September 5, 2023

As we approach the midpoint of 2023, the Australian automobile market continues to chart an exciting trajectory. A diverse array of brands compete for consumer attention, reflecting a dynamic and evolving landscape that's responding to both global challenges and local preferences. The sector has demonstrated remarkable resilience and adaptability, signaling promising prospects for those willing to understand and navigate its complexities.

From January to May 2023, the vehicle market in Australia has shown an impressive upswing. Despite initial challenges from disruptions in the global supply chain and the COVID-19 pandemic, sales reached a notable 102,076 in May, marking a 12% increase from the previous month1. In the broader context, this trend continues the momentum from 2022 and exemplifies the sector's recovery and growth. However, it's not just about the numbers. It's about the shifting preferences and emerging trends that are propelling this growth.

A particularly noteworthy trend is the rise of electric vehicles (EVs). Market revenue is predicted to reach a whopping US$2.85 billion in 2023, signaling a strong market evolution. The broader implications of this shift extend beyond mere sales figures, reflecting a more profound transition towards sustainability and a response to global climate change2. This is corroborated by the fact that 68% of Australian executives reported increased investment in sustainability over the past year3.

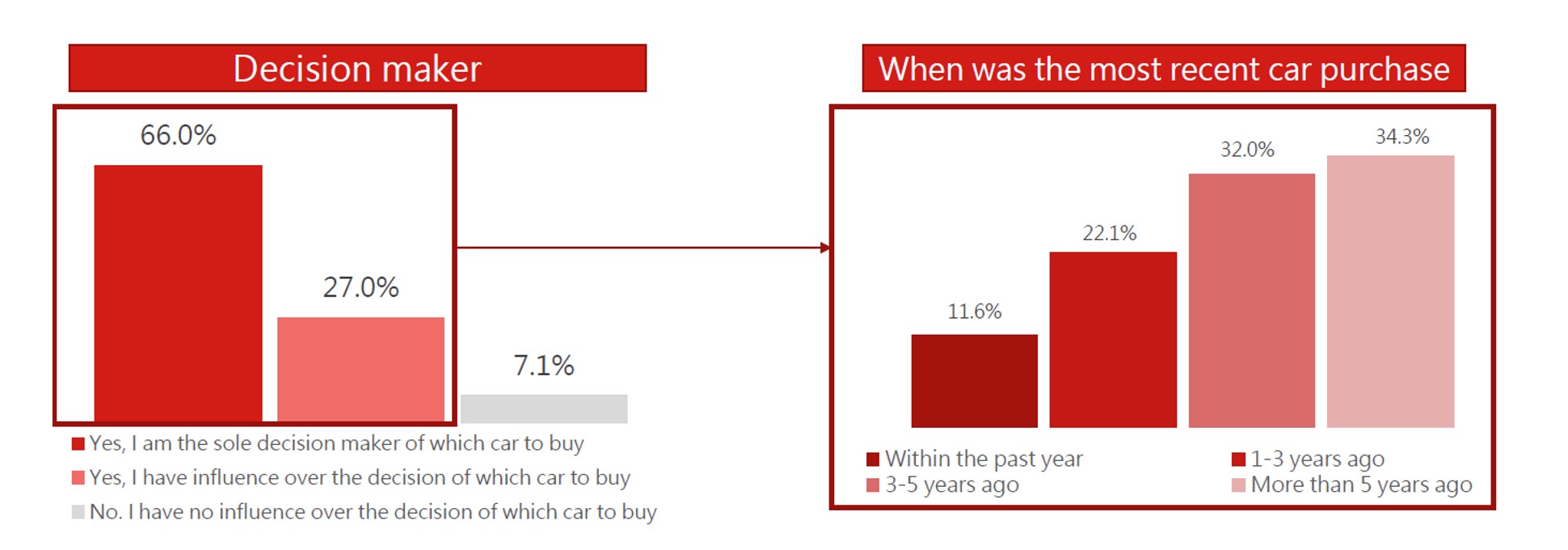

But what does this mean for the consumer? A recent study by Z.com Engagement Lab provides valuable insights into the behaviors and preferences of Australian car buyers. A crucial finding of the study is that car purchases are significant decisions for most Australians, with 93% having direct or indirect influence over their most recent purchase. This suggests that automobile purchases are not impulsive, but rather, they are considered and deliberate actions.

Despite the buzz around EVs and sustainable options, gasoline cars through dealerships remain the mainstream choice for Australian consumers. Nearly 60% of decision-makers opt for new cars, while 40.6% choose used cars. This preference for traditional gasoline vehicles indicates a market that, while open to change, still holds onto familiar and tried-and-true options.

