September 5, 2023

As we reach the Summer days in June, the COVID-19 pandemic in Taiwan is now ebbing. Until June 8, there had been no local transmission and community spread. Since four incubation periods for the virus had passed, the Central Epidemic Command Center officially announced the lifting of restrictions on large gatherings on June 7, declaring the official start of the “Epidemic New Life Movement” in Taiwan. In this post-pandemic era, how do Taiwanese females view the current situation, make their consumer choices, and look ahead to the future developments?

Compared to the fact that almost half of Taiwanese females were pessimistic about the overall circumstances during the past year, almost 50% of the interviewees now believe that the situation will turn better, while only 20% are more pessimistic.

In terms of the feelings that interviewees have towards the overall environment, the number of those who think it will “get worse” has decreased, while around 40% of the interviewees believe the future will “get better.”

In terms of the pandemic, about 75% of the interviewees think the pandemic is not severe or has been flattened, while more than 50% of the interviewees think the situation will improve in 30 days.

Whether people believe the pandemic is a serious crisis or not, interviewees all agree that it will take at least more than half a year to return to their normal lifestyles.

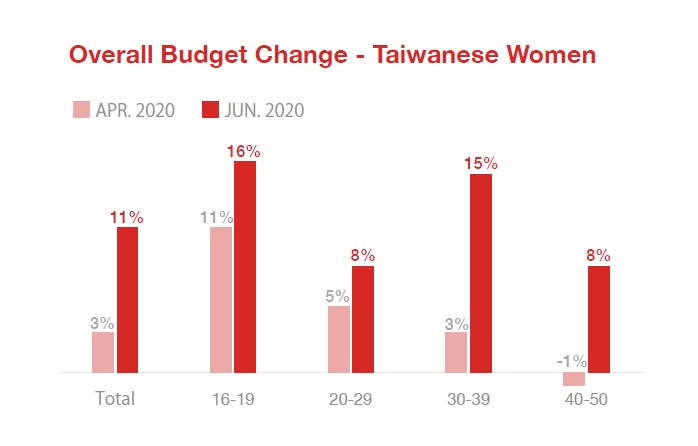

In terms of consumption, the overall consumer budget of the interviewees has increased. The greatest change in budget lies in the young age group 16-19, while the group 30-39 has the most obvious scale of increase, as their budget rose from 3% to 15%.

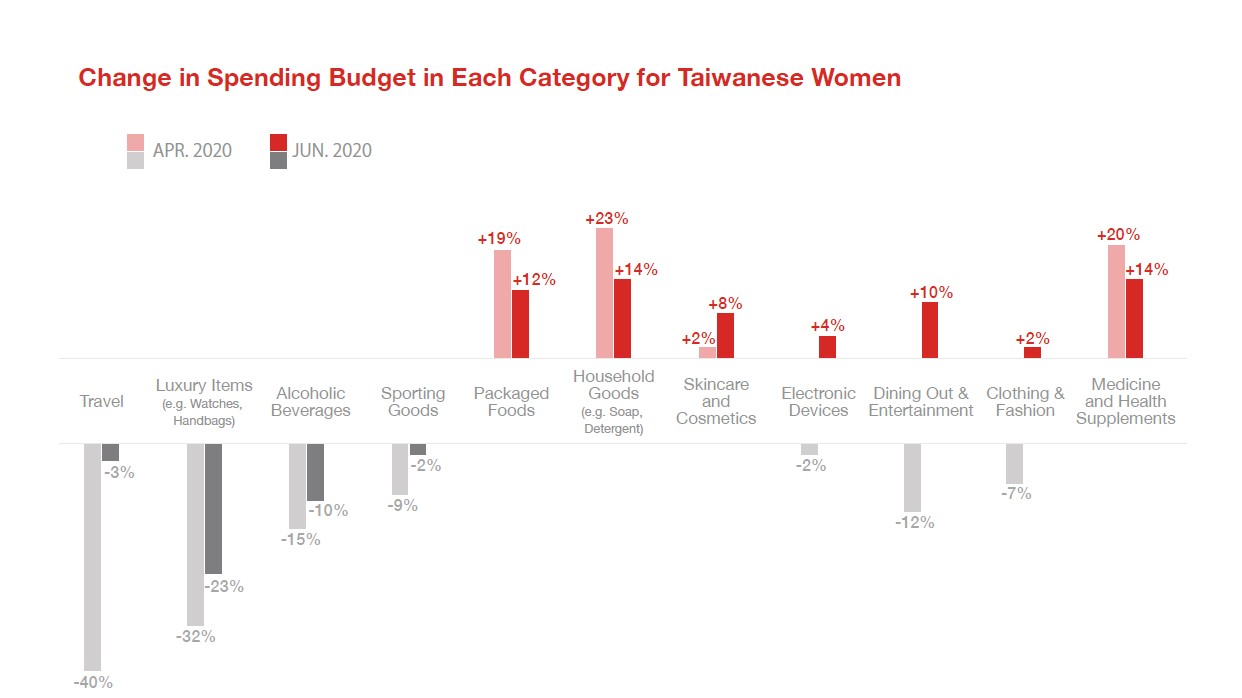

In terms of consumption category, the needs for packaged food, household goods, and medicine & health supplements have decreased compared to April, but they are still the largest category.

Meanwhile, consumption of social life related to skincare & cosmetics, electronic devices, clothing & fashion, and dining out & entertainment has bounced back, indicating that interviewees’ demands for dining out & entertainment have obviously increased.

