Consumer Behaviors: How Singapore Leads APAC’s Digital Banking Revolution

The APAC region is the fastest-growing market for digital banking, with the market size for digital banking platforms projected to reach 19.56 billion USD by 2029. As such, the compound annual growth rate (CAGR) is expected to be 14.04% in coming years, solidifying the region's position as a dominant player in the industry.

At the heart of this growth is Singapore. Ranked 4th globally and 2nd in Asia in the Global Financial Centres Index (GFCI), the country has established itself as a leading fintech hub, supported by its robust economic infrastructure and advanced regulatory framework.

This article explores the usage and satisfaction levels of digital banking services in Singapore, based on a survey of 218 digital banking users. By analyzing these findings, we aim to uncover the key factors behind Singapore’s success in the digital banking sector and examine the challenges that have emerged alongside its rapid growth. Furthermore, insights from Singapore’s experience can serve as a valuable reference for financial institutions in neighboring Asian countries as they develop their own growth strategies.

Key Findings

- In Singapore’s digital banking market, a few major banks dominate as the primary choices for users.

- Apart from core functions such as account information inquiries, notifications and fixed deposit features are the most frequently used.

- Overall satisfaction with digital banking is high, but concerns over security could impact future usage intentions.

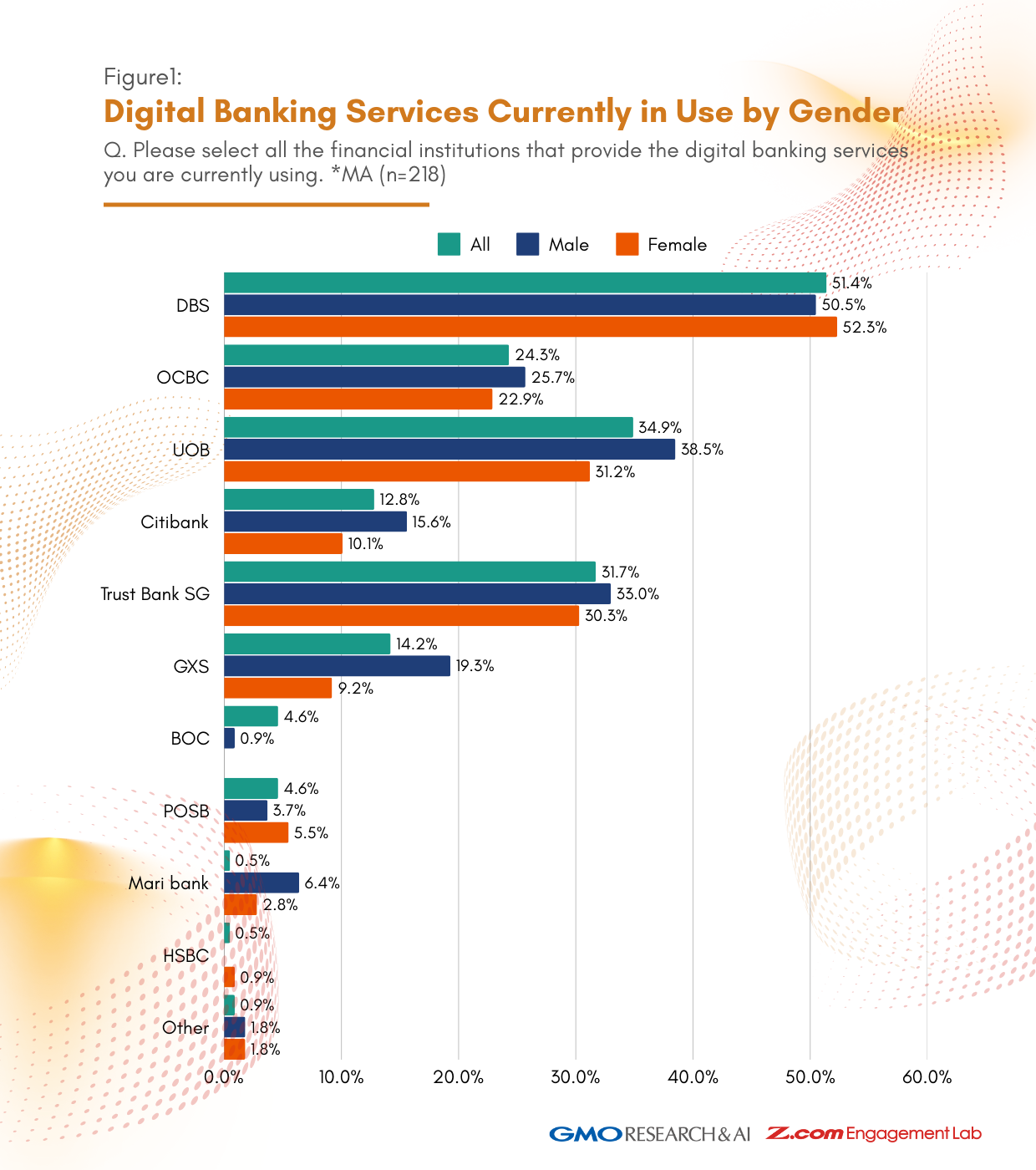

Digital banking services currently used

- Overall, DBS users accounted for the largest share at 51.4%. DBS's dominance can be attributed to its advanced digital cash management technology, which has earned high recognition, including being named one of the World’s Best Digital Banks 2024. This functionality and reliability contribute to its strong market position. Moving forward, the key challenge will be how emerging digital banks carve out their market presence and expand their user base to compete effectively.

- When analyzing digital banking users by gender, there were no significant differences between male and female users for most services. However, notable gender disparities were observed in UOB and GXS, where the proportion of male users was approximately 10 percentage points higher than female users. Both UOB and GXS focus on leveraging digital technology to enhance user experience, suggesting that these differences may be influenced by the variation in frequently used features and promotional strategies, which will be discussed later.

