May 22, 2024

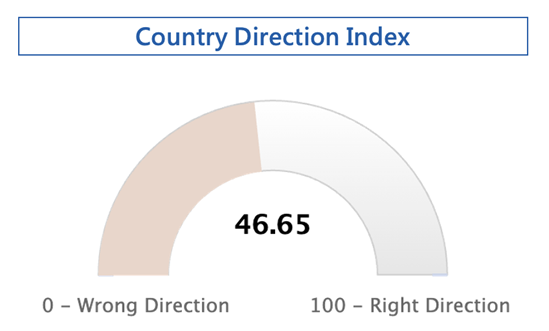

The findings reveal a general pessimism among Japanese netizens regarding the country's direction over the next 12 months, with the Country Direction Index scoring a mere 46.65 out of 100. This sentiment is likely tethered to Japan's longstanding economic challenges, the yen's depreciation, internal political reshuffling, the impending 2024 Prime Ministerial election, and geopolitical unrest, particularly with China and Korea.

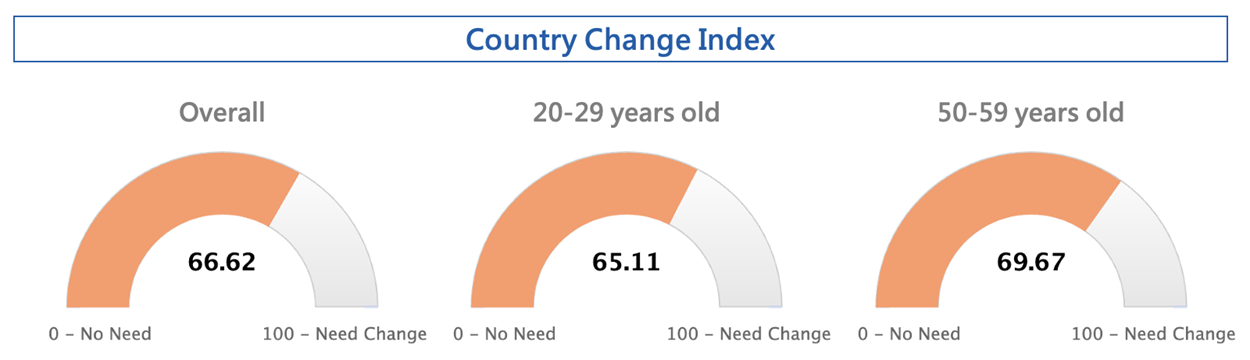

In contrast, the Country Change Index is notably higher, at 74.31, indicating a strong desire for significant reforms within Japan. When queried on the importance of undertaking major changes in the next 12 months, respondents awarded a score of 66.62, highlighting a particularly strong demand for reform among the 50-59 age demographic.

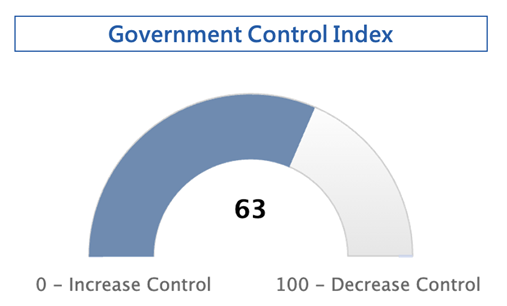

The Government Control Attitude Index, which gauges public support for increasing or decreasing government regulation, stands at 63. It would be important to observe this index in the coming months.

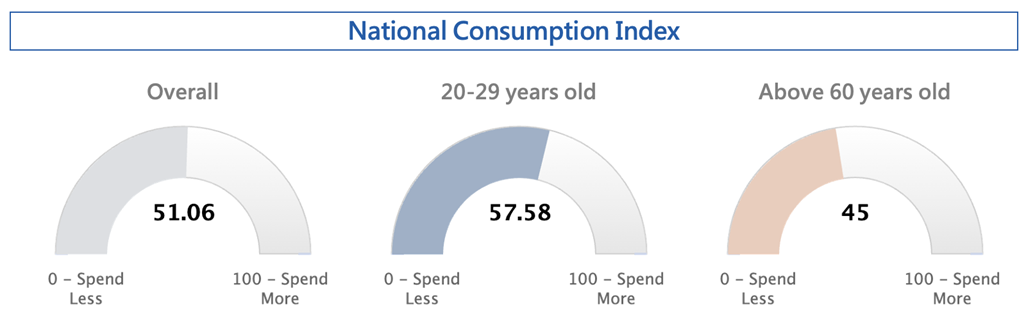

Regarding consumer behavior, the National Future Consumption Index indicates a stable overall consumption budget for the coming year, with a score of 51.06. However, a generational divide is apparent; younger individuals (aged 20-29) are inclined to increase their spending, scoring 57.58, while those over 60 plan to reduce their expenditure, scoring 45.

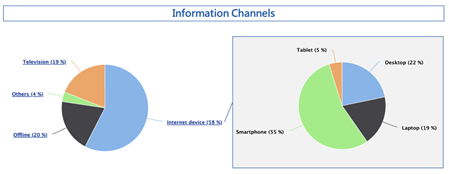

The survey also sheds light on information acquisition habits, with nearly 60% of respondents relying on digital mediums, primarily smartphones (55%), followed by desktops (22%) and laptops (19%). Traditional offline channels and television play a lesser role in daily information gathering.

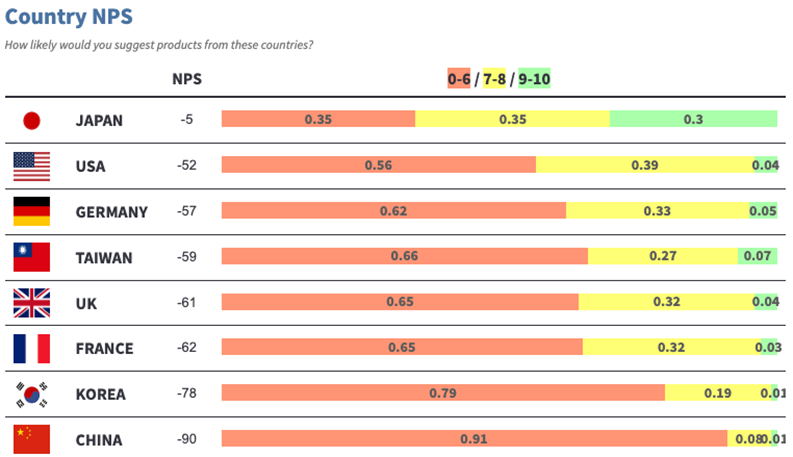

When it comes to product and service endorsement, Japanese netizens show a strong preference for domestic offerings, scoring them at 7.31 out of 10, the highest among surveyed categories. International products and services ranked next, with American goods leading at 6.21, followed by German (6.08), Taiwanese (6.03), British (5.96), and French (5.93) products and services.

This survey offers valuable insights for business decision-makers looking to navigate the complex landscape of post-COVID Japan. Understanding the nuanced perspectives of Japanese internet users—ranging from economic pessimism and a desire for change to preferences in consumption and information gathering—can inform more effective strategies tailored to the evolving needs and attitudes of consumers.

Z.com Engagement Lab will continue to monitor the sentiments of the Japanese public regarding the country's overall situation and update survey data, tracking market trends and changes in consumer demands.

|