March 27, 2024

As Japan navigates the post-pandemic landscape, the majority of its internet users signal a deep-seated pessimism about the country's future. Our recent survey reveals that over half of the respondents view the past year negatively and hold a similarly bleak outlook for the coming year. The road to recovery is perceived as long and arduous, with a significant majority believing that it could take over a year to return to a pre-pandemic state. Yet, amidst these challenging times, we see a glimmer of optimism in the younger demographic of 16-29 years, driving consumer activity with an anticipated increase in spending, particularly in dining, entertainment, travel, food, and cosmetics. This divergence in sentiment provides valuable insights for businesses as they adapt and pivot in the post-COVID era.

Explore the evolving landscape of Japanese travel amidst currency devaluation, COVID-19 concerns, and bureaucratic barriers. Learn about the surge in 'individual travel' choices and top destinations amid these challenges.

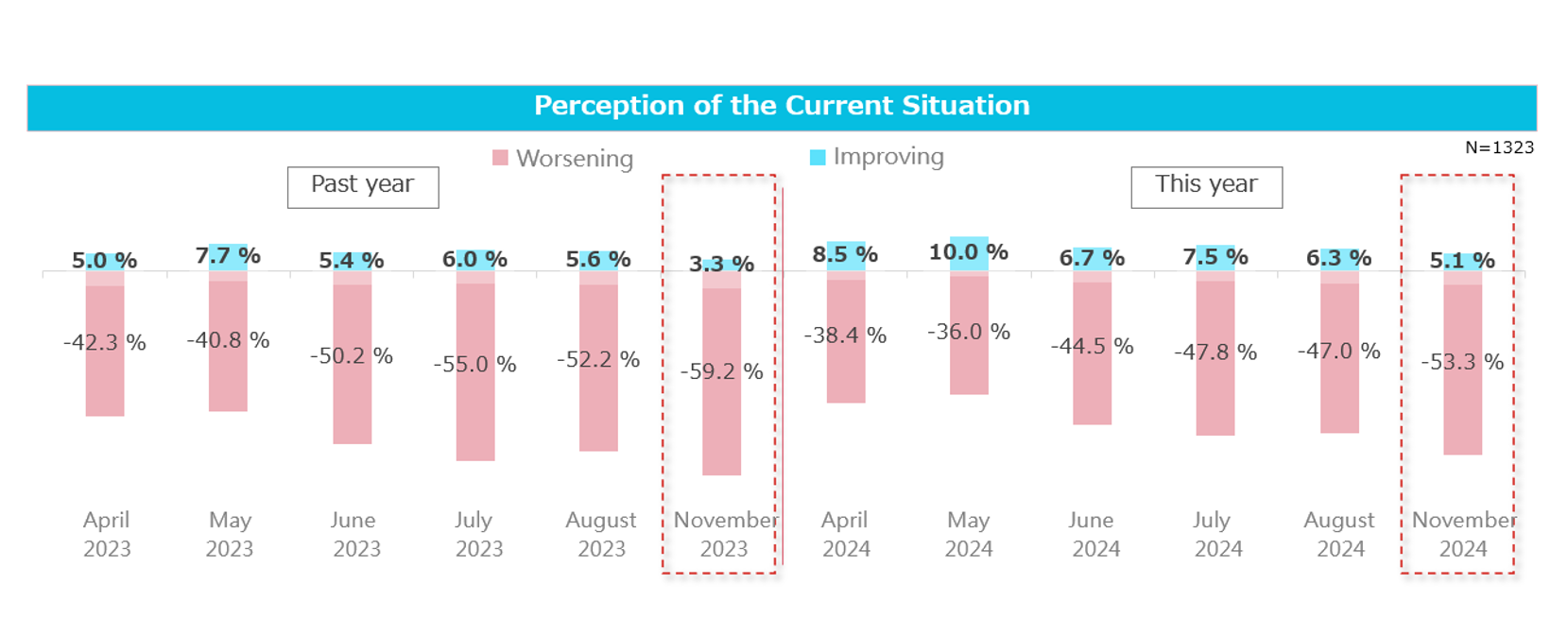

According to the latest survey by Z.com Engagement Lab. In a stark reflection of the current sentiment, the survey revealed that over half of the respondents hold a pessimistic view of Japan's situation over the past year and the year to come. The proportion of respondents who believe that Japan's situation will improve over the next year was at its lowest in the past eight months at 5.1%, while those who predict a worsening situation reached a record high of 53.3%.