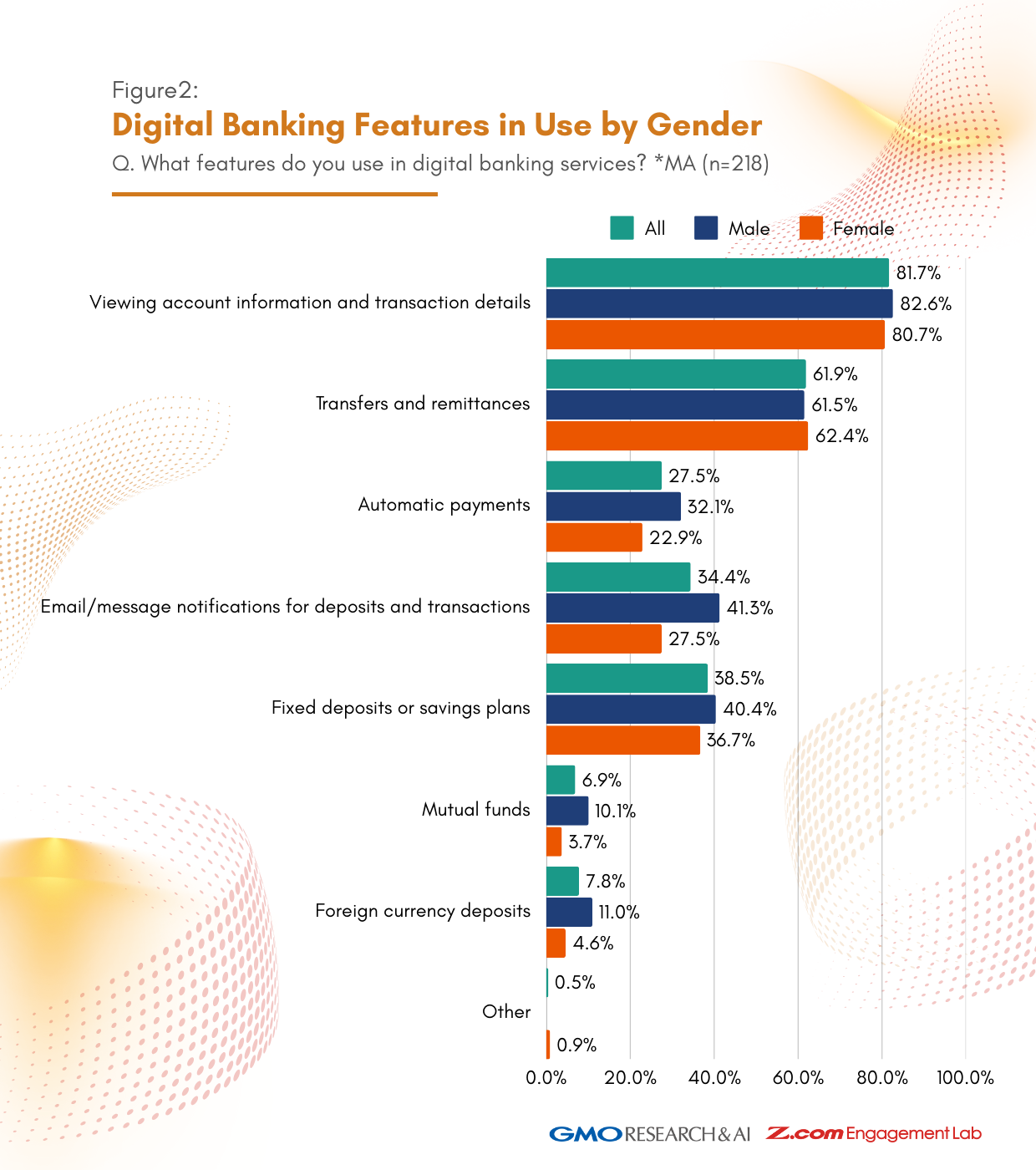

Top 3 Features

All

- Viewing account information and transaction details (81.7%)

- Transfers and remittances (61.9%)

- Fixed deposits or savings plans (38.5%)

Male

- Viewing account information and transaction details (82.6%)

- Transfers and remittances (61.5%)

- Email/message notifications for deposits and transactions (41.3%)

Female

- Viewing account information and transaction details (80.7%)

- Transfers and remittances (62.4%)

- Fixed deposits or savings plans (36.7%)

- "Viewing account information and transaction details" is the most widely used function, with a utilization rate of over 80%. This next most used function is "Transfers and remittances", which is used by more than 60% of users. Overall, fundamental banking functions demonstrate high usage rates.

- Gender Differences in Usage Patterns:

When analyzed by gender, men showed a higher usage rate across all functions except for "Transfers and remittances." This suggests that men tend to utilize a broader range of digital banking features. However, this trend may not only reflect differences in financial behavior but also be influenced by service offerings and marketing strategies.

On the other hand, women's usage is more concentrated on specific functions, such as "Viewing account information and transaction details" and "Transfers and remittances." This pattern is likely shaped by financial behavior, service design, and targeted marketing strategies.

- Initiatives for Female Financial Empowerment:

In response to trends focusing on female financial empowerment, Ladies Finance Club has established a community where women can learn about investments and wealth management from one another, aiming to promote greater engagement with financial products among female users.