In addition, the needs for luxury items, alcoholic beverages, and sporting goods, compared to other consumption categories, still remain low, but are showing tendency of increasing gradually.

What’s worth our attention is that even though the number of the budget for traveling remains low, the force of its rebound is big, showing that the needs for domestic travel is reviving.

Judging from the overall consumption, we can see that the trend to accumulate staple merchandise is not as high as before, and people’s urge to pursue a greater life quality has increased.

Citizens were limited from coming into contact with other people during the pandemic and the lockdown, so how businesses understand and propose marketing strategies that appeal to consumers’ mentality and their needs after the ban was lifted will be an important battle faced by all sales channel in the latter half of the year.

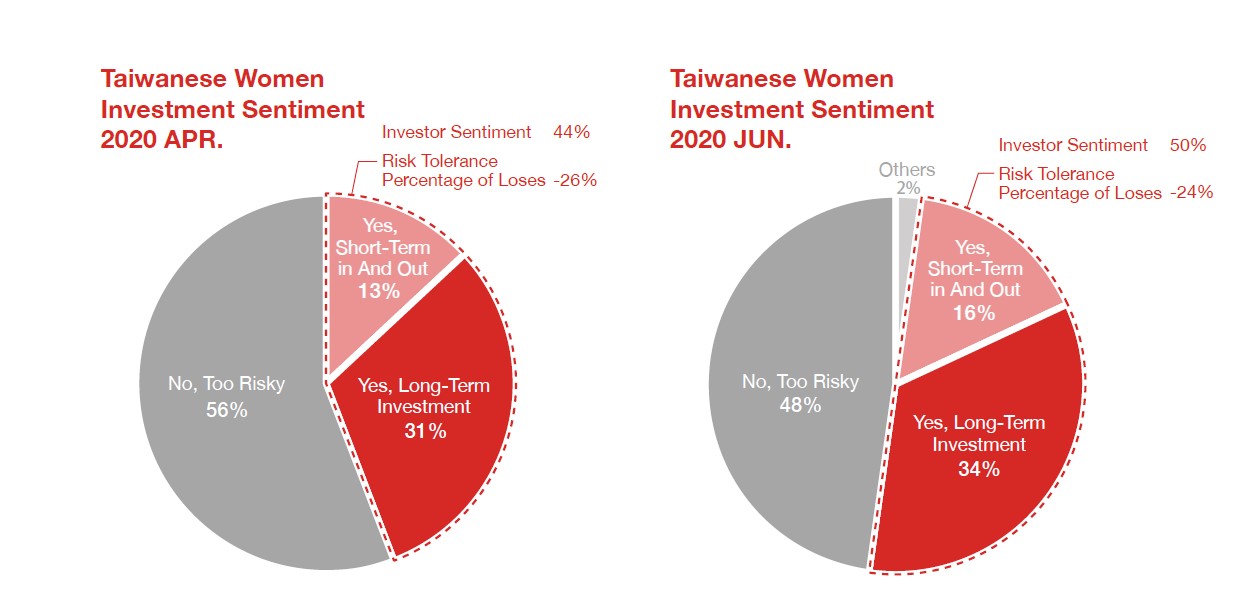

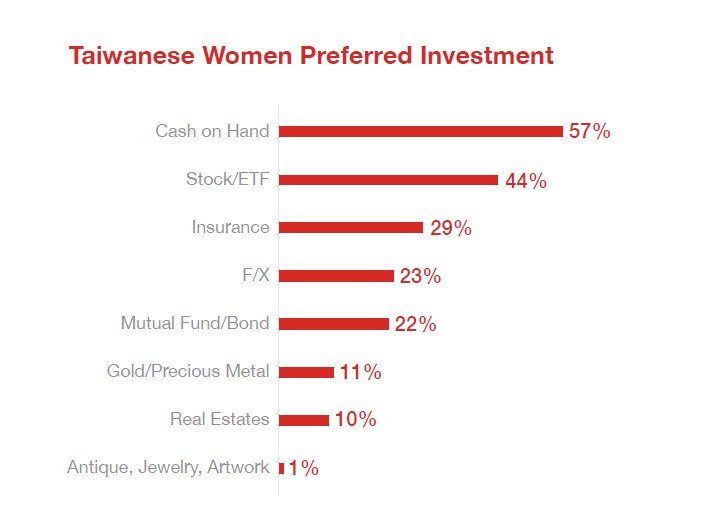

If we further understand the aspect of investment, we’d find that as the pandemic slows down, there are around 50% of citizens willing to invest, with those who can accept deficit at around 24%. In terms of investment behaviors, around 60% of interviewees are more inclined to keep their cash, and stocks/ETF is the most welcomed investment target, with around 40% of interviewees expressing interests in it. There are around 30% of interviewees expressing interests in insurance products.

On the contrary, there are only around 10% separately for investment in gold/precious metals and real estate. Around 30% of interviewees believe the real estate market has been impacted by the pandemic, and those who are willing to go into the market have rose from 6% to 24%.

As time passes, the tendency will become clearer in the latter half of the year. Whether inves- tors choose to enter the market or not, they gradually do not only stand and watch anymore, but are more inclined to make choices. Taiwan has officially entered the post-pandemic era. The most urgent challenge and chance that all businesses face is whether the market can follow the tempo of “Pandemic New Life Movement” and propose products that appeal to consumers’ desires and make them willing to purchase.

|