September 5, 2023

The COVID-19 pandemic drives the growth of the game market and the business opportunities of devices, advergames, and in-game advertising. The estimation of the market size has increased to $174.9 billion. Does the game market in Taiwan synchronize with the global market? What are the features of game players in Taiwan? How do brands communicate with the market in games?

Home quarantine and travel restrictions speed up the raise of the game market and the market size is up to $174.9 billion. The game advertisement, in-game advertising, real-time data, and the ecosystem of players become important for branding-communication strategies.

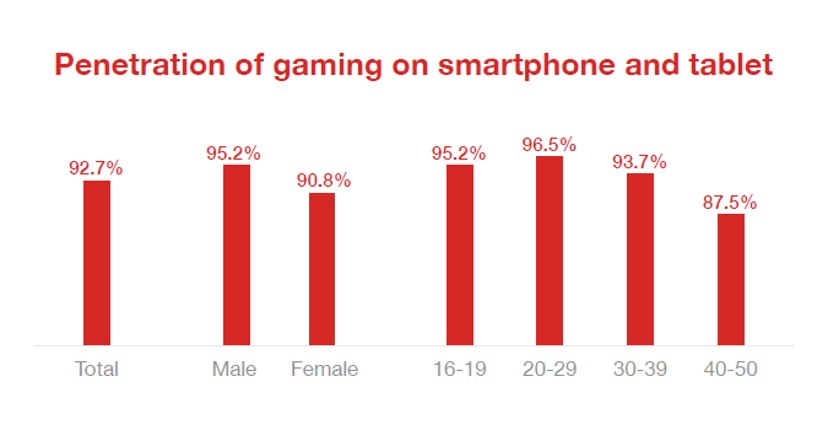

According to the latest survey report, over 90% of netizens play games, and the male players slightly more than female players. In addition, the players with 97.2% tend to use mobile devices. Most of the players who use mobile devices are in the age group of 20-29 followed by the age group of 30-39. Because of convenience and abundant choices, mobile devices are the priority choice for most opinion leaders and advocates to play games. Moreover, PC is the second choice for participants. The participants who tend to use PC are from the age group of 16-19, but the game players whose age is 20-29 like to login to the game via console.

In terms of downloaded games, players in Taiwan annually download 23 free games and 10 paid games on average, and the male players download 10 more games than female players. Most of the participants who paid for downloading games are aged 30-39, and the players who are in the age group of 40-50 tend to download for free.

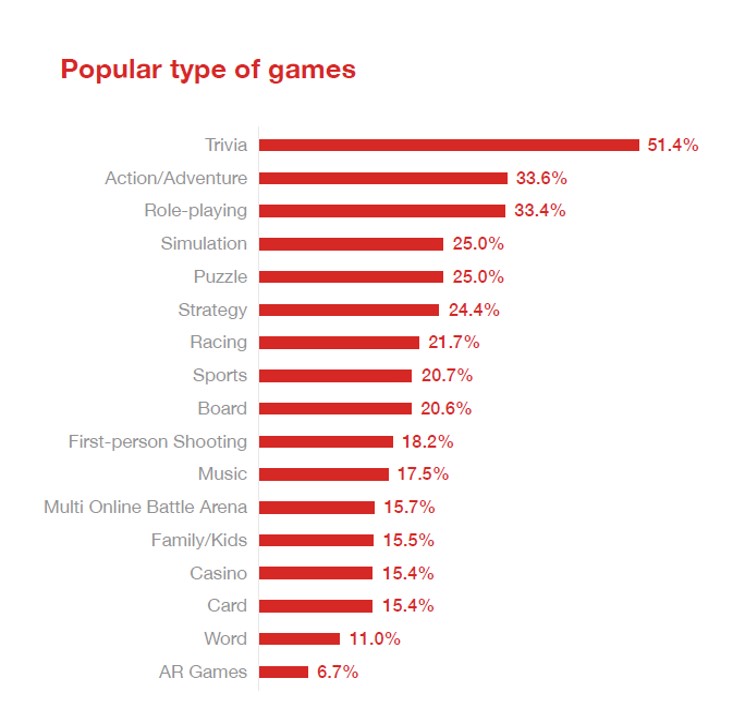

More than half of the players in Taiwan like trivia games, although the male players like to spend time on action and adventure games. The second popular type among female players is puzzle, and the role-playing game is the third popular type in both male and female players. Cross analyzing the types of game and the devices players chose, females play trivia games across the devices, and males play trivia games on mobiles, role-playing games on PC, and shooting games on consoles. Nevertheless, family and kids games are very popular among the age group of 40-50. The result shows that kids players are lurking in the adults' account.