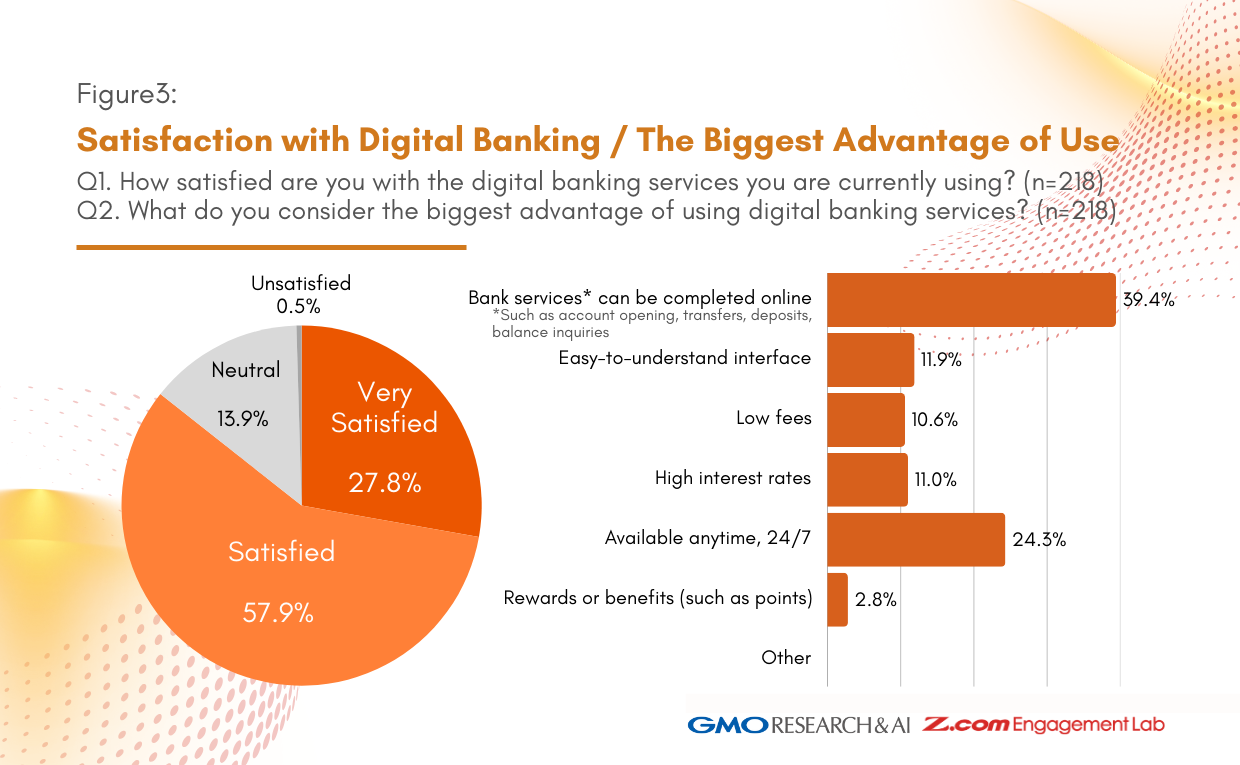

Satisfaction with Digital Banking

- Overall Satisfaction:

The majority of users are satisfied with their current digital banking services, with over 80% expressing satisfaction. Meanwhile, the percentage of users who reported dissatisfaction was minimal, at just 0.5%.

- Key Perceived Benefits:

When asked about the biggest advantages of digital banking, approximately 40% of users highlighted the ability to complete banking services online (such as account opening, transfers, deposits, and balance inquiries). Additionally, around 20% cited 24/7 availability as a major benefit.

