Industry Trends: 2024 Insights into the Asian OTT Streaming Media Market

In recent years, the increasing penetration of smartphones and improvements in network infrastructure have led to the thriving development of the OTT (Over-The-Top) streaming media market year by year. Additionally, major streaming platforms such as Netflix, Disney+, and HBO Max are continuously enhancing their investment in localized content, attracting a large number of new users.

Based on the latest Asia OTT streaming media market survey by Z.com Engagement Lab, the study focuses on six countries: Taiwan, Japan, Thailand, Indonesia, Singapore, and Malaysia, analyzing four key indices: industry direction, change necessity, government regulation, and consumption intention.

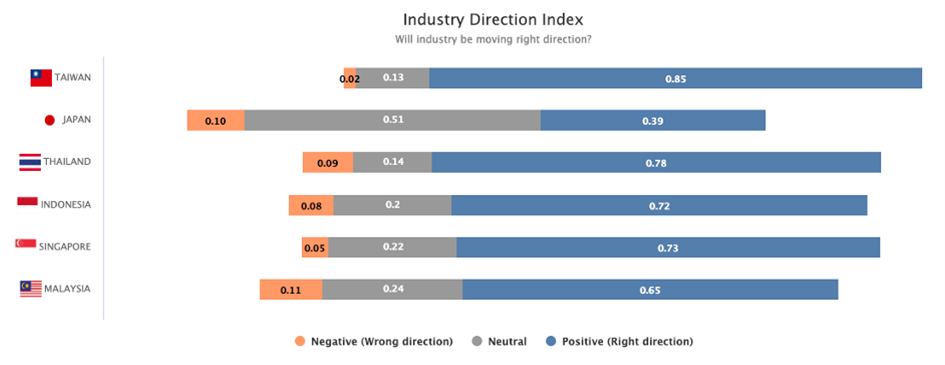

1. Industry Direction Index

- Overall Trend: Taiwan has the highest positive index at 85%, indicating strong confidence in the development of the OTT industry. In contrast, Japan has a positive index of only 39%, with a neutral opinion of 51%, showing uncertainty about future development.

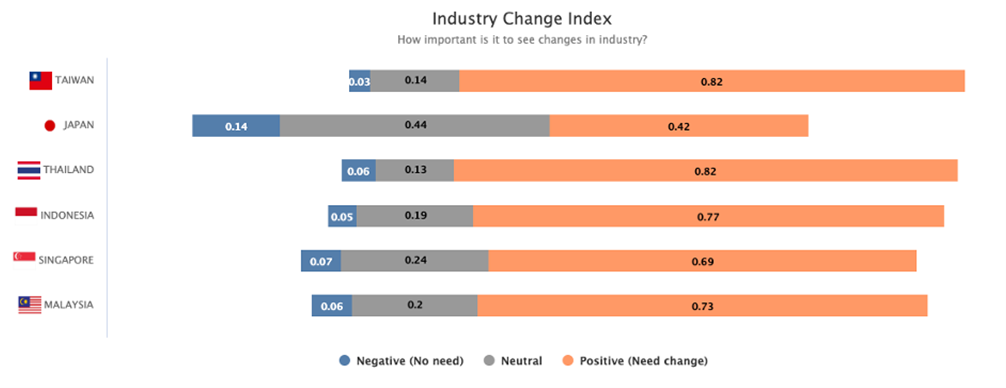

2. Industry Change Index

- Overall Trend: Taiwan and Thailand show the strongest demand for industry change, both with a positive index of 82%. In contrast, Japan has a high neutral index of 44%, indicating a wait-and-see attitude towards change.

- Taiwanese consumers have the highest expectations for improvements in OTT services, suggesting that existing services or content need more innovation to meet consumer demands.

