September 5, 2023

As we navigate through the lasting effects of the pandemic, the citizen's perception of the situation and their behavioral changes become key indicators of economic recovery. While concerns persist regarding the severity of the virus, the silver lining is the anticipated increase in consumer spending across various age groups and sectors. This could signify a newfound resilience amidst the crisis, fostering hope for normalcy in the near future.

The global impact of the pandemic remains unrelenting, with Japan recently facing its ninth wave of COVID-19. According to a report by the Japanese Ministry of Health, Labour, and Welfare on July 1, 2023, the number of coronavirus infections in the country has been increasing for six consecutive weeks since May 8, intensifying concerns about the ninth wave. The total number of coronavirus infections reported by approximately 5,000 designated medical institutions nationwide that week reached 30,255. Okinawa Prefecture was hit the hardest, with an average of 39.48 infections per medical institution — the highest in the country. The severity of the epidemic has surpassed the peak of the "eighth wave", with a high bed occupancy rate of 68%.

Shigeru Omi, once the head of the government's coronavirus response group, expressed to the media after meeting with Prime Minister Fumio Kishida on the 26th, that the "ninth wave may have already begun". With the arrival of summer, the further expansion of the epidemic has become possible. This situation has undoubtedly brought new shocks and challenges to the national consumer market.

In this context, this report aims to delve deeply into the impact of the pandemic on Japan's consumer market and make predictions and suggestions for post-pandemic consumption trends in order to combat the seemingly endless impact of the pandemic.

About a month has passed since the novel coronavirus was reclassified as "Category 5," but the nationwide infection situation, based on the "fixed-point grasp" by the Ministry of Health, Labour, and Welfare, has been on a slow rise since April. From the beginning of the year until the previous survey in May, both the "perception of the past year" and "forecast for the next year" showed a gradual improvement in people's mindset and current perception due to the visible end of the coronavirus calamity. However, in the June survey, the situation deteriorated from the previous month. Approximately half of the respondents believe that the "perception of the past year" and "forecast for the next year" are deteriorating. Furthermore, an expert meeting at the Ministry of Health, Labour, and Welfare also analyzed that there is a "possibility of a certain spread of infection in summer."

