September 5, 2023

Countries still strict on prevention measures, wearing masks and relentless handwashing have become global citizens’ daily routine. Our online research during Apr 1st to 8th this year explore insights of female consumers age 16 to 50 years old. We want to know what they think about the overall societal change, skincare consumption behavior, and if any changes regarding demand for the upcoming Mother’s Day promotion, so that brands can stay well-informed.

The market may be slowing down, but for the skincare market Taiwanese female consumers are still contributing to the increase (10%). Growth predominately brought by the cleansing (12.8%) and hand cream (11.4%) categories. Brands should seek ways to bundle products (such as other skincare or makeup) with the promising categories and create growth despite the downturn.

65.9% of Taiwanese female consumers expressed problems such as itching and acne issues due to wearing masks for long periods. This has affected their purchase to look for products that are mild and less irritating. Brands can leverage related topics for content marketing campaigns. Topics should be informative but also related to the product categories. Such as, light makeup tutorials/skincare regime for wearing masks the whole day, or Dermatologists suggestions on skincare (face & body) during the epidemic.

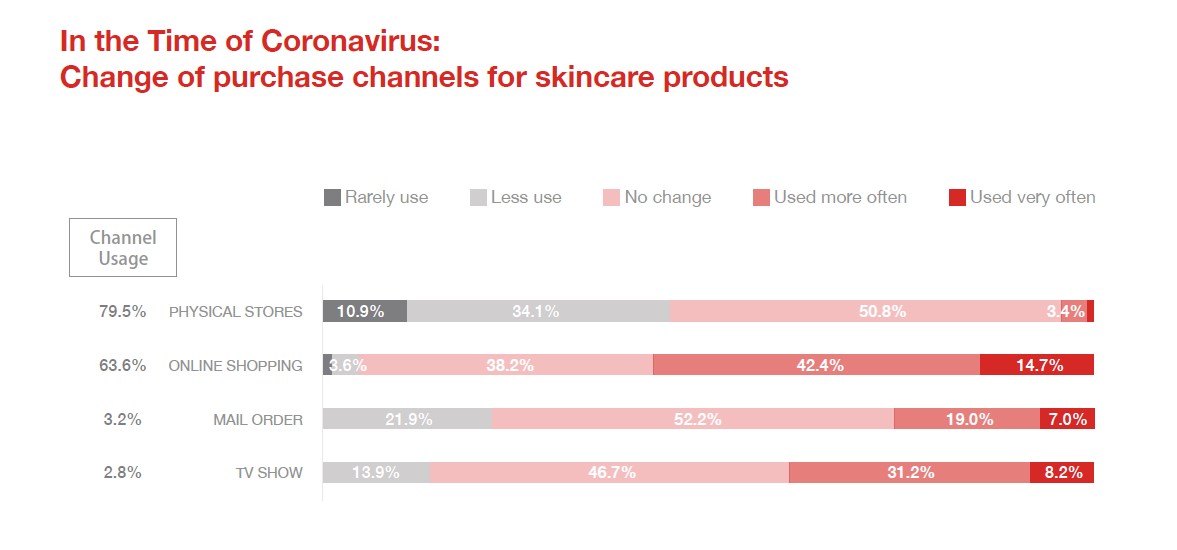

Brick & mortar shops still dominate skincare purchase channels (79.5%), yet during this epidemic, online shopping frequency has increased drastically (57.1%). Not only does this foretells the next growth for ecommerce, it also suggests brands should start allocating relevant marketing and communication resources reflecting strategies.

For example, obtain key marketing ad channels/spaces within the ecommerce platforms, influencer marketing, content marketing, and cross-industry collaborations. PR efforts that promote social good is also a good way to increase meaningful share of voice for the brand. Ideas such as gifting hand creams to workers in the medical, service related fields.

