September 5, 2023

Japan is one of the world's biggest video game markets, with revenues of US$ 24 billion in 2024. Mobile games are the most popular and profitable platform in Japan, with more than half of the gamers playing on mobile devices. A recent survey conducted by Z.com Engagement Lab provides valuable insights into the gaming habits and preferences of Japanese gamers, which can help industry decision-makers make informed choices.

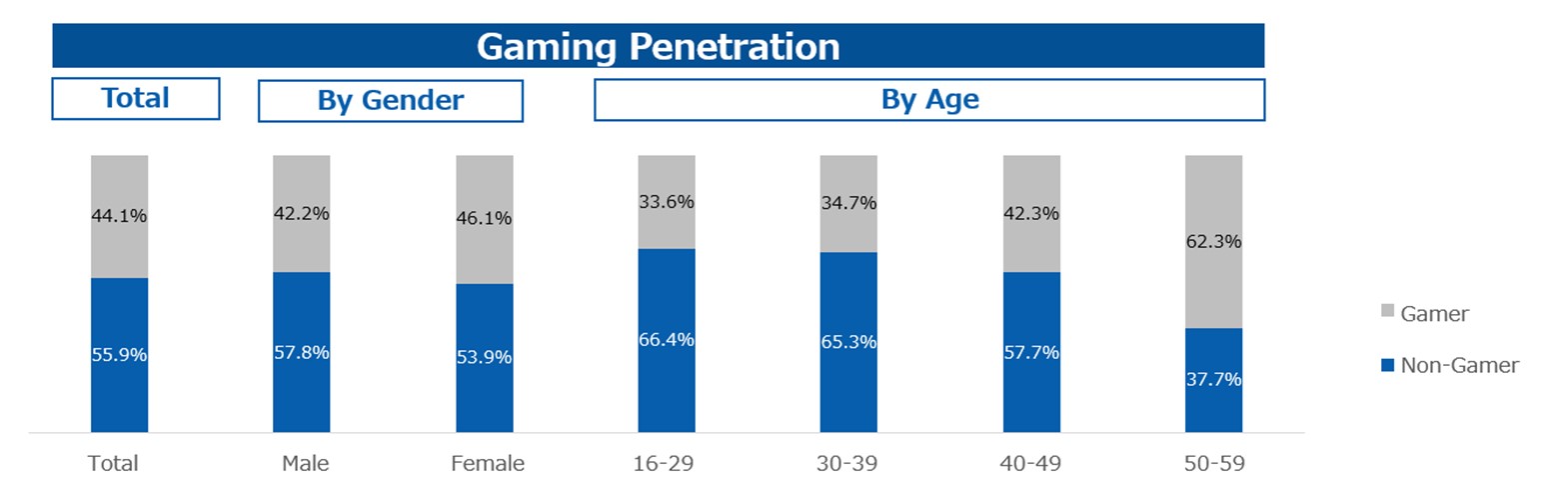

The survey reveals that approximately 56% of respondents play games on at least one device, with no significant difference between male (58%) and female (54%) gamers. Gaming penetration is highest among the 16-29 age group (66%), followed closely by the 30s (65%) and 40s (58%). Excluding the 50-60 age group, over half of all age groups are gaming enthusiasts, which indicates widespread adoption across various demographics.

Smartphones are the most popular gaming platform, with 82% of male and 89% of female gamers using them. While the 16-29 age group has the highest smartphone gaming penetration (90%), other age groups also show more than 80% adoption. PCs and gaming consoles are used by 45% and 44% of gamers, respectively, with a slightly higher prevalence among males (50%+) than females (approx. 35%).

On weekdays, smartphone gamers play for an average of 1.8 hours, while console gamers play for 2.6 hours on weekends. In general, gaming sessions are 30 minutes to 1 hour longer on weekends. Most gamers play for 1-2 hours, regardless of platform and day of the week.

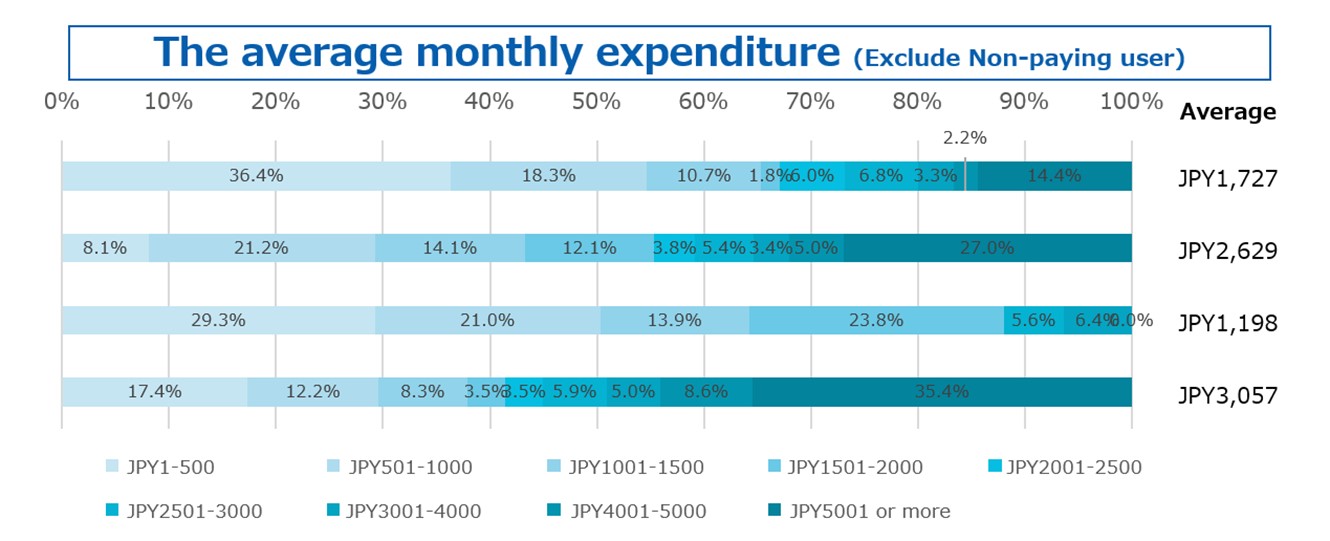

In terms of spending, gaming consoles have the highest proportion of paying users (39%), followed by smartphones (24%), PCs (22%), and tablets (15%). The average monthly expenditure is highest for console gamers (JPY3,057), followed by PC (JPY2,629), smartphone (JPY1,727), and tablet (JPY1,198) gamers.

Relaxation and killing time are the primary motivations for gaming across all age groups. However, younger gamers (16-29) also enjoy exploring open-world games and completing missions for a sense of achievement. Puzzle and brain games are the most popular genres overall, but role-playing games are the top choice for male gamers. Female gamers prefer puzzle/brain games, simulation games, and casual games. Music games are particularly popular among young female gamers.

Friends and acquaintances are the most influential sources of game recommendations, followed by app store/online game store rankings and official game websites. Younger gamers (16-29) are more likely to discover games through app store rankings and influencer/celebrity trials or live plays.

The survey segments gamers into three categories based on their spending behavior:

Analysis of these segments reveals interesting patterns in gaming preferences and motivations, which can help industry decision-makers create targeted strategies and offerings that cater to the needs of each group.

Understanding the gaming market in Japan is crucial for industry decision-makers to create targeted strategies and offerings.

|