September 5, 2023

The global economy has been affected by the pandemic through 2020, and the proposed policies of Joe Biden become matters of economic impact after the American presidential election. Throughout this article, you will find out how Taiwanese people manage their private wealth under a series of big changes and what the features of financial management in young adults are.

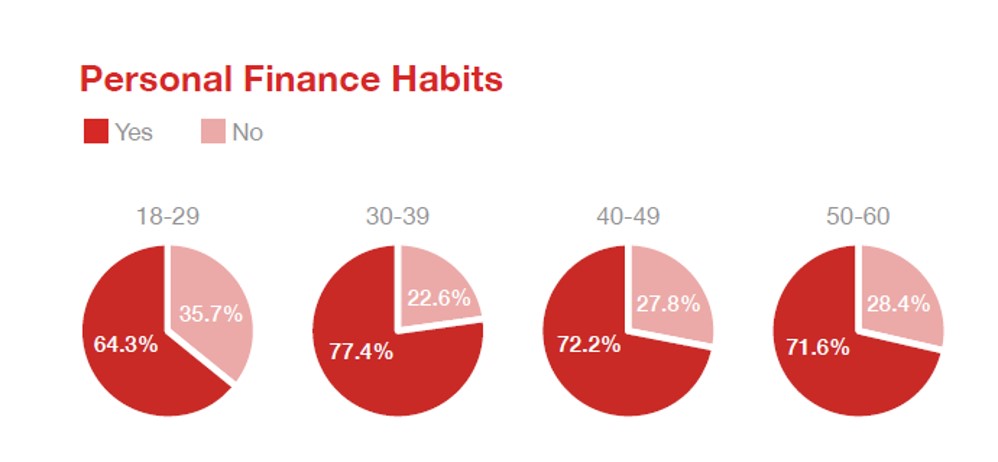

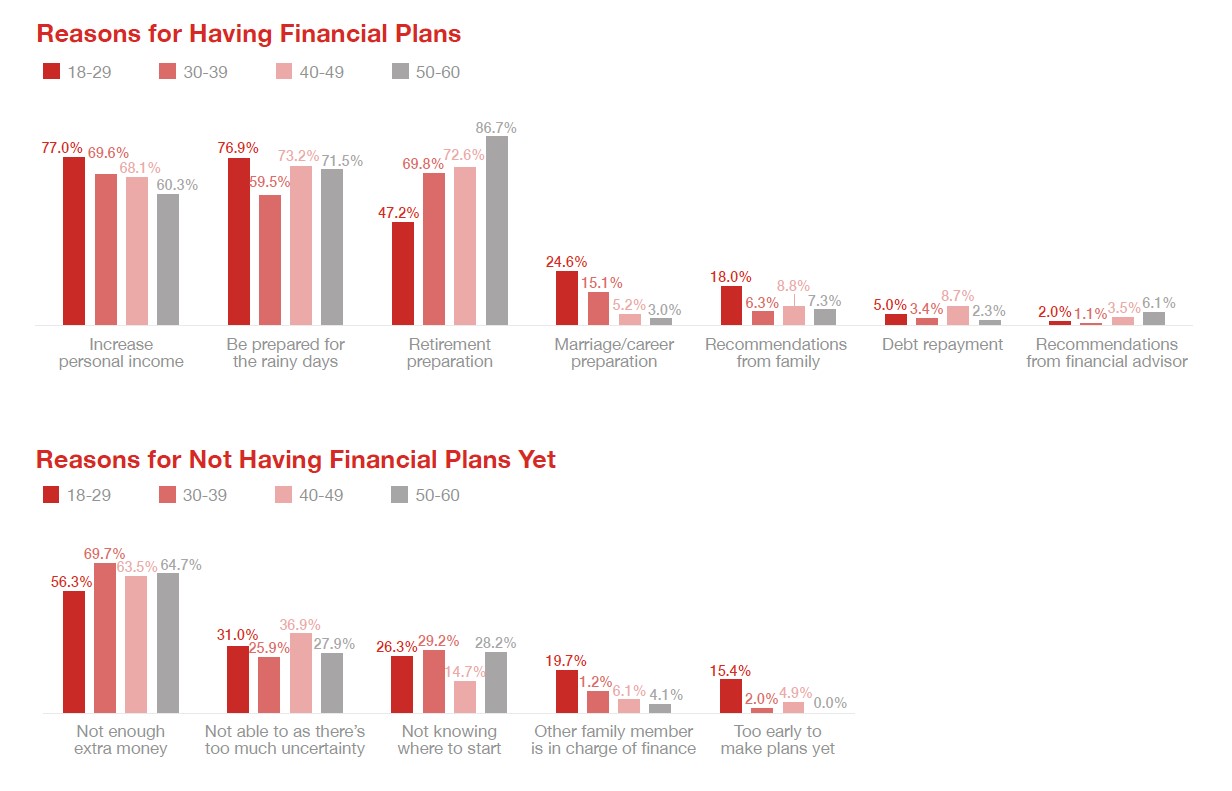

The latest survey report points out that most Taiwanese manage their money, but the motivations of financial management are varied. Although the 18 to 29 age group has the least percentage in financial management, over half of the young participants claim that they plan to manage personal wealth. Moreover, young adults address that they manage their money to increase personal income. In contrast, people in the 30 to 39 and 50 to 60 age groups manage fortune for retirement, and the 40 to 49 age group manage money against unexpected needs. On the other hand, short of money is the major reason to stop people manage their finance. In addition, uncertainty is one of the essential hurdles for the youth to manage wealth, and financial illiterate is an important investment barrier for people in the 30 to 39 and 50 to 60 age groups. Conclusively, small investment and customized suggestions can effectively facilitate people to start investing.

