September 5, 2023

As we navigate the post-COVID era, it's essential to understand that the digital landscape is evolving rapidly. In Japan, over half of internet users are embracing mobile payments and internet banking, driven by convenience, security, and transaction fees. Companies must take note, the future of consumer behavior is increasingly digital, and those who can dispel security concerns while offering convenience will take the lead.

This analysis is based on a survey conducted by the Z.com Engagement Lab from June 30, 2023 to July 03, 2023. The survey collected data from 1,323 Japanese internet users aged between 16 and 60, with the aim of providing insights for business decision-makers on consumer perspectives in the post-COVID era.

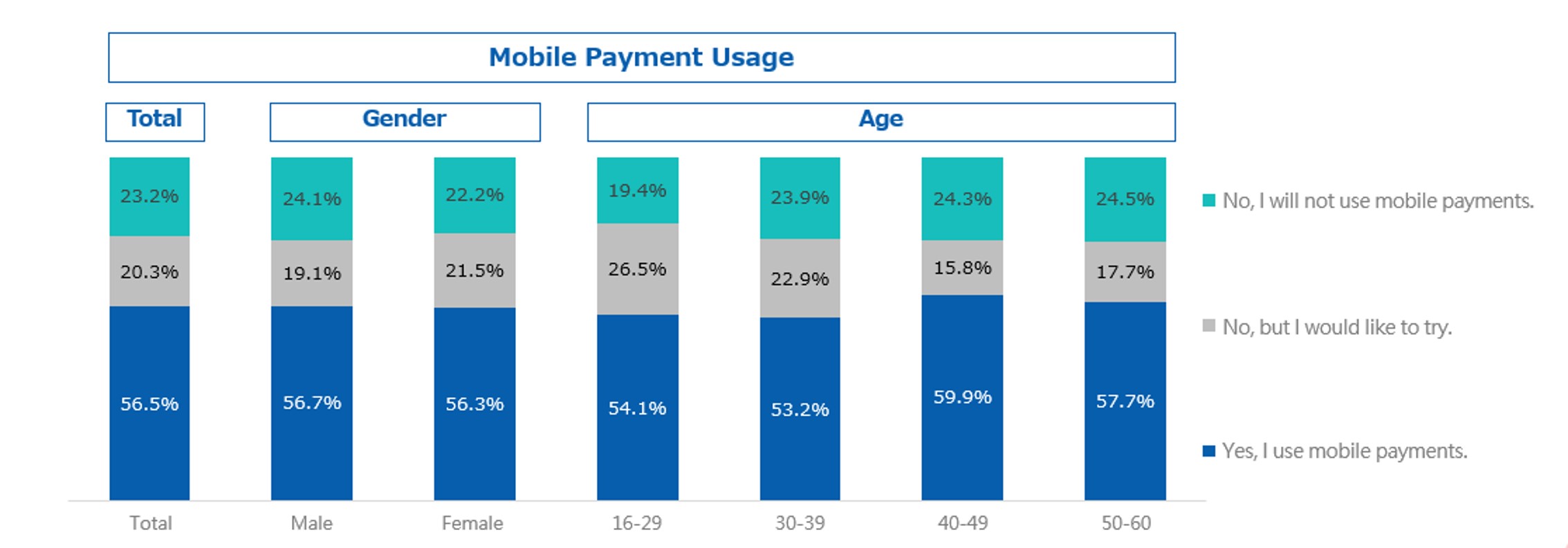

57% of Japanese internet users are currently using mobile payment methods, with little variation between genders. Age-wise, the highest usage rate is among the 40-49 age group (60%), while the lowest is the 30-39 age group (53%). Interest in future use of mobile payments is highest amongst the 16-29 age group, suggesting over 80% acceptance rate when combining current and potential users. The proportion of people refusing mobile payment increases gradually with age, with 1 in 4 people aged 50-60 rejecting its use.

When choosing a mobile payment service, the top three factors were convenience (69.1%), security (67.9%), and transaction fees (67.8%). However, nearly half (46.9%) identified security as "very important." The top reasons for not using mobile payment services were "no perceived benefits" (30.5%) and "security concerns" (29.7%). This highlights a need for better communication about convenience and security assurance.

