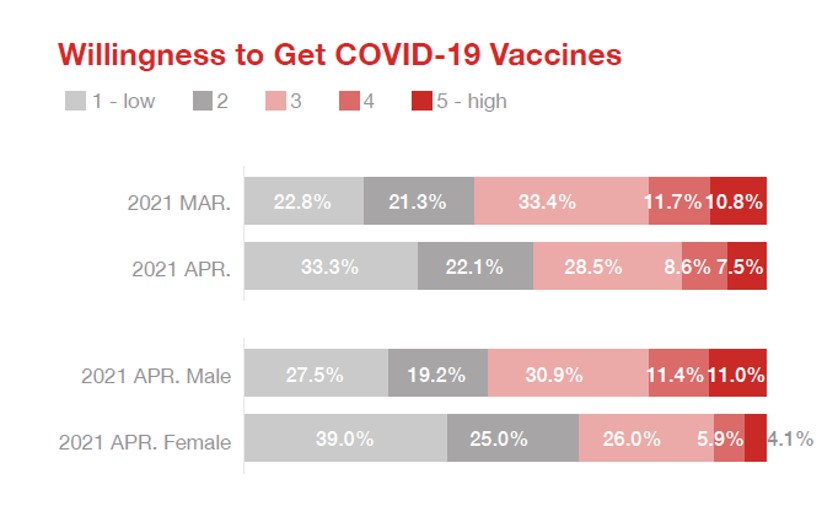

Taiwanese people's views on the pandemic and the time it takes to resume their daily lives have basically continued to be averagely optimistic since March. As there is no immediate sense of crisis, and there is news about the side effects due to the vaccination heard from time to time, in general, the people's willingness to get vaccinated is lower than that in March, among which is more obvious in women. Highly willing (5 points) + very willing (4 points) add up to only 10%, and 25% in men; about 60% of women have lower willingness, while men are less than half, about 47%.

But why does the difference lie in gender? Probably because the situation of the pandemic has been relatively optimistic recently, most women that are observing have become less willing to get vaccinated; in addition, it may also be due to the different proportions of the number of side effects of vaccines administered to different genders. According to a survey conducted by CDC from December 2020 to January 2021, 61% of the people who received the COVID-19 vaccine in the study were women, and 72% of the women reported side effects, including headache, fatigue, dizziness, chills, nausea, etc.

However, this situation does not seem to be rare because the same Yale medical report also pointed out that when women were vaccinated over the years, there have been many reported cases of side effects. This may be related to the fact that the subjects of biological experiments are mainly adult males, or also it may be that men with similar side effects have not reported. But in any case, whether why Taiwanese women are deterred from getting vaccinated at this moment is due to the frequent cases of side effects in the world requires more inspection and evidence.

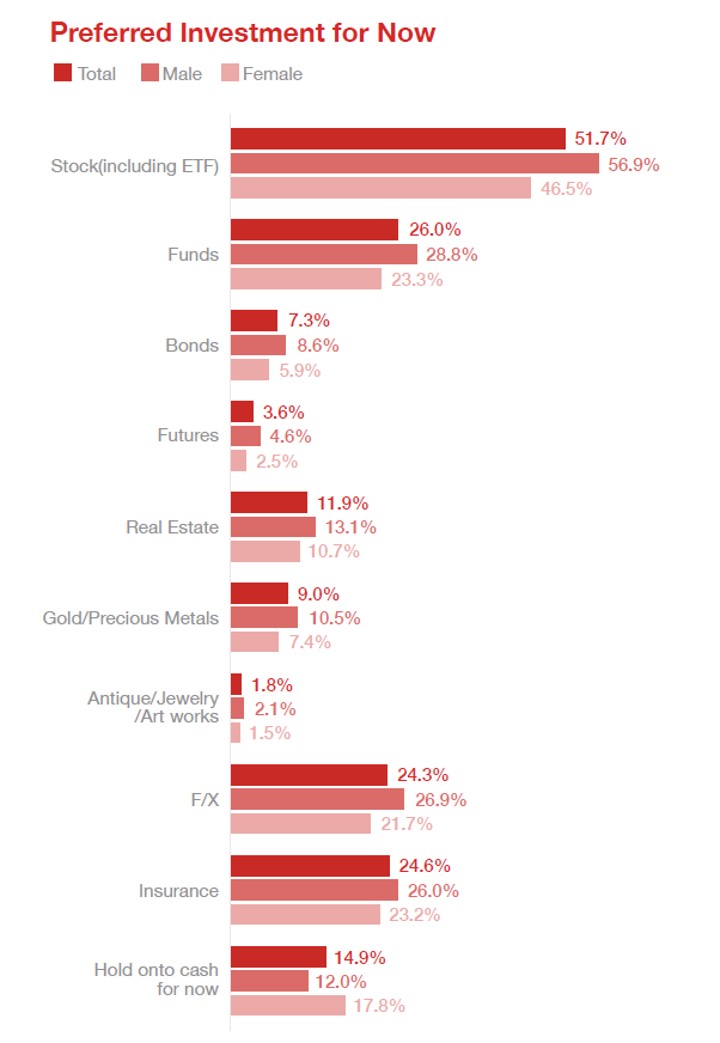

However, Taiwanese women's wait-and-see behavior also appeared in the latest investment behavior survey.

Although more than half of the people continue to invest in stocks (including ETFs), a closer look at consumers of different genders shows that compared with women, men invest 10% more in stocks than women, while women tend to invest in stocks with lower risks, such as insurance and funds. About 18% of women prefer keeping cash to investing, while that is 12% in men.

