November 22, 2023

In the wake of the global pandemic, Japanese travelers are prioritizing safety first, reshaping their travel decisions around safety, food, and cost. With an evident inclination towards shorter domestic excursions and extended overseas trips, the independent travel style dominates both spheres. As we look towards a post-COVID future, an intriguing trend emerges - a younger generation spearheading the resurgence of overseas travel. With South Korea, Taiwan, and Hawaii topping the list of preferred destinations, the evolving dynamics of Japan's travel trends present intriguing opportunities and challenges for the tourism, food and beverage sectors, and associated industries.

The survey reveals safety, food, and cost as the three crucial factors that Japanese internet users consider when choosing travel destinations, both domestically and internationally. Approximately 75% of respondents deemed safety and food as extremely important, while nearly 70% considered cost as a crucial factor. Interestingly, safety took on even greater importance when choosing overseas destinations, with 60% of respondents citing it as a critical factor compared to 45% for domestic travel.

Demographically, apart from younger respondents (16-29 years) who prioritized food, all other age groups saw safety as the most important factor in their travel decisions.

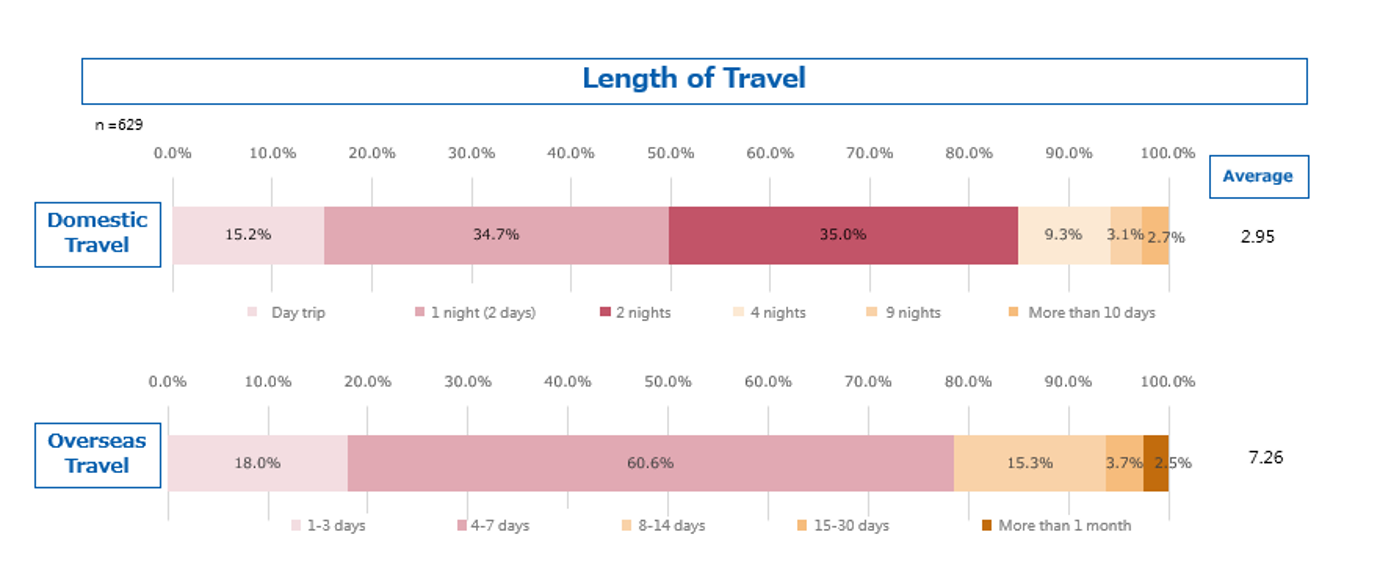

When it comes to the length of travel, most respondents preferred short domestic trips of 1-3 days, with 35% opting for a stay of 1 night (2 days) or 2 nights (3 days). For overseas travel, the majority (60%) chose a duration of 4-7 days. Only 15% selected domestic trips lasting over five days, whereas 22% of respondents chose overseas trips extending beyond eight days.