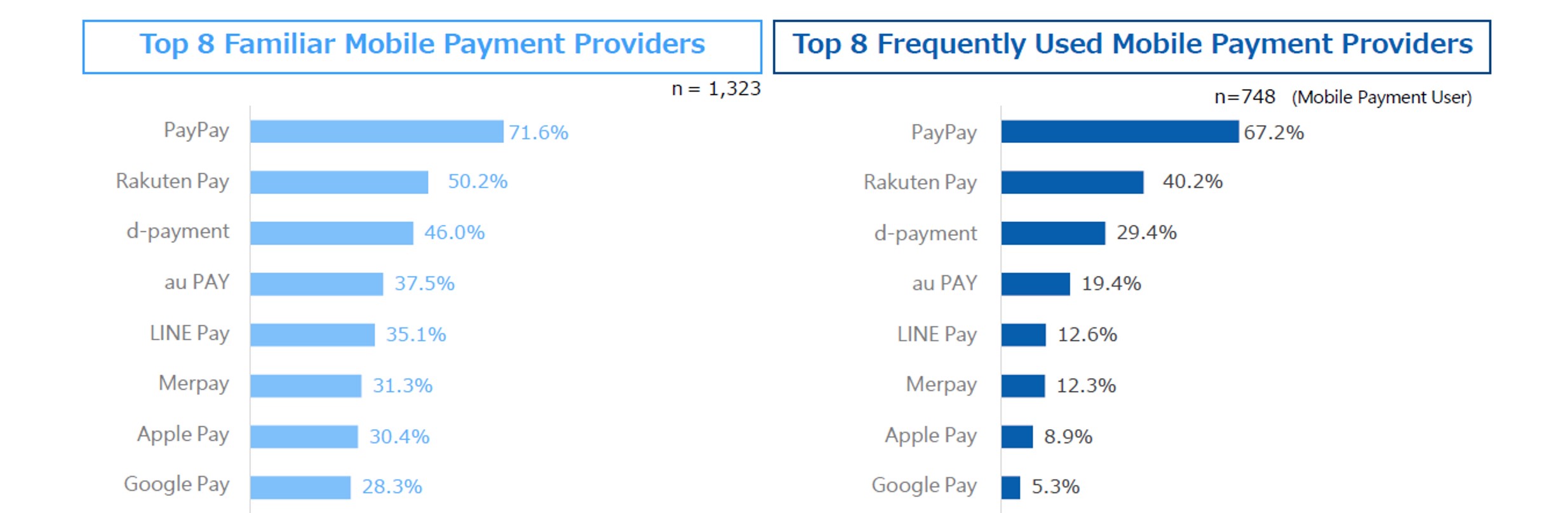

PayPay emerged as the most recognized (71.6%) and used (67.2%) mobile payment provider, followed by Rakuten Pay (50.2% aware, 40.2% usage), d-payment (46.0% aware, 29.4% usage), au PAY (37.5% aware, 19.4% usage), and LINE Pay (35.1% aware, 12.3% usage). There was a clear correlation between provider recognition and usage rates.

PayPay had nearly 70% usage across all age groups, showing its dominance. Rakuten Pay had lower penetration rates among 16-29 age group (31%) compared to the 40s age group (45%), indicating a need for better reach into younger demographics.

Currently, 52% of Japanese are using internet banking, and the usage rate is more than 10 points higher in men than women. Among age groups, 50-60 years olds showed the highest usage rate (63.1%), followed by 40-49 years olds (54.5%), 30-39 years olds (49.3%), and 16-29 years olds (37.9%). When combining current and potential users, about 65% of 16-29-year-olds and about 75% of 50-60-year-olds are open to using internet banking.

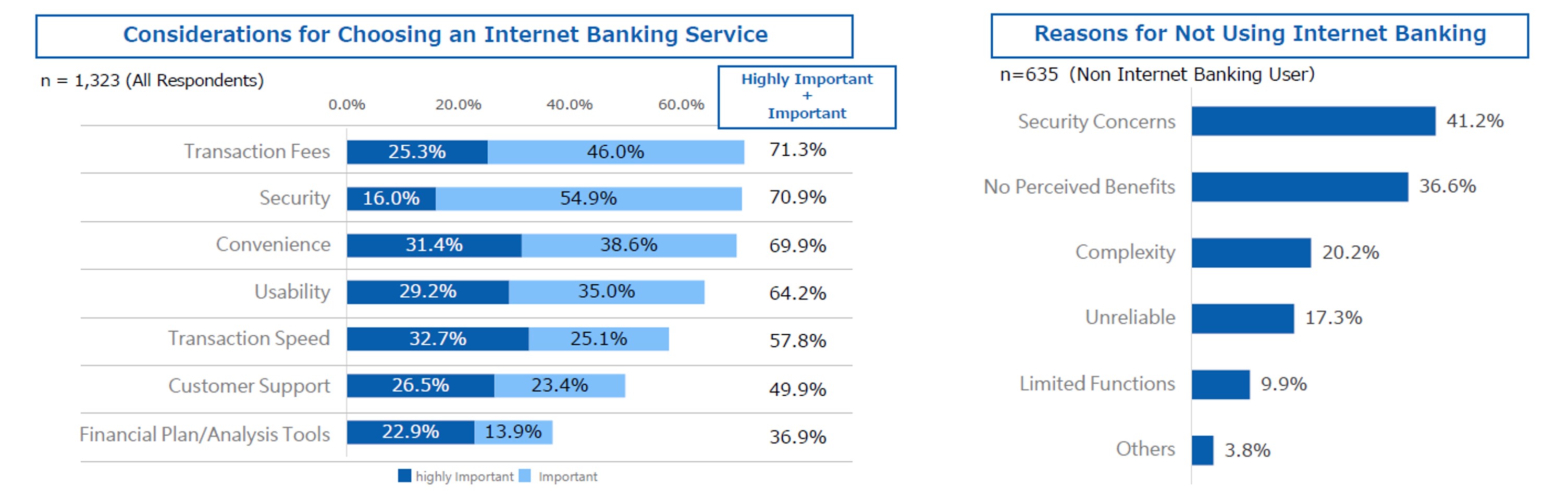

When choosing an internet banking service, transaction fees (71.3%), security (70.9%), and convenience (69.9%) were the top three considerations. The top reason for not using internet banking was "security concerns" (40+%), followed by "no perceived benefits” (36.6%). Dispelling security concerns appears to be a prerequisite for internet banking providers, as those who have overcome their security fears tend to choose banks offering cheaper transaction fees and high convenience.

This in-depth analysis offers rich insights for business decision-makers looking to better understand the evolving consumer attitudes in Japan’s digital landscape.

Z.com Engagement Lab will continue to track the digital behavior and preferences of the Japanese public and update survey data, monitoring market trends and changes in consumer demand.

|