November 17, 2023

Amid the fluctuations of the post-pandemic world, Japanese internet users continue to show resilient financial behaviors. Cash remains their steadfast companion, the allure of short-term trading rises among the younger generation, and the popularity of ordinary deposits, credit cards, and time deposits remains undiminished. In this changing landscape, we aim to delve deeper into these financial preferences and behaviors, providing insights for a more comprehensive understanding of Japan's financial climate.

In Z.com Engagement Lab’s latest survey in September, over half of the respondents (50%) reported they have no surplus funds for investment, a trend similar to the previous survey conducted in July 2023. While the percentage of people who want to hold cash instead of investing in financial products decreased by 1%, there was no significant change in the desire to invest in equities or mutual funds.

Investment interests showed that stocks, including ETFs, garnered the highest attention at 24.4%. Mutual funds followed closely with 21.8% interest.

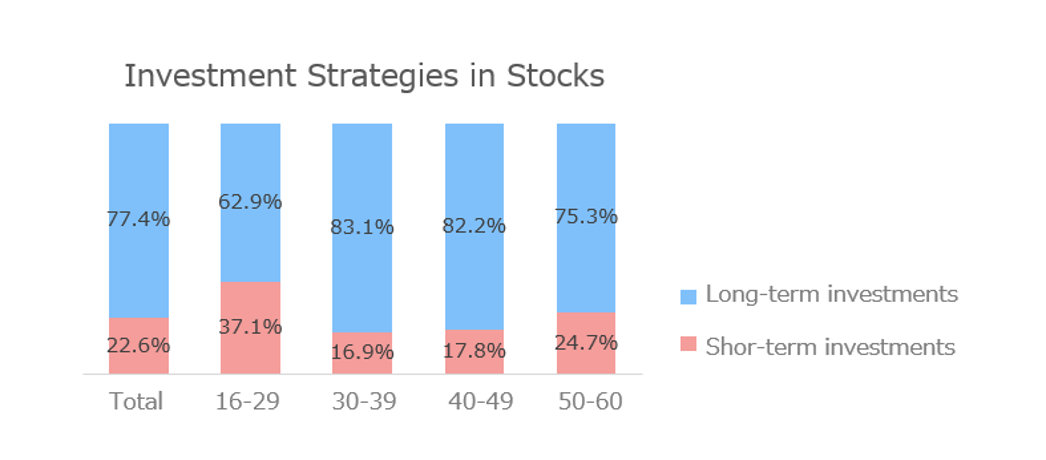

Regarding investment strategies in stocks, about 80% of the respondents considered long-term investments, with only 20% contemplating short-term trading. However, the age group of 16-29 showed a deviation, with nearly 40% favoring short-term trading, suggesting a generational difference in investment attitudes.

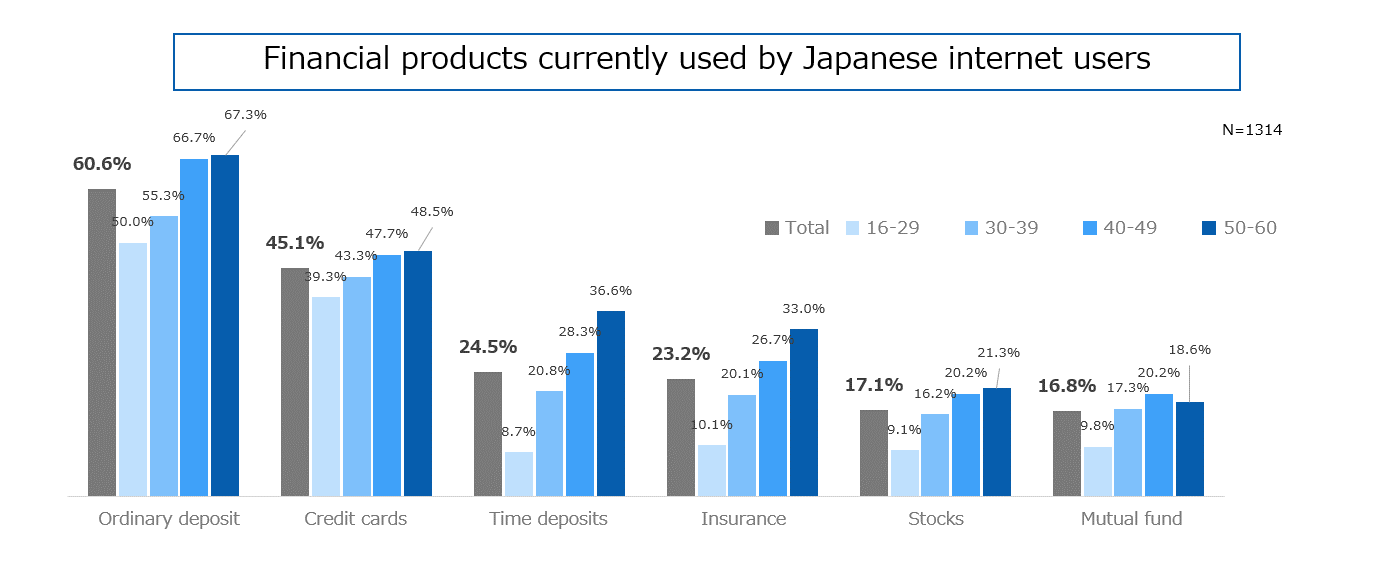

The top three financial products currently used by Japanese internet users are ordinary deposits (60.6%), credit cards (45.1%), and time deposits (24.5%). The usage rate of these financial products generally increased with age.

In comparison to ordinary deposits and credit cards, the usage rate of time deposits and insurance among the 16-29 age group was low, at around 10%. However, these financial products showed a significant increase in usage rates with age, reaching 37% and 33% respectively among those in their fifties.

Z.com Engagement Lab will continue to track the financial investment of the Japan public and update survey data, monitoring market trends and changes in consumer demand.

|