September 5, 2023

Since the pandemic impacted the economy, some time-honored restaurants closed for business, and some elder employees retired. Do you also plan your retirement?

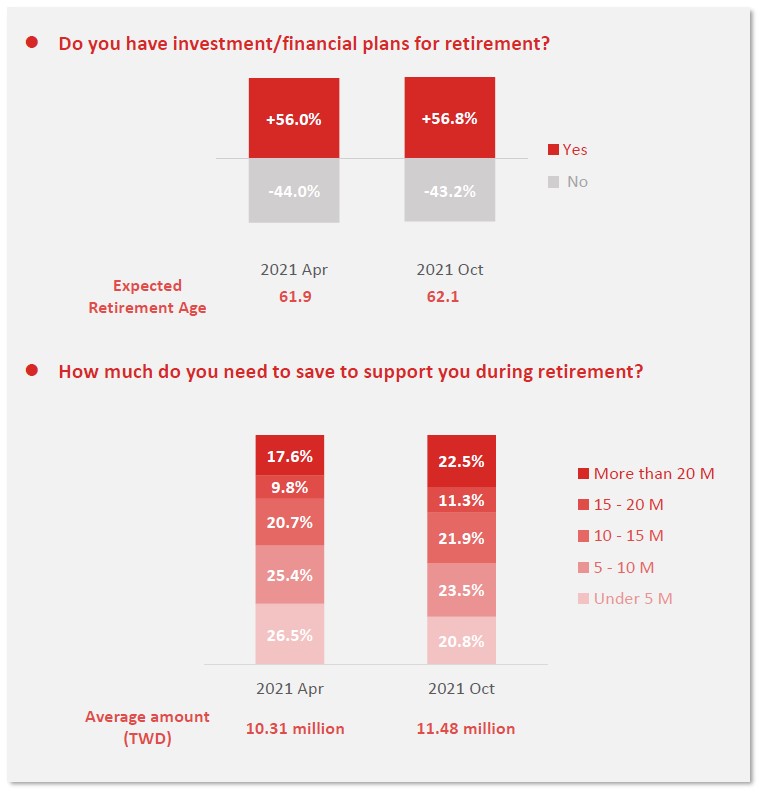

According to the latest study result, approximately 25% of netizens expected to retire in the age of 60 to 64 and 22% of participants wanted to retire between 65 to 69 years old. Moreover, there was a 0.8% increase in people who invest for retirement compared with the result six months ago.

How much do you need to retire? In April, netizens estimated that saving 10.31 million for retirement was needed, but it rose to 11.48 million in October. It can be seen that people change their expectation of retirement preparation because of the impact by COVID-19 and the stress of inflation.

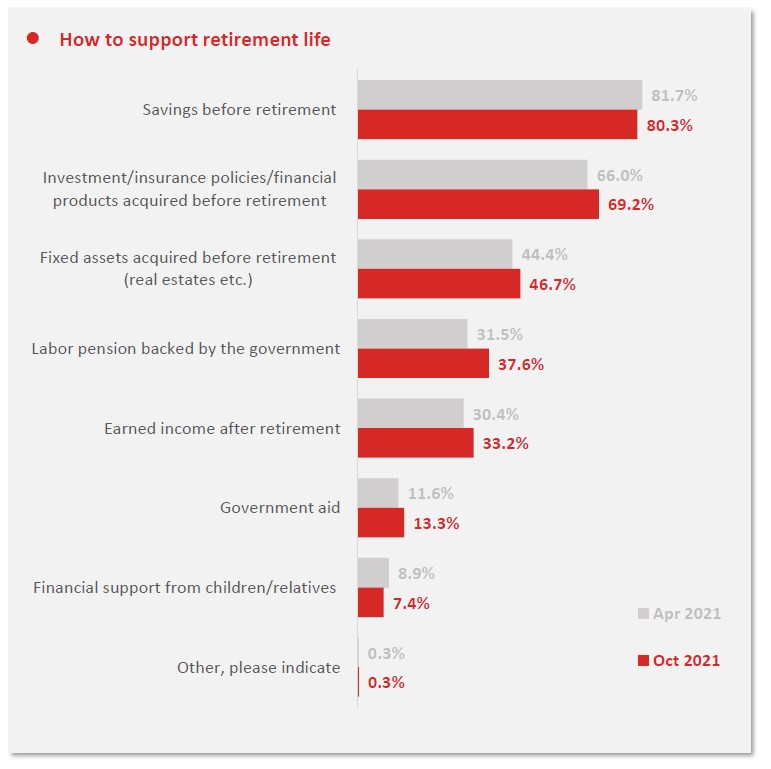

How do people prepare their retirement deposit? 80.3% of people wanted to rely on the pre-retirement deposit, but it decreased 1.4% compared with this April. At the same time, more and more people want to use insurance and real estate investment to replace pre-retirement deposits.

People who choose investment, insurance, and financial tools for their retirement money increased 3.2% in the six months, and a 2.3% raise in people who wanted to use pre-retirement fixed assets. Moreover, the study also found an increase in people planning to use pension, subsidy, and continuing working to sustain themselves during retirement.

How do they get the investment information? Top 2 information channels were investment websites with 42.5% and social media with 36%. Yet, word of mouth replaced television shows to become No.3 reliable information channel in October.

What is your expected retirement age? How do you approach your retirement plan?

|