February 3, 2025

With the rapid global proliferation of smartphones in recent years, the mobile gaming market has been on a steady rise. In particular, Southeast Asia has seen an increasing number of young mobile game users, driven by the widespread availability of affordable smartphones.

Statista's latest survey shows that hyper-casual games have become mainstream in the Asian mobile gaming market due to their quick play and easy learning curve.

Additionally, microtransactions, such as the purchase of virtual currency and virtual items within apps, are also thriving. This trend is expected to continue through 2025.

Furthermore, according to a report by the global research firm Sensor Tower, the number of mobile downloads in Southeast Asia reached 4.2 billion (3.4% increase compared to the previous period) in the first half of 2024. Of these, 91% were downloads from Google Play, revealing that the number of players prefer app-based gaming is increasing.

Regarding popular game trends, simulation games centered on food, such as pizza shops or food delivery driver simulations, ranked highest in downloads, indicating a strong preference for games with a "food" theme.

Another popular genre is sports simulation games. Notably, the top two football simulation games achieved remarkable revenue growth in Southeast Asia, with approximately 80% and 20% growth compared to the previous period.

Indonesia leads the mobile gaming market in Southeast Asia regarding download numbers. It accounts for over 41% of mobile game downloads, which increased by 10% year over year from January to August 2024 from a report by Sensor Tower.

Thailand ranks first in revenue, with a 10% year-on-year increase in the mobile gaming sector.

This highlights the enormous potential of the mobile gaming market in Southeast Asia, making it an incredibly attractive and continuously growing demand for gaming-related companies.

Willingness to Spend on Mobile Games in Asia

Numerous research reports exist on the gaming market. Still, an intriguing recent study by Z.com Engagement Lab focuses on users' willingness in five Asian countries: Taiwan, Japan, Thailand, Indonesia, Singapore, and Malaysia. The survey targeted people aged fifteen and above in these countries, offering valuable insights into mobile gaming purchase intentions across the region.

Microtransactions in mobile games provide a significant source of revenue for game developers. They also offer players an addictive system that enhances their enjoyment by allowing them to acquire virtual items.

Furthermore, the widespread adoption of 5G has improved smartphone connectivity, enabling faster, smoother performance and better visuals. As a result, the willingness to engage in further transactions is expected to increase in the future.

Willingness to Spend on Games

The latest survey by GMO Research & AI : Industry Consumption Index

This study provides valuable insights into the evolving trends and factors influencing the willingness to invest in mobile games, shedding light on the growing monetization potential in these key markets.

As mentioned in the previous section, the graph shows that consumers in Indonesia (61%), Malaysia (63%), and Thailand (67%) have a positive attitude toward future spending on mobile games. These percentages suggest that these countries are developing markets with significant potential for growth in mobile game monetization.

Purpose of Gaming

What motivates people to play games?

According to a trend survey by GMO Research & AI, targeting general consumers in emerging gaming markets such as Vietnam, Thailand, and Singapore, about 40% of mobile game players engage in gaming almost daily.

The primary purposes for playing games include:

The survey also revealed that key factors in choosing a game are:

Preferences for game content and playing times vary by country. Therefore, marketing strategies focusing on country-specific trends could significantly influence download numbers and revenue in each market.

Expected Game Genres for the Future

In terms of game genres anticipated to remain popular, simulation games, sports simulation games, and MOBA (Multiplayer Online Battle Arena) games,all of which recorded high download numbers in 2024 are expected to continue enjoying strong popularity among players.

Willingness to Spend by country

The three countries with a high positive outlook—Indonesia (61%), Malaysia (63%), and Thailand (67%)—anticipate continued market expansion through the introduction of new products and strategic marketing. In these substantial markets, the key to success lies in swiftly and effectively delivering products (mobile games) that meet user demands.

On the other hand, in Taiwan and Singapore, where Neutral responses are 35%, identifying the usage patterns and challenges faced by Neutral users could help drive higher purchase intent. By offering more appealing products to this segment, it may be possible to convert Neutral users into active spenders.

To achieve this, it is highly recommended to conduct online surveys to analyze usage trends and identify challenges. These insights guide the development of tailored strategies and products that better meet user needs and enhance monetization potential.

What is a Usage Trend Survey?

A usage trend survey lets you understand users' utilization status, usage patterns, behaviors, and perceptions regarding specific services, products, systems, or facilities.

The purpose of this survey is to identify:

A well-structured survey might include questions on preferred gaming times, favored game features, and barriers to making in-app purchases. This data helps tailor marketing strategies effectively by aligning product offerings with user preferences.

Country-Specific Usage Trend Survey

Since purchasing intentions vary by country, conducting surveys tailored to each market's conditions is advisable.