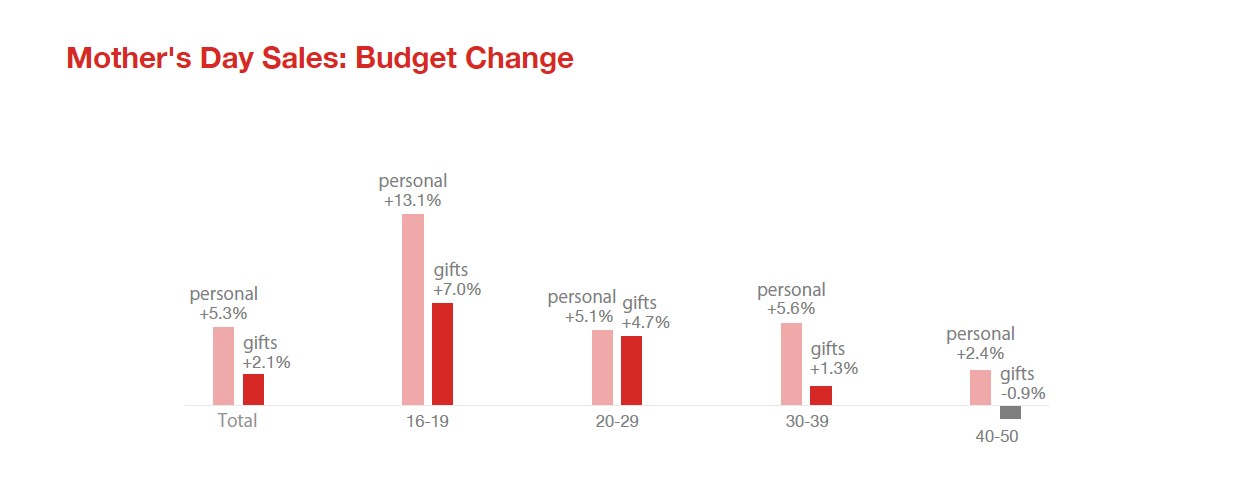

The budget saved from limited social gathering turned into purchase power for Mother’s Day promotion. In the seemingly economic downturn, Taiwanese female consumers’ budget actually increased. The most obvious groups are the younger crowd (16-19), opinion leaders, and amplifiers. The question is, how long can this purchase power last?

Though social media is still the main purchase decision factor, perhaps it’s time to think beyond price promotion, gift-with-purchase, and content marketing. Individual travelling packages with tour cars that take you to the north coast could be an interesting incentive. International skincare brands still dominate the market, however if smaller brands with strong product efficacies can push through strategically, it’s hard to say who will win in the future.

While time spent on online shopping is relatively similar, younger consumers (age 16-19) show a stronger increase (13.1%) for Mother’s Day promotion purchases, surpassing consumers age 30 and over. Mature consumers might be more conservative on spending due to pessimistic future outlooks.

Therefore, brands should customize key communication messages for different age segments. It is also a good idea to design at-home sampling programs that continue to secure or convert new users for the brand. This in the future will have an opportunity to turn into sales.

Cosmetic giants such as L’OREAL have started to incorporate AR into their service model. Last year way before the outbreak, they initiated the #ColorMe campaign collaborating with Watsons mobile APP. This allows consumers to virtually try-on 300 different L’OREAL Paris/Maybelline products. Watsons now temporarily removed testers off the shelves, therefore perhpas this is a good timing to bring AR tryons back.

In addition, NYXCosmetics recently teamed up with female singer Princess Nokia for a live concert on Instagram. The entire copywriting focuses on isolation at home but also demonstrates using their makeup lines. This collaboration is not just creating buzz for both, but could be a beginning of a new business relationship/opportunity.

The epidemic is said to drive long-term consumer behavioral changes. Therefore, staying in the know is crucial for any strategic next steps. In addition to female skincare products, what about the makeup and male skincare insights?

For custom reports on your industry, consumer insights and market intelligence in the Asia region, please contact us.

Obtaining key consumer insights is the first step to turn crisis into opportunity.

|