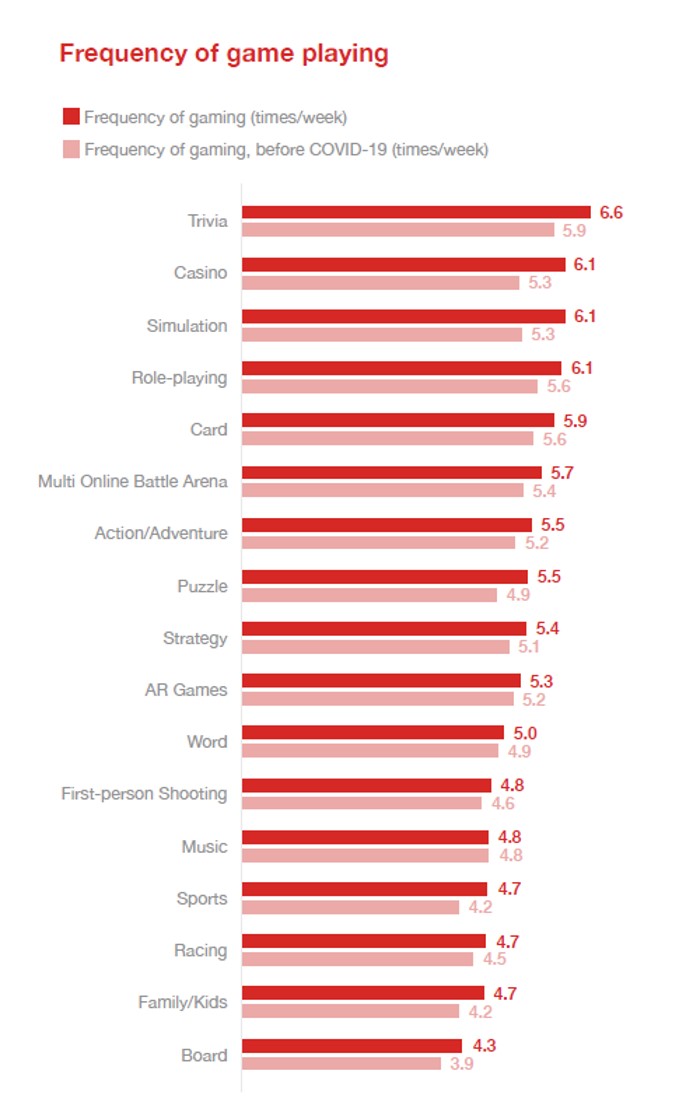

The frequency of playing games has grown after the pandemic, but the amount of time, budget, and downloaded games that the players spend on games are equivalent to the situation before the COVID-19 crisis. On the one hand, the frequency increase significantly is in trivia, casino, and simulation types. On the other hand, the players play games for 1.68-1.21 hrs a day before and after pandemics.

In other words, players are getting used to playing games at odd moments. Long games do not impact the result of time-spending, because it only attracts male players under 30.

In addition, a big part of players in Taiwan tend to download games for free before and after the pandemic. The participants claim that they pay for some in-game purchases for cosmetics and followed by the in-game advantages that include items, characters, or boosts.

Regarding marketing communication, over one of four players are interested in the topics of online games or mobile games. However, people pay less attention to the topic as they get older.

The game companies can attract players effectively through word-by-mouth, good game experiences, and social networks because most participants know new games through the App Store and the introduction of friends.

Furthermore, advergaming is another approach for brands to communicate with the market besides in-game advertisement. For instance, ResMed's advergame which is considered the best in 2020 attracted over 50% of players who ended up on ResMed’s website, 1.9% of players shared the game on their social media pages, and led to significant business growth. To sum up, understanding the players' habits and features has become important to brands.

|