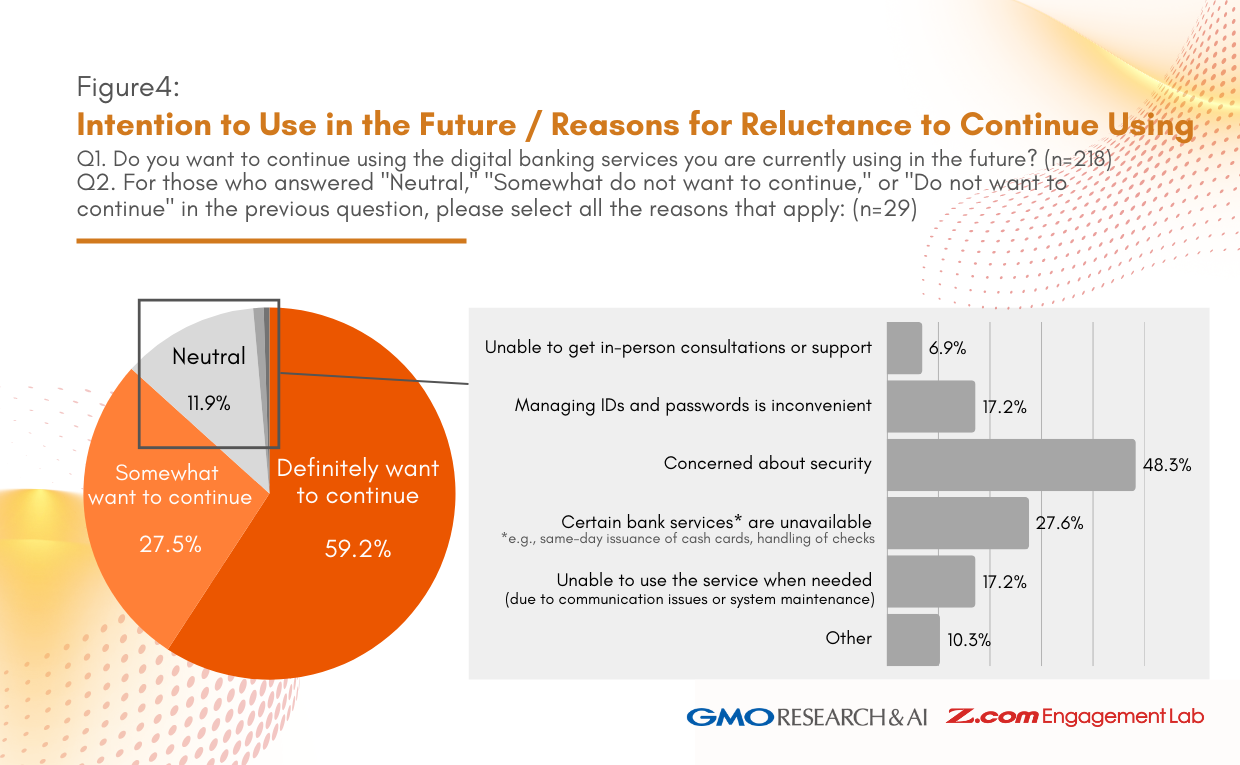

Intention to Use Digital Banking in the Future

- High Continuation Intent:

More than 80% of users expressed a strong or moderate willingness to continue using digital banking, aligning with the overall high satisfaction levels.

- Security Concerns as a Key Barrier:

However, nearly half of users showed a neutral or hesitant stance toward continued use due to security concerns. Additionally, 25% of non-digital banking users surveyed cited security worries as the main reason for not adopting digital banking.

These findings highlight the need for enhanced security measures and stronger customer support to retain existing users and attract new ones.

- Security Initiatives by Singapore’s Leading Banks:

To address these concerns, major Singaporean banks ranked among the World’s Safest Banks 2024: Global 50 have implemented advanced security measures:

- DBS Bank (World No.12 / Asia No.1): Replaced traditional One-Time Passwords (OTP) with a digital token-based security protocol for enhanced protection.

- UOB Bank (World No.14 / Asia No.3): Introduced the "Money Lock" feature, allowing users to lock digital transactions above a specified amount to safeguard funds from unauthorized withdrawals.

Lessons from Singapore's Digital Banking Market

The survey results reveal that DBS and UOB are widely embraced by consumers in Singapore. Their popularity can be attributed to high customer satisfaction and strong trust, which these banks have cultivated through strategic initiatives.

1. Optimizing User Experience (UX)

- DBS: Implemented the “Virtual Assistant,” streamlining customer inquiries and enhancing satisfaction.

- UOB: Introduced “Mighty Insights,” providing real-time financial advice to users.

2. Enhancing Financial Literacy & Customer Engagement