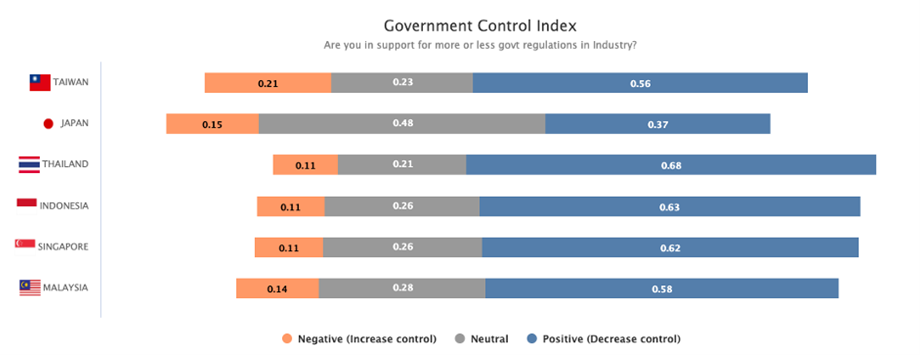

3. Government Control Index

- Thailand has the strongest support for less government regulation, with a positive index of 68%. Taiwan tends to have a slightly stronger positive view of increased government regulation at 21%.

- Thai consumers are most strongly in favor of market liberalization, which is important in promoting more flexible market policies.

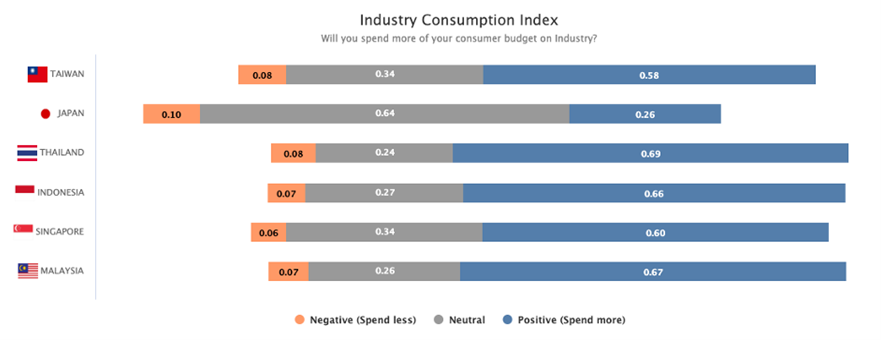

4. Industry Consumption Index

- Overall Trend: Thai consumers show the highest willingness to increase spending on OTT services, with a positive index of 69%. In contrast, Japan has a positive index of only 26% and a neutral index of 64%, indicating a reserved attitude towards increased spending.

- Thai market shows strong potential for consumption growth, worthy of further cultivation and resource investment.

Based on the survey analysis by Z.com Engagement Lab, here are recommendations for industry decision-makers:

- General strong demand for OTT with all countries expecting to increase consumer spending in this area. With established leaders, bringing new innovation and differentiated content will drive more growth.

- Deepen Localization of Content: For the Taiwan and Thailand markets, increase investment in localized content to meet consumer demands for innovation and improvement.

- Optimize User Experience: In Japan, understand consumers’ specific needs and pain points, possibly requiring optimization of user experience and service quality to enhance consumption willingness.

These insights and recommendations aim to help industry decision-makers seize the growth opportunities in the Asian OTT market, driving continuous business development and innovation.

Z.com Engagement Lab will continue to track the attitudes of East Asian populations towards their domestic OTT streaming media industries and update survey data, monitoring market trends and changes in consumer demand.

Research by: Z.com Engagement Lab

Survey Date: April 9th to 16th, 2024

Methodology: Online survey

Target Group: Internet users aged above 15 years old

Target Country: Japan, Taiwan, Thailand, Indonesia, Singapore, Malaysia

Sample Size:

Taiwan 1,656

Indonesia 2,880

Japan 1,313

Singapore 197

Thailand 676

Malaysia 591

Editor: TNL Research

Review by: Tatt Chen

* Contents in this report were drafted with input from generative.ai