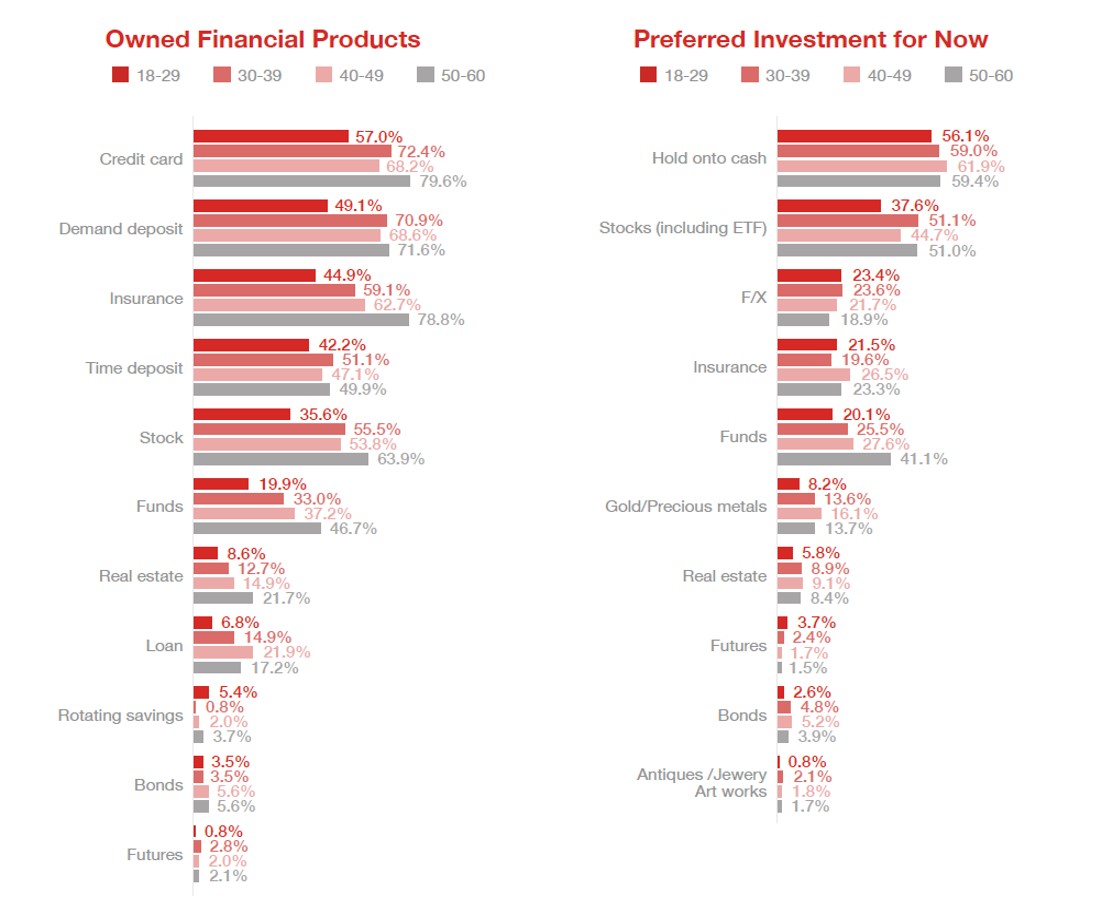

According to the result of the latest survey, the most popular financial product is credit card and followed by different financial management tools. Regarding the second preference of financial products, most of the participants in the 18 to 49 age group choose deposit accounts, and people whose ages between 50 to 60 need insurance. In terms of investment products, stocks and ETC are the most popular types of investment products followed by foreign currencies and funds. The 18 to 29 age group tends to invest in foreign currencies, but others prefer to invest funds. In the stock market, a large number of participants will hold stocks over the long-term, but some people the age between 18 to 39 may choose a short-term investment. The investment of real estate only attracts people from the 30 to 39 group currently, but the youth claims that they will keep observing the trend.

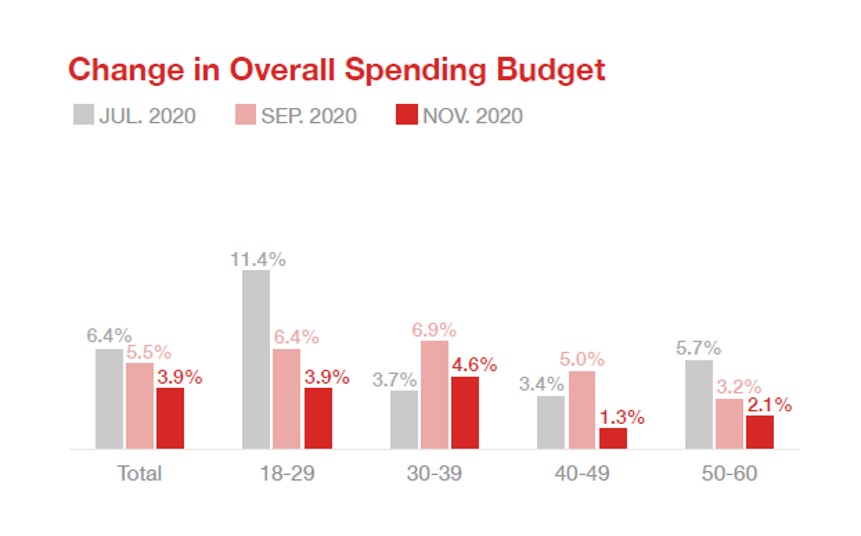

Regarding financial and investment forecasting, the youth group expects that there is no significant change in the next 12 months. The 30 to 39 age group thought that the economy will have a positive turn, but people in the 40 to 49 age group considered the economy is going to keep declining. Therefore, the purchasing budget of the 40 to 49 age group has been decreasing by 3.7 percentage that is a great reduction among all age groups since September and followed by a 2.5% reduction of the 18 to 29 age group.

Considering the effects on investment in the near future, there are not only the aforementioned features in financial management but also a remarkable impact after the American presidential election. Indeed, some proposed policies of Joe Biden's administration will lead to some considerable changes in the economic trend. First of all, climate change is one of the key issues that Biden stands on may drive a comprehensive growth in the concept stock of electric vehicles, renewable energy, and green supply chain. Secondarily, in Biden's foreign policy, America may once again lead some international organizations and trade agreements, and the trade barriers will be reduced as the decrease of trade tax. That said, the Taiwanese trade economy will be benefited.

Third, Biden's proposal to add a penalty surtax on offshore profits would greatly inhibit American companies’ ability to shift income and tax breaks between countries to avoid paying levies in the U.S. and abroad. Moreover, Biden can be more active antitrust on the tech giants that are Facebook, Google, and Amazon, and it may affect the market com- munication strategies of the marketers from many brands.

|