- DBS: Strengthened its wealth management services with tailored solutions through three segments—Treasures, Treasures Private Client, and DBS Private Bank—offering investment and insurance advisory services.

- UOB: Leveraged AI-driven personalized banking features, delivering customized financial insights to users.

These initiatives highlight how UX innovation and financial education contribute to strong consumer trust and engagement, positioning Singapore's digital banking sector as a model for other markets.

Conclusion

The survey results reveal that major banks are driving Singapore’s digital banking market by enhancing user satisfaction and trust through their unique initiatives.

These insights should also serve as a valuable reference for financial institutions in neighboring countries aiming to expand their digital banking services. Accurately understanding market characteristics and user needs, and formulating strategies accordingly, will be the key to sustainable growth.

At Z.com Engagement Lab from GMO Research & AI, you can leverage our proprietary consumer network across 16 countries in Asia to conduct in-depth research on user behavior and needs in your target markets. If you are considering research to optimize your digital banking strategy, please feel free to contact us.

Survey Theme: Digital Banking Usage Survey

Survey Date: January 17 - 23, 2025

Methodology: Online survey

Target Group: Singapore digital banking users aged over 15

Target Country: Singapore

Sample Size: 218

Bridging the Financial Gap: 2025 Unbanked Digital Banking Report

With over 50% of the population in Southeast Asia still unbanked, the expansion of digital banking presents a significant growth opportunity. This report analyzes market trends across the region based on insights from Indonesia and outlines effective strategies for financial institutions and fintech companies to drive adoption.