Survey Objectives

Sample Questions:

For Positive-Oriented Countries:

For Neutral-Oriented Countries:

Positive Regions (Indonesia, Malaysia, Thailand)

Neutral Regions (Taiwan, Singapore)

After conducting a usage trend survey, it becomes possible to improve the usability and quality of products or services by adding new features based on customer usage and needs or by modifying specifications to address issues and dissatisfaction raised by customers.

For mobile games, a unique feature of the industry, detailed data can be extracted, such as the frequency of app usage after installation and the acceptable range of spending on in-game purchases.

Online Surveys Tailored for Smartphone Game Users

Online surveys are well-suited for smartphone game users, offering an efficient way to collect responses. They enable the quick and cost-effective collection of results, making them the ideal method for gathering a broad range of consumer opinions in the initial stages of research.

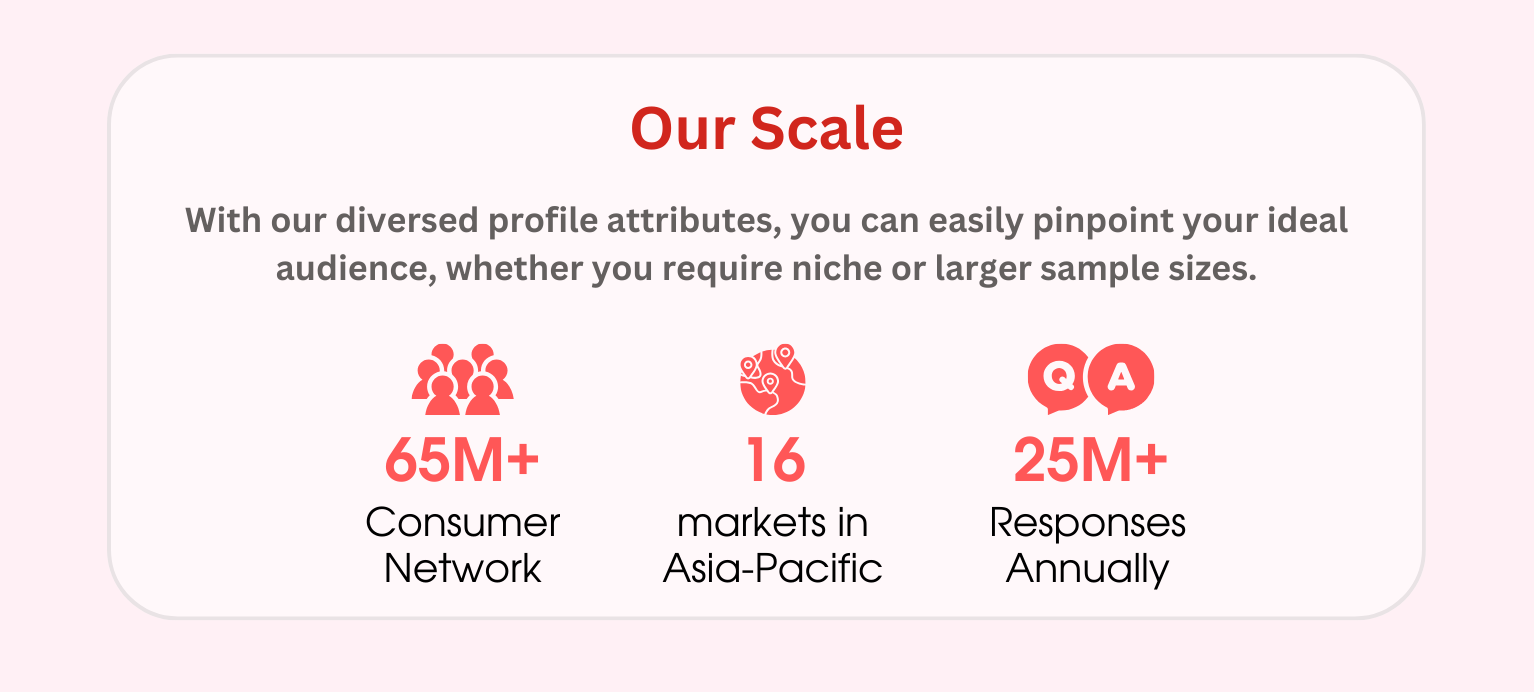

Z.com Engagement Lab ensures the success of your online surveys. Our proprietary consumer network, Asia Cloud Panel, connects you to over 65 million real consumers across 16 countries in the Asia-Pacific region.

By identifying your target audience, you can maximize the value of your survey results!

Beginner's Guide to Online Survey

If you are new to online surveys, feel free to check our beginner's guide HERE!

Feel free to contact us for more service details!

|