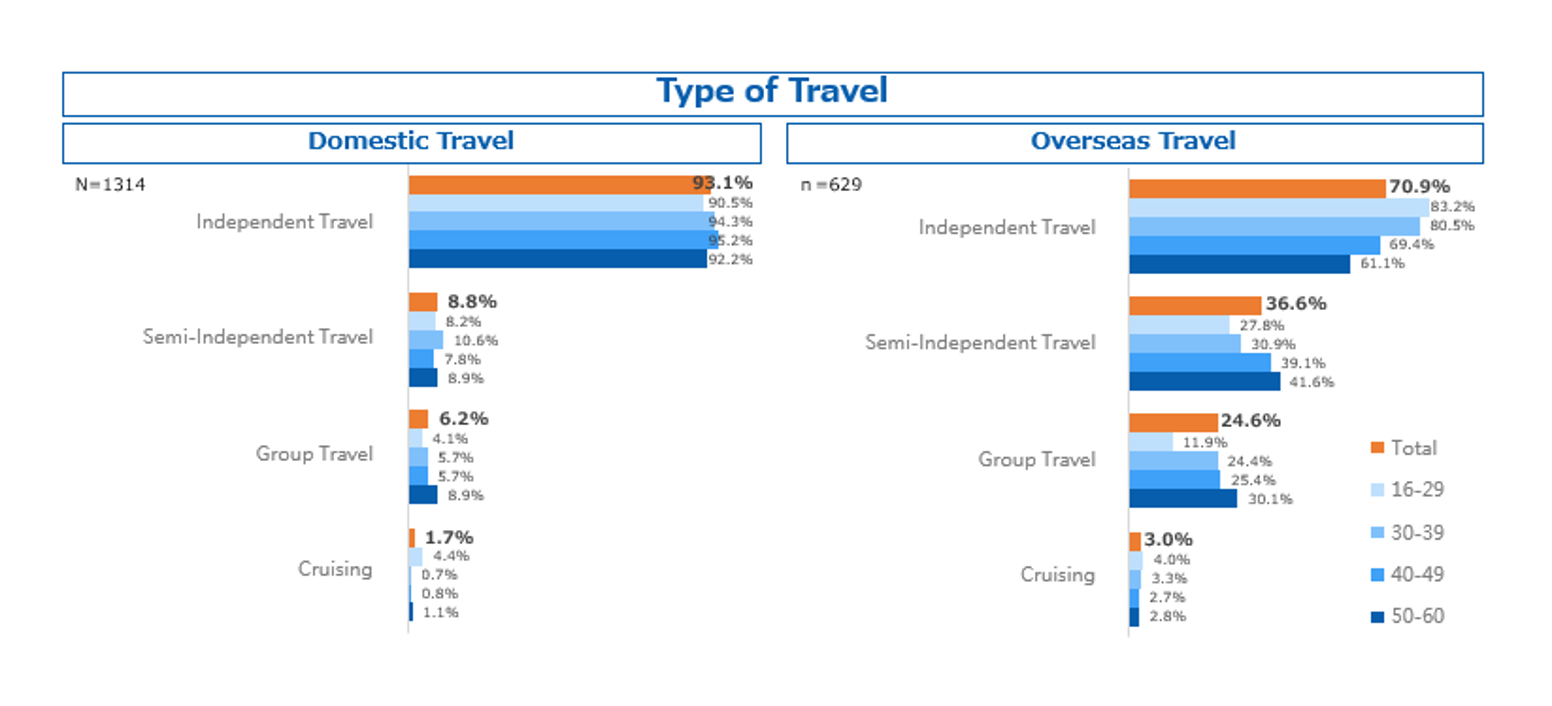

When you look into the type of travel, independent travel emerged as the most popular choice for both domestic and overseas trips, with over 90% and 70% of respondents, respectively choosing this option. Notably, overseas travelers exhibited a more diverse range of preferences, including semi-independent travel (37%) and group travel (25%).

The impact of the pandemic was less on domestic travel compared to overseas travel. Nearly half (48%) of all respondents reported not currently engaging in any overseas travel, particularly those in the 50-60 age bracket, with almost 60% stating they have no current plans for international trips. However, the frequency of travel among younger generations has not decreased, rather showing a trend of increase, or at least remaining at pre-pandemic levels. This trend could indicate a gradual resurgence of overseas travel demand starting with the younger generation.

