July 10, 2024

According to a recent report by Canalys, the Southeast Asian smartphone market experienced a contrarian growth of 4% in the fourth quarter of 2023, reaching 23.8 million units. This marks a shift after seven consecutive quarters of decline, indicating a gradual recovery in the market. Moreover, smartphone shipments in 2024 are expected to increase by 7% compared to 2023. The driving forces behind this growth include the overall recovery of the regional economy, the expanding middle class, the rise of a youthful population, and the increase in digital payment and financing options, all of which make high-end devices more affordable for the general public.

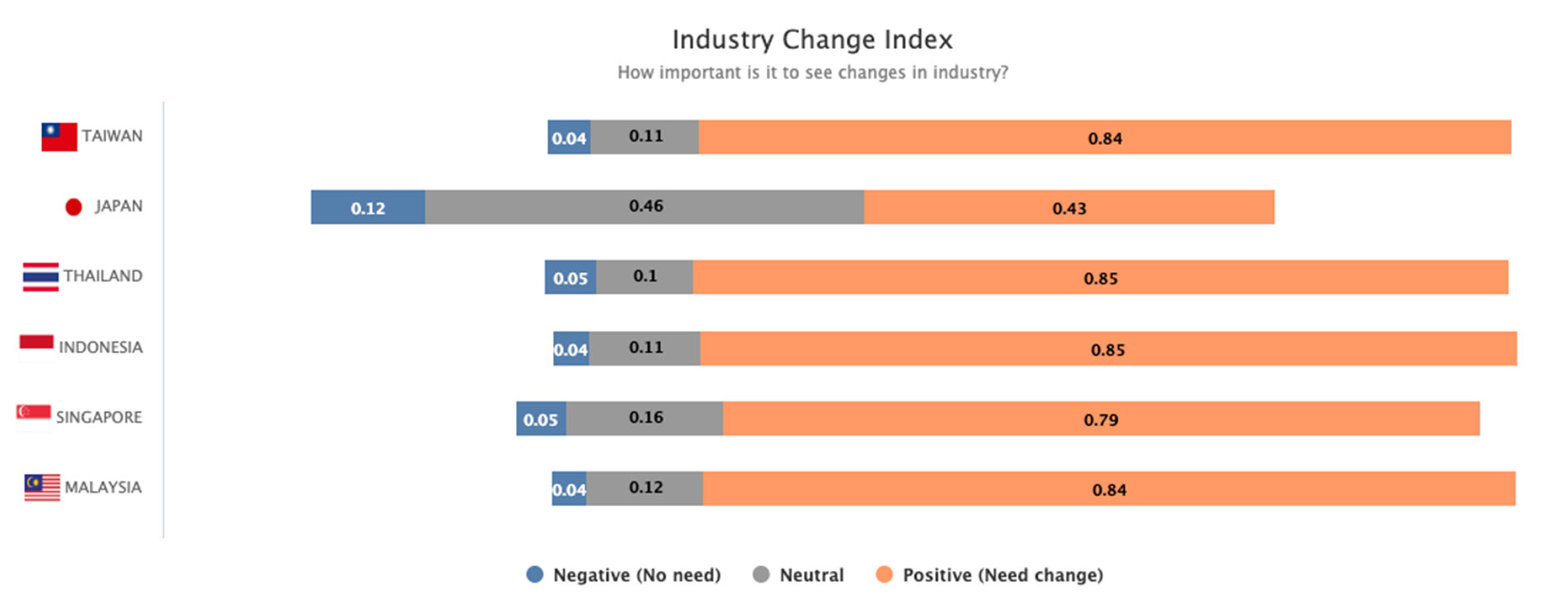

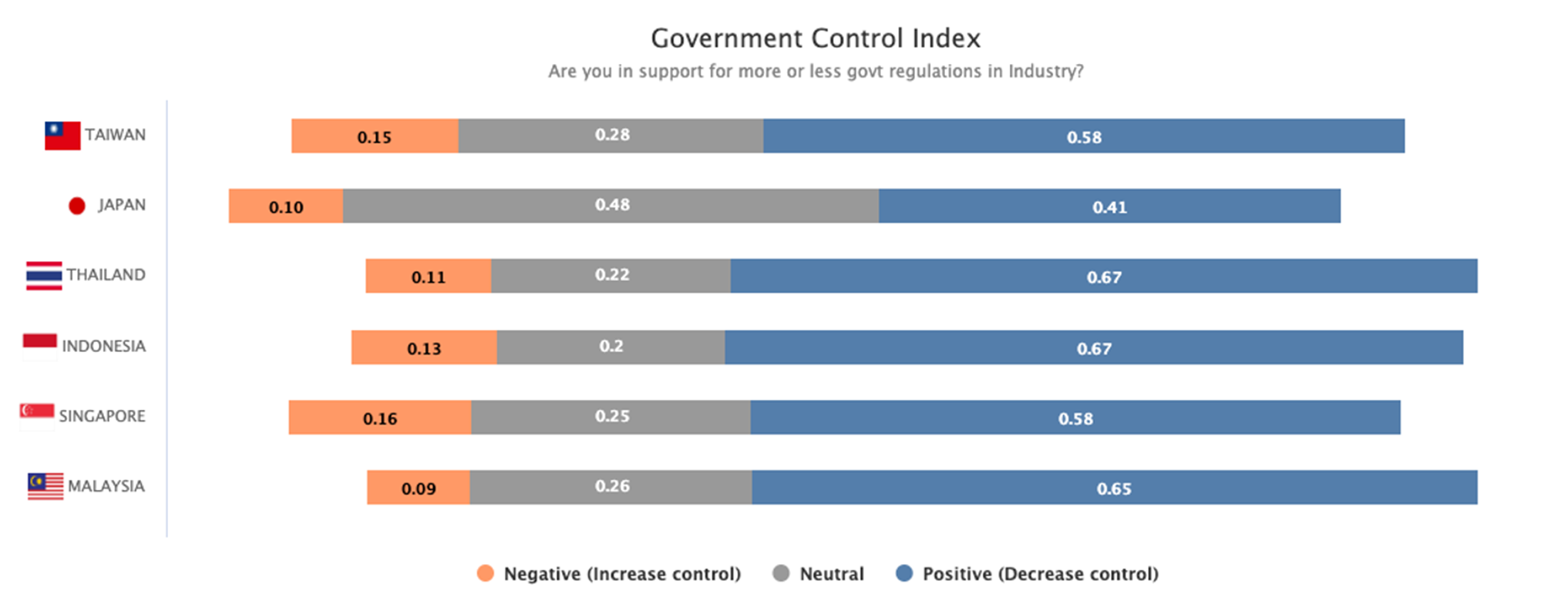

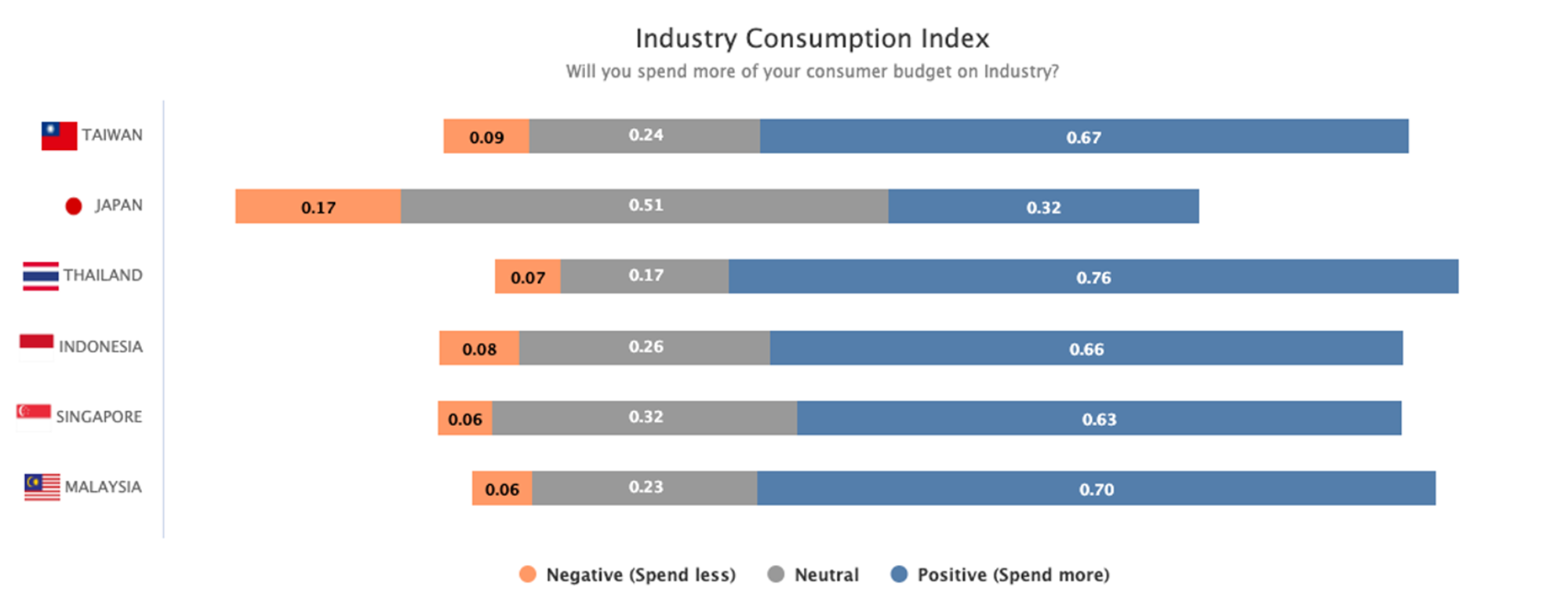

According to the latest survey by Z.com Engagement Lab, most consumers in countries like Taiwan, Thailand, Indonesia, and Malaysia hold a positive view of the future development of the smartphone industry. Particularly in Taiwan, a significant 88% of respondents affirmed the correct direction of industry development. In Thailand and Indonesia, more than two-thirds of consumers believe that the industry needs transformation. However, the Japanese market shows a different trend, with 50% of respondents maintaining a neutral stance regarding the future direction of the industry. This might reflect a higher satisfaction with the status quo or a cautious attitude towards future developments among Japanese consumers. In terms of budgeting, Thai consumers show a strong willingness to increase their expenditure on smartphones, whereas 17% of Japanese consumers intend to reduce their spending on these devices, reflecting the varying maturity levels and consumer dynamics across different markets.

Based on the survey analysis by Z.com Engagement Lab, here are some recommendations for industry decision-makers:

Overall, industry decision-makers should recognize the diversity and dynamism of the Asian market in the smartphone industry and adjust strategies according to the specific attitudes and needs of each country's market. Through precise market positioning and product innovation, coupled with alignment with government policies, success can be achieved in the competitive smartphone market.

Z.com Engagement Lab will continue to monitor the attitudes of the populations in East Asian countries towards their domestic smartphone industries and update survey data regularly. This effort aims to keep a pulse on market dynamics and shifts in consumer demands.

|