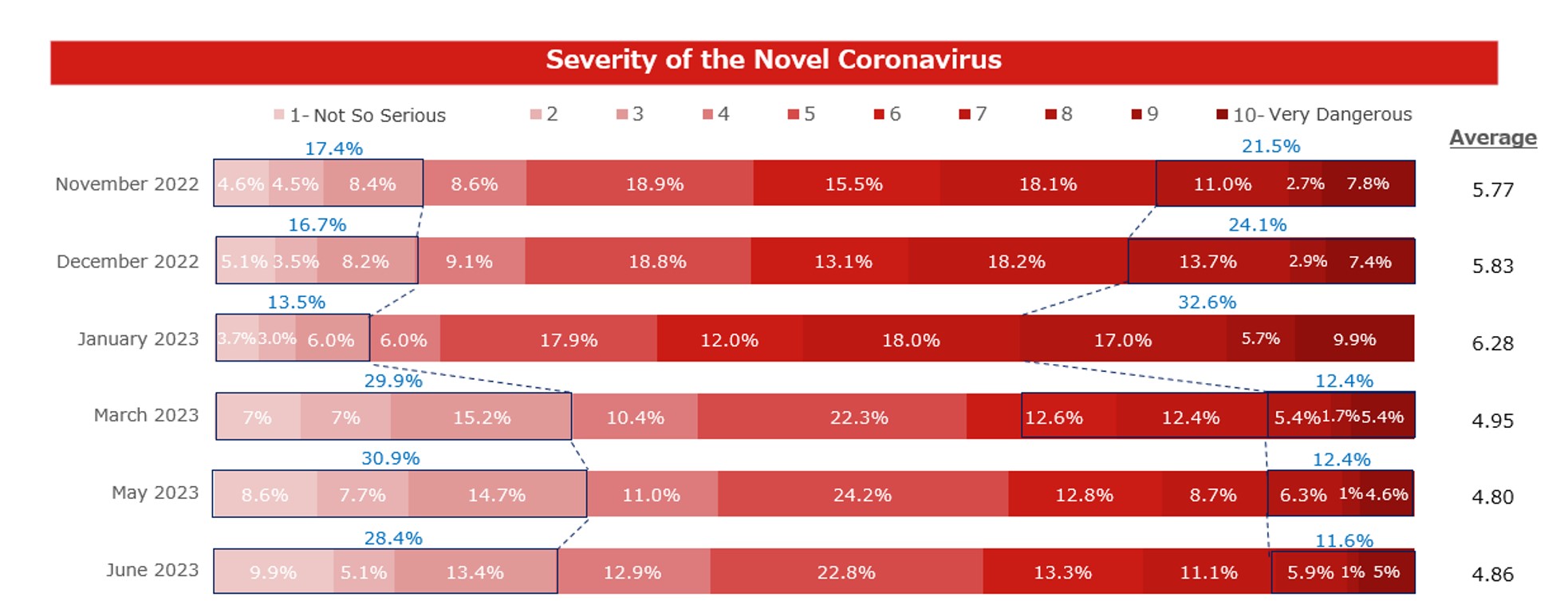

When it comes to the severity of the novel coronavirus, the percentage of people who perceive it as "very dangerous"decreased by about 1 point from the previous month, coming to 11.6%. Also, 28.4% felt it was "not so serious", which also decreased by 2 points. Since May 8, the classification of the infection disease changed to a category 5 infection, and measures such as wearing masks were basically left up to individual discretion. Although the end of the coronavirus can be visibly felt, the recognition of severity has hardly changed from the previous month.

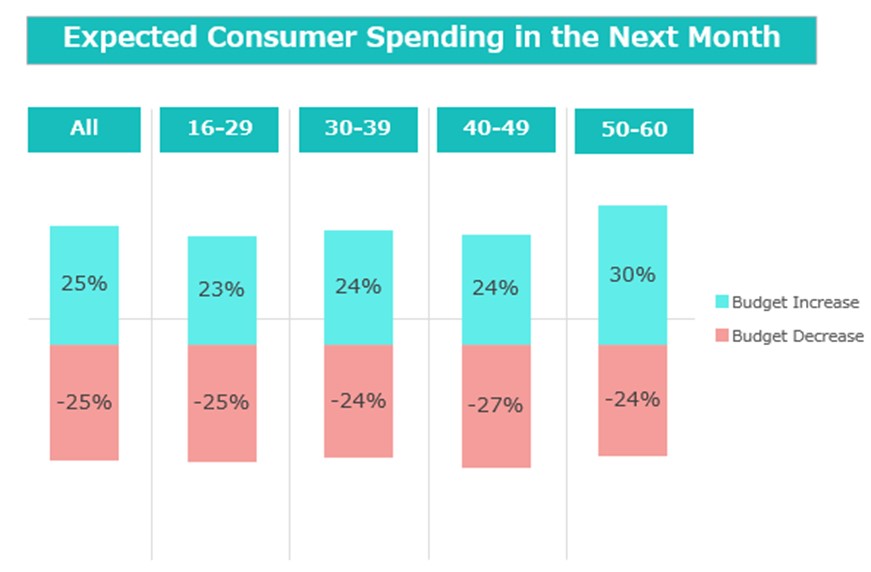

Looking at the expected consumer spending in the next month, 25% anticipate a spending increase, while another 25% expect a decrease. This was an improvement in purchasing desire in all age groups compared to the previous month's survey. Particularly in the 50-60 age group, the proportion of those expecting a "budget increase" was 30%, the highest among all age groups. In addition, the proportion of those who expect an increase in the budget also increased by more than 10 points in the 16-29 and 30-39 age groups.

Looking at individual product categories, an improvement in the desire to consume from the previous month's survey was seen in almost all age groups for "dining out/entertainment," "travel," and "household goods" categories.

Z.Com Engagement Lab will continue to track the consumer behavior of the Japanese public and update survey data, monitoring market trends and changes in consumer demand.

|