No matter if it's about getting vaccinated or investing, women are more conservative and passive. However, whether it’s because women are relatively conservative when making decision, or because they are affected by this pandemic/vaccine situation, these two different factors seem to extend to different consumer attitudes and needs: the former may require softer, more comprehensive, and complete information marketing packages because they are slow to warm up; the latter may have to be more direct in marketing. Only by focusing on the particularities and immediacy of the COVID-19 pandemic and emphasizing the demand of "immediate need, the sooner the better" can create more business opportunities.

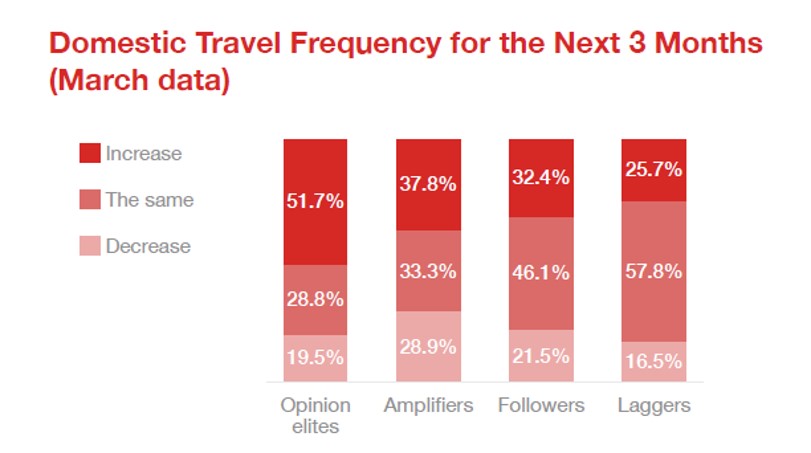

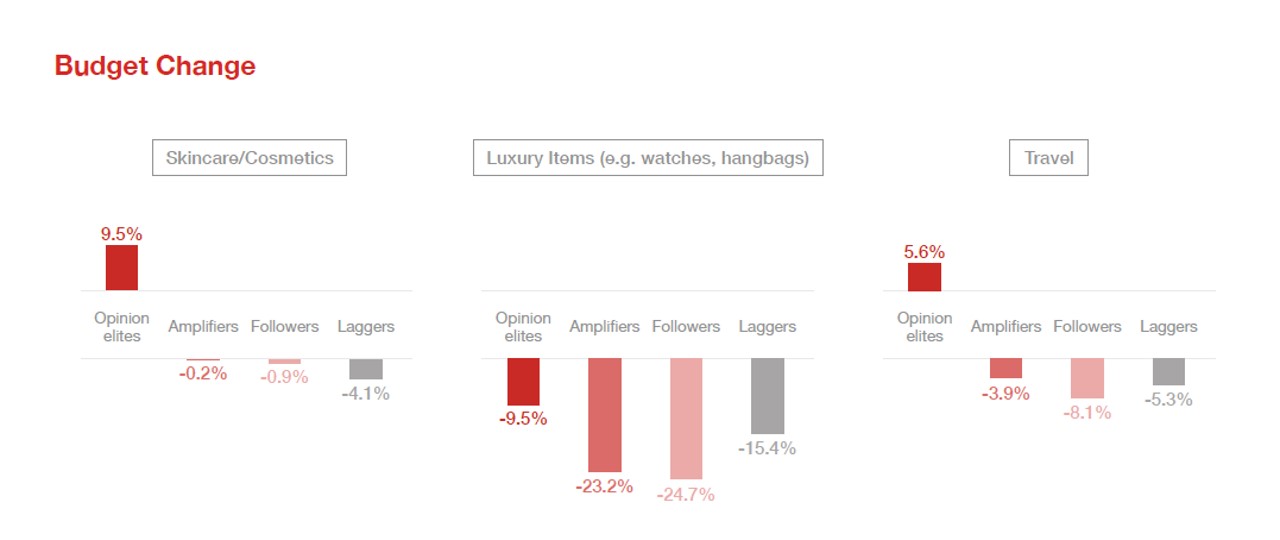

Another group worthy of attention is opinion elites. Generally speaking, this group has higher social and economic status and academic performance and is featured the first to receive the latest news and trends. They also often follow news, actively discuss it, spread it, give suggestions to relatives and friends around, and express opinions widely. In the survey of consumption changes, the opinion elite groups outperformed in "skin care and cosmetics" and "tourism" items, and said they would increase their budgets.

If focusing more on tourism, more than half of the opinion elite group in the March survey mentioned that they would increase the frequency of travel in the next three months. In addition to revealing clues to the recovery of the tourism industry, it also shows that specific groups have already desired to travel, which is unstoppable and very likely to take place in a short period of time.

At the time when the first travel bubble group returned to Taiwan, all were tested negative, which is an important breakthrough and incentive. Even though the Palauan travel corridor plan has received many criticisms, including the complicated and long inspection procedures for tourists, the excessively high cost, and the lack of succession of the group, the importance of the first successful group is that it will allow us to negotiate with Palau in order to further adjust and improve the quality and experience.

These experiences will also be a valuable bargaining chip to continue to advance and increase possibilities when negotiating with other potential cooperation areas in the future. Combining these aspects, we can optimistically expect that there is still plenty of room for growth in the travel bubble group. In addition, the tourism industry should pay more attention to and strengthen marketing and communication with the opinion elite groups in order to seize the opportunity. No matter how the pandemic evolves, it will eventually become the norm we must coexist with, and the tourism industry will definitely return.

However, what irreversible and profound impact does the COVID-19 pandemic have on the ecology of the tourism industry? Can the tourism industry combine creatively with other industries such as transportation, IT, e-commerce, media, etc.? How will it show to us? These are worthy of our close attention and breath-taking expectations.

|