The survey also indicated that a significant majority of Japanese internet users find it challenging to return to the pre-pandemic state within a year. When asked about the time needed for life to return to normal, 64% believe it would take over a year, 16% think it would take six months to a year, and 10% estimate it would take two to five months. Only a mere 9% think a recovery could occur within a month, indicating that most users still feel the strong impact of the pandemic and expect recovery to be a long-term process.

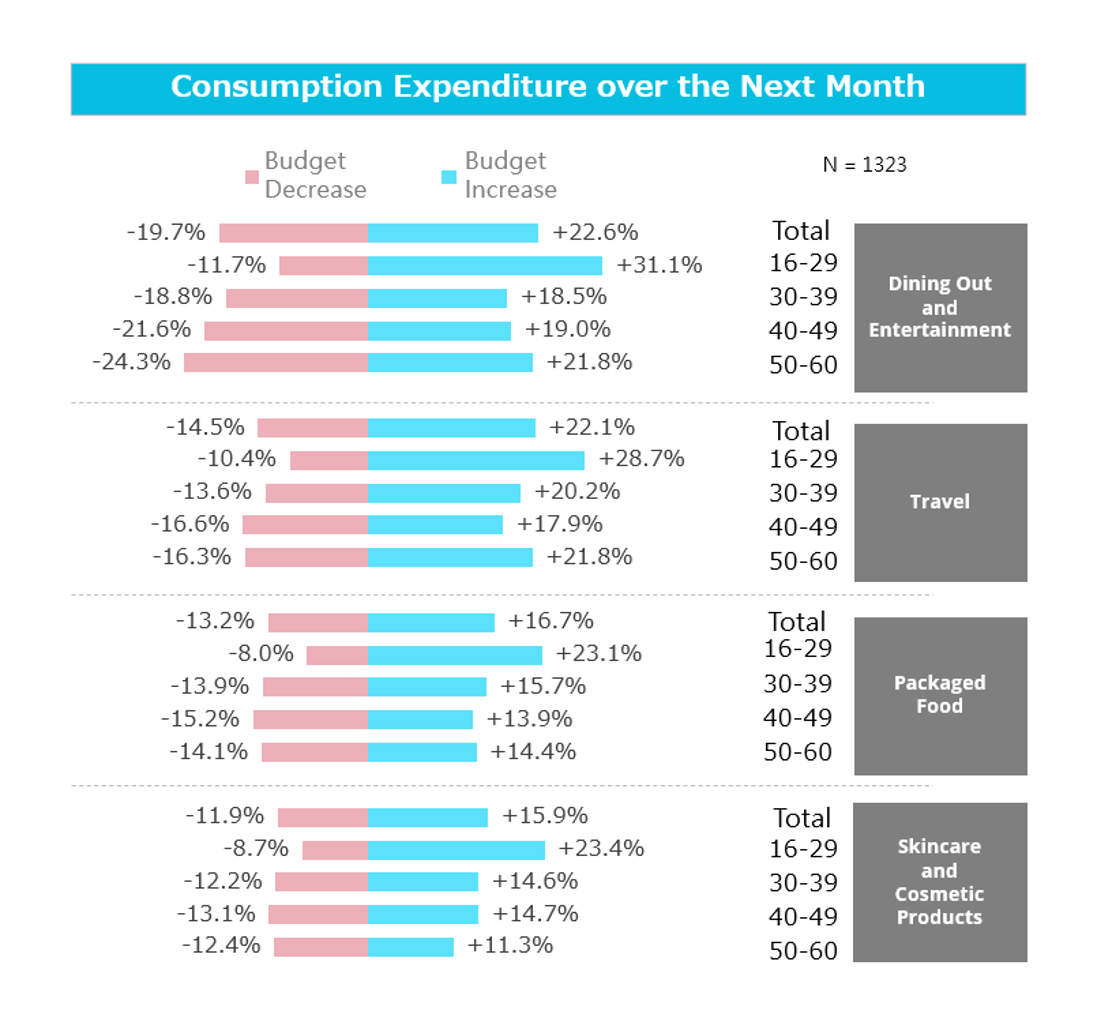

In terms of consumer expenditure in the coming month, the survey showed a roughly equal divide between those who expect an increase (28%) and those who predict a decrease (26%). However, analyzing the data by age group revealed an interesting trend: respondents between 16 and 29 years old were somewhat more likely to anticipate an increase in spending than a decrease.

The top categories where spending is expected to increase were dining out and entertainment (23%), followed by travel (22%), packaged food (17%), and skincare and cosmetic products (16%). For these categories, the younger demographic of 16 to 29 years old anticipated a greater increase in spending by about 10 percentage points, signifying that this age group could be driving consumer activity.

Z.com Engagement Lab will continue to track the COVID-19 of the Japan public and update survey data, monitoring market trends and changes in consumer demand.

|