September 5, 2023

It is now the latter half of 2020. Because of the success of pandemic prevention in Taiwan, the government’s overall policies have gradually allowed people to move around and placed their emphasis on revitalizing the economy under the premise that the pandemic prevention remains steady. But globally, the pandemic is still severe in every other country; how do Taiwanese people view the overall circumstances now? Will the pandemic regulations become the new normal of their daily lives? And can digital finance create more influences on Taiwanese people’s consumption habits?

Overall, Taiwanese people feel positive about the pandemic, and they expect the future will see a turn for the better.

However, as other countries relaxed their restrictions on crowd activities recently, the pandemic also starts to intensify at each location. While the nearby Asian countries are doing more steadily, but there are also reports of local transmission cases, and other areas may even see the peak of a second-wave pandemic. Therefore, we cannot let our guard down. In this investigation, the interviewees also postpone their expectation of the time when they can return to normal lifestyle. Before this, people believe their lives will go back to normal in September or at the end of the year at the latest, but in this newest investigation, the expected time is postponed to February and March next year.

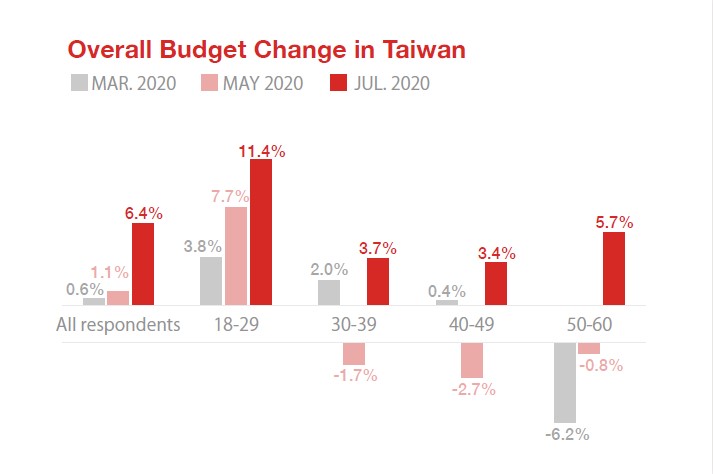

Taiwanese people’s consumption budget has gradually bounced back, and the growth of that of the young people’s group (18-29-year-old) is the most obvious. In terms of consumers’ preferences for products, the desire for overall merchandise has increased.

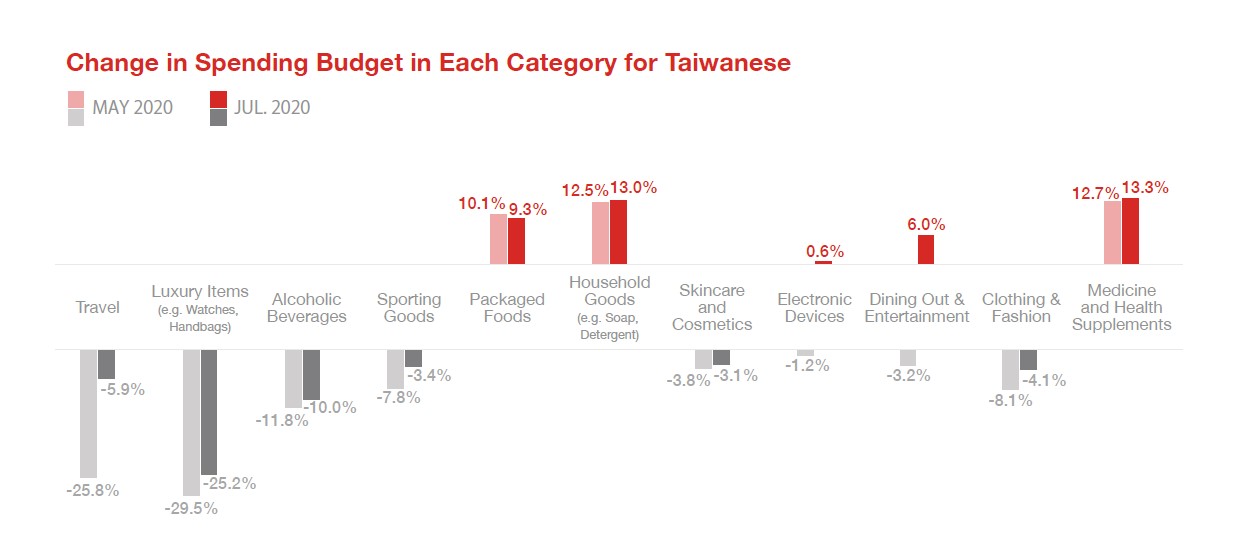

More specifically, the three major merchandises that people bought in large quantity during the pandemic were medicine and health supplements, household goods, and packaged foods, which remain the categories for which the highest consumption budget is reserved in people’s minds. On the other hand, the need for dining out & entertainment has obviously increased, and travel industry has also quickly risen from the bottom now after experiencing a major setback before.

The policy of stimulus voucher started in July, and it is hoped that with the slowdown of the pandemic and the coming of Summer vacation, people will be more willing to spend. But to stimulate people to take out their wallet and create a ripple effect, apart from business owners who introduce even more bonus, there should also be a timely introduction of merchandises that match with consumer’s mentality, coupled with payment option suitable to different conditions, or with the likings and modes that people have grown accustomed to during the pandemic. These are all necessary methods to create business opportunities.