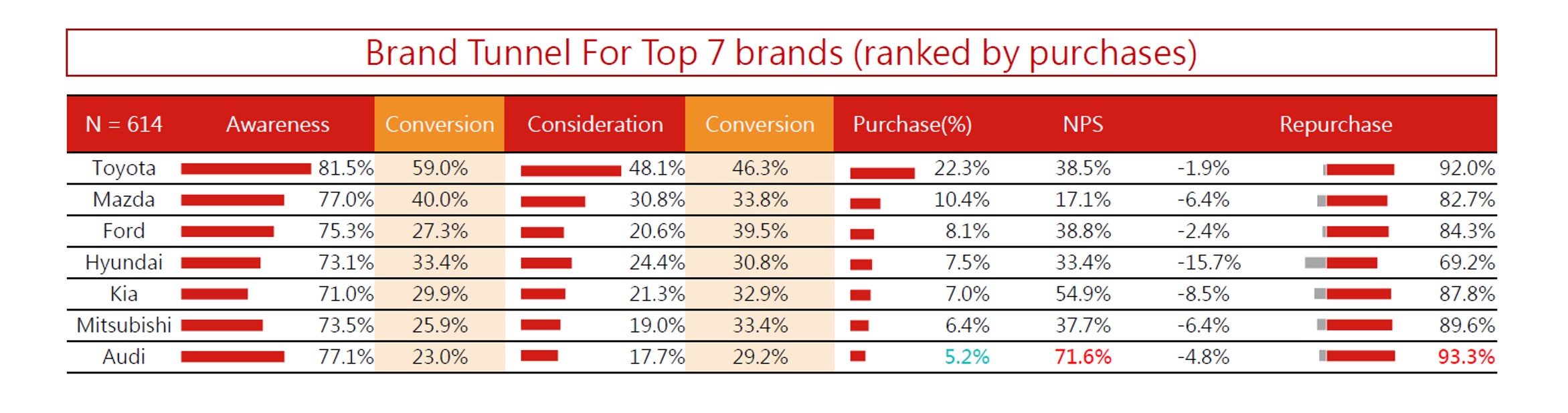

In this highly competitive market, Toyota has emerged as the clear market leader across all brand funnel stages. It has achieved a strong consumer awareness level that other brands are striving to match. However, the 'chasing pack,' comprising Mazda, Ford, Hyundai, Kia, and Mitsubishi, each face unique challenges at different points in the brand journey. Mazda leads in various measures but struggles with the lowest Net Promoter Score (NPS). Ford, Hyundai, and Kia exhibit weaknesses in the consideration and purchase stages, suggesting that these brands need to improve their marketing strategies to convert awareness and consideration into sales.

After runing factor analysis, the Z.com Engagement Lab study identifies three key factors driving consumers' purchase decisions:

These factors offer a lens to understand the nuanced behaviors of consumers towards different brands. When combined with Stated vs Derived Analysis results, we revealed Toyota buyers, for example, exhibit a more balanced approach, emphasizing practicality and performance, as well as system, service, and affordability, while placing less emphasis on aesthetics and brand experience. Mazda buyers, in contrast, tend to focus on system, service, and affordability. Ford, Hyundai, and Kia buyers prioritize practicality and performance, while Mitsubishi buyers consider all three factors equally. This provides a detailed map for marketers to understand and target their consumer bases more effectively.

So, how should decision-makers in the auto industry utilize this wealth of information? The starting point is recognizing that each brand resonates with a distinct consumer profile. This understanding is paramount.

Each brand in the automotive market has its own unique appeal and set of characteristics that draw in a particular demographic. Recognizing these distinctive attributes and the consumers they attract is the first step towards leveraging these insights effectively. This comprehension allows decision-makers to tailor their marketing strategies, design principles, and customer service practices to resonate with their target consumer profiles.

By doing so, automotive industry leaders can create a more personalized experience for their consumers. This can lead to greater customer satisfaction, stronger brand loyalty, and potentially, increased market share. Furthermore, understanding the distinct consumer profile of each brand can also help industry decision-makers anticipate and respond more effectively to shifts in market trends and consumer preferences.

In conclusion, in the complex and ever-evolving landscape of the automotive industry, understanding the unique appeal of each brand to its consumer profile is not just beneficial—it's essential. It's the compass that can guide decision-makers in navigating the challenges and opportunities that lie ahead.

At Z.com Engagement Lab, we pride ourselves on having the latest consumer data to keep you informed on emerging trends in the Automobile industry. Our recent study, conducted between April 25 and May 8, 2023, delves into the automobile brand perceptions and preferences of Australians, providing invaluable insights for decision-makers. Stay connected with us to keep your finger on the pulse of the ever-evolving transportation landscape.

Sources:

|