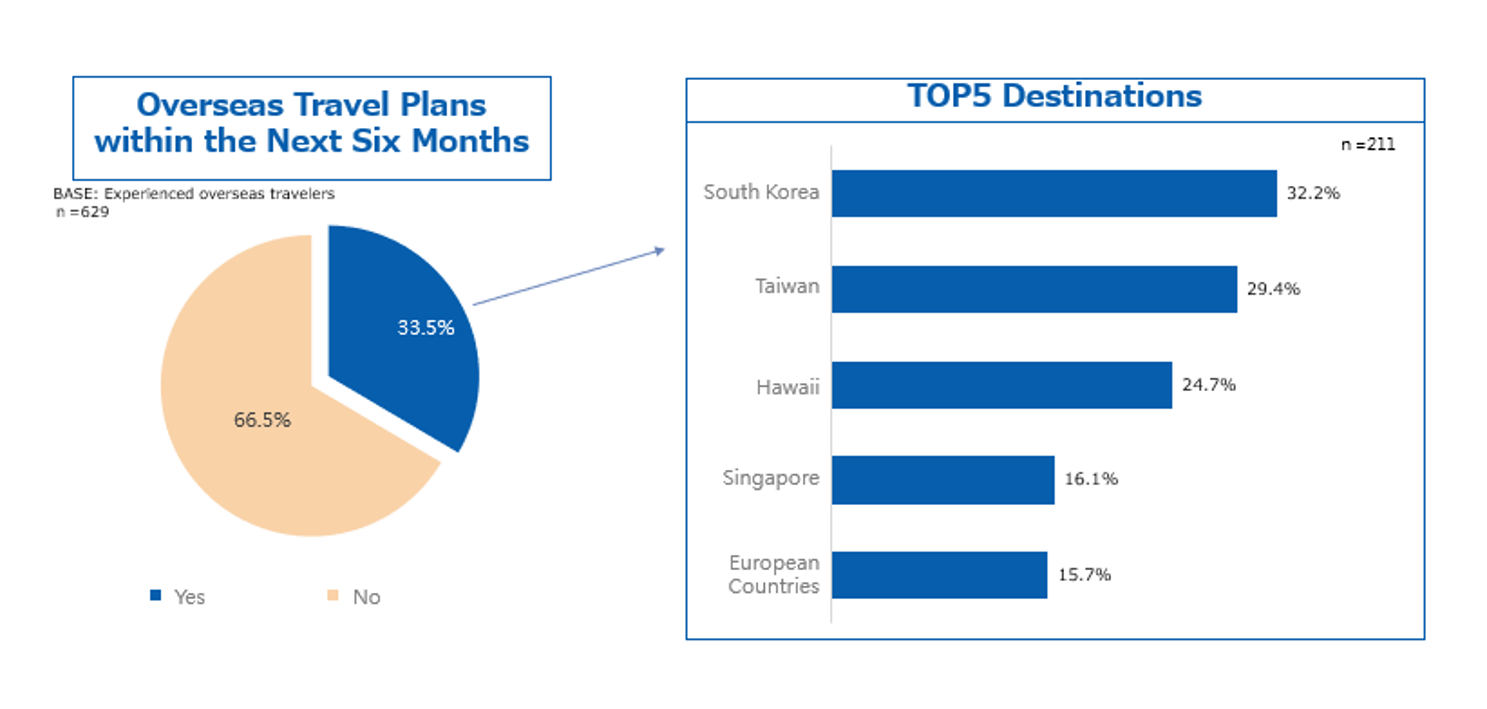

Regarding future overseas travel plans, the survey found that a third of all respondents with prior overseas travel experience planned to travel abroad within the next six months. The top three preferred destinations were South Korea (32%), Taiwan (29%), and Hawaii (25%), followed by Singapore and various European countries.

To conclude, while COVID-19 has indeed influenced travel habits, as the situation gradually comes under control, people's travel needs may recover. In the post-pandemic era, new trends may emerge in the importance of factors influencing travel decisions (safety, food, cost), the selection of travel duration, and the choice of travel style. These potential changes present both new challenges and opportunities for the tourism industry, the food and beverage sector, and related industries.

Z.com Engagement Lab will continue to track the leisure travel of the Japan public and update survey data, monitoring market trends and changes in consumer demand.

|