For instance, Songshan Airport proposed a “pretend to go abroad” tour recently, which aims at the desire of people who have not traveled outdoor for a long time and wish to experience ceremonial activities and the excitement similar to the experiences of going abroad. Meanwhile, there are also adapted or changed business models in different countries due to the Covid-19 pandemic, including “online cocktail parties” that avoid actual in-person contact but continue alcohol-involved social gatherings; or, in response to the increase of online meetings, the focus of cloth shopping now turns to business tops; or, there is an emphasis on one-piece dress that one can directly take off with less risk of touching it after coming home from outside.

Under the situation that the outlook of the global pandemic is unclear, and that the opening of national borders will keep being postponed but never permanently closed, business owners have to plan in advance and continue to renew their plans.

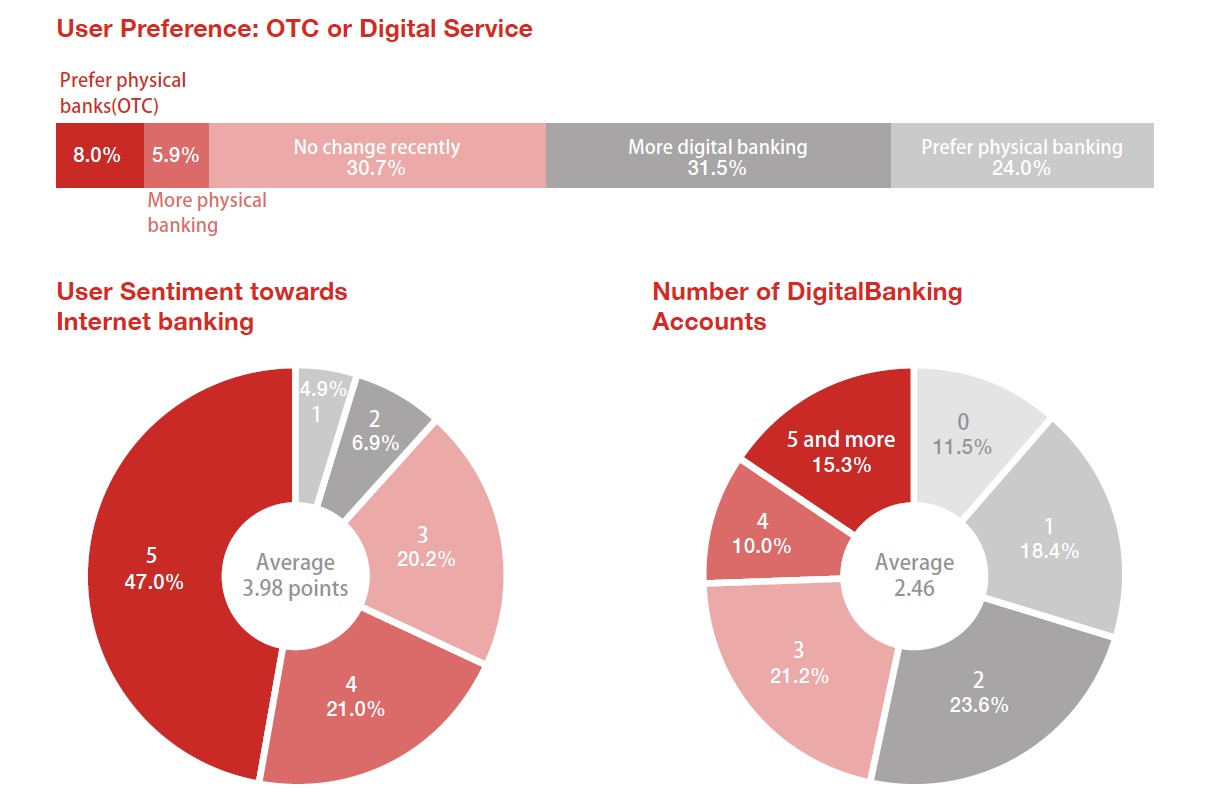

This investigation discovers that: there are half of Taiwanese people who are more willing to use digital service compared to over-the-counter service recently, and only 10% of interviewees do not have an online bank account. There are 70% of them who have two or more online bank accounts, and their willingness to use online banking is 4 points on average (5 points in total). This indicates that online banking has advantages such as instantaneity, fast speed, and conveniences. Under the current condition of low interest rate on bank deposit, there are more than a few people who choose to use online banks that provide benefits such as bonus interest rate for current deposit or reduced fees for transfer service. While Taiwanese consumers are more and more familiar with online financial interface, and the frequency of using it has also increased, but in view of the specific qualities of Taiwanese market, the consumption habits of the consumers, and the policies for payment instrument, there is room for improvement for digital financial service.

Take the stimulus voucher this time for example. It is estimated that there are more than 100 million people who obtained paper form vouchers, and only about 1.56 million people who chose digital form, among them about 1.05 million choosing a tie-in with credit card, and only 0.3 million and 0.2 million chose mobile payment and electronic stored value cards respectively (before 7/12). Apart from the fact that the stimulus voucher excludes most of the online shopping platforms from the start, which makes its usage similar to cash payment in retail industry, this phenomenon also indicates the fact that the cost for people to obtain the paper form is not high, as convenience stores have effectively diverted the crowds who wish to obtain it. Moreover, paper form voucher does not need to be tied with other payment methods in terms of its usages, and there are a lot of stores where it can be used, and it can be used accumulatively. These features make paper form voucher more enticing.

While there is the new digital option, consumers do not necessarily feel attached to it. How to make people feel better about the benefits of digital financial service, and more addicted to the user operation interface, is a challenging question during